Understanding the 1992 Indian Stock Market Scam

Understand the Problem

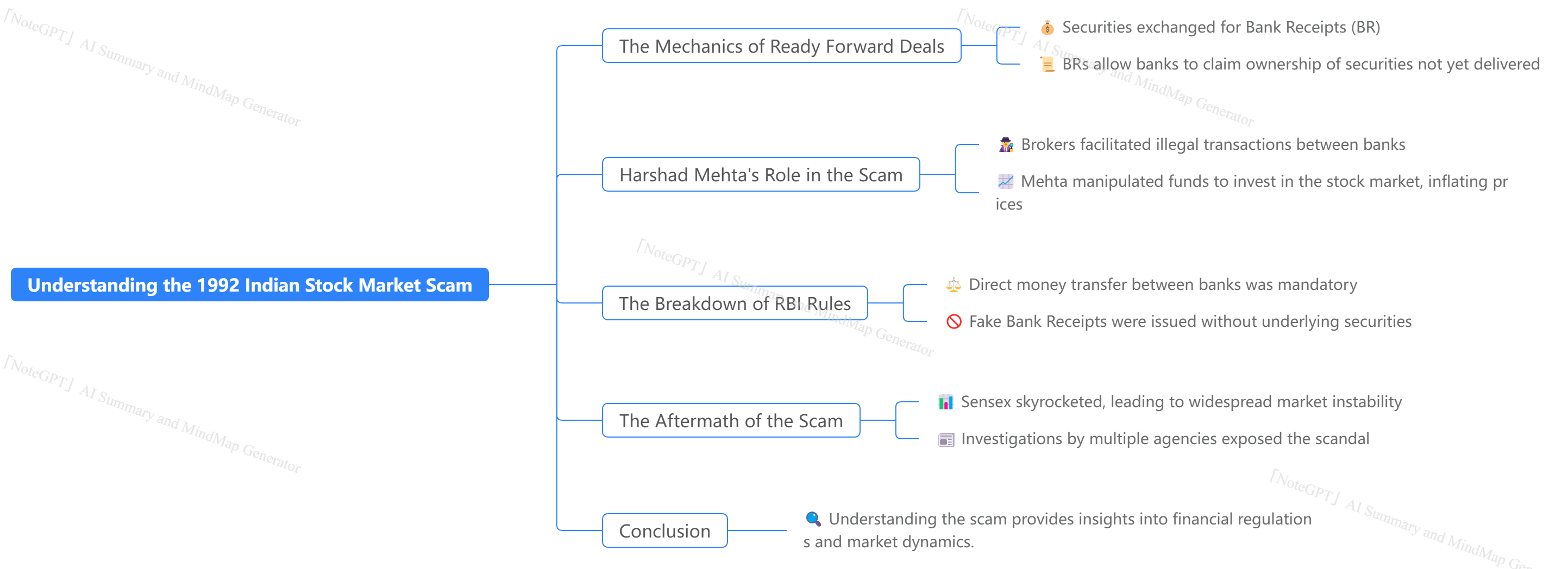

The question is focused on understanding the various aspects of the 1992 Indian Stock Market Scam, including its mechanics, key players, regulatory breakdowns, aftermath, and overall significance.

Answer

Harshad Mehta manipulated bank receipts, leading to a market collapse.

The 1992 Indian stock market scam was orchestrated by Harshad Mehta, involving manipulation of bank receipts and securities, leading to a collapse in the market. Mehta used fake bank receipts to siphon off funds from banks and inflate stock prices.

Answer for screen readers

The 1992 Indian stock market scam was orchestrated by Harshad Mehta, involving manipulation of bank receipts and securities, leading to a collapse in the market. Mehta used fake bank receipts to siphon off funds from banks and inflate stock prices.

More Information

Harshad Mehta, often called the 'Big Bull', exploited loopholes in the banking and securities systems. The scandal had a profound impact, leading to stricter financial regulations in India.

Tips

A common mistake is misunderstanding the role of fake bank receipts, which allowed Mehta to illegally transfer funds.

Sources

- 1992 Indian Stock Market Scam - Wikipedia - en.wikipedia.org

- Scam 1992 Explained: How Harshad Mehta, brokers and banks ... - CNBCTV18 - cnbctv18.com

- Scam 1992: The Harshad Mehta Financial Fraud That ... - 5paisa - 5paisa.com

AI-generated content may contain errors. Please verify critical information