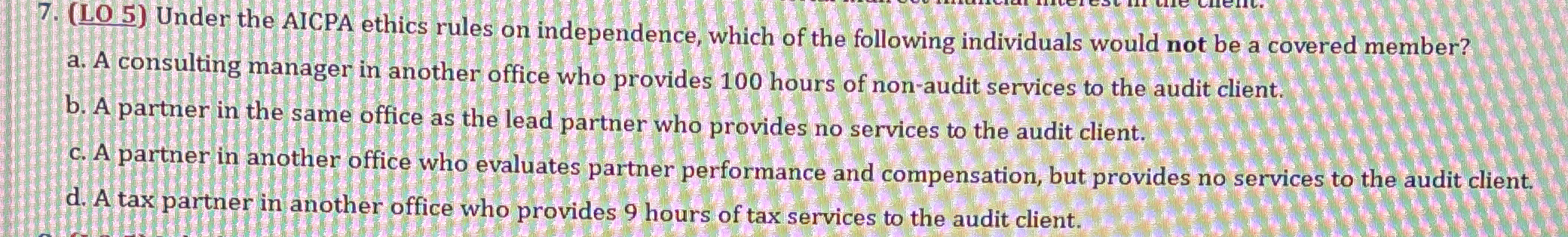

Under the AICPA ethics rules on independence, which of the following individuals would not be a covered member? a. A consulting manager in another office who provides 100 hours of... Under the AICPA ethics rules on independence, which of the following individuals would not be a covered member? a. A consulting manager in another office who provides 100 hours of non-audit services to the audit client. b. A partner in the same office as the lead partner who provides no services to the audit client. c. A partner in another office who evaluates partner performance and compensation, but provides no services to the audit client. d. A tax partner in another office who provides 9 hours of tax services to the audit client.

Understand the Problem

The question asks which individual, under AICPA ethics rules on independence, would not be considered a covered member in relation to providing services to an audit client.

Answer

A tax partner in another office who provides 9 hours of tax services to the audit client.

The individual not considered a covered member is d. A tax partner in another office who provides 9 hours of tax services to the audit client.

Answer for screen readers

The individual not considered a covered member is d. A tax partner in another office who provides 9 hours of tax services to the audit client.

More Information

Under AICPA independence rules, covered members typically include those in a position to influence the audit or those providing more direct services. Limited engagement, like providing a few hours of tax services, often does not meet these criteria.

Tips

A common mistake is to assume any partner is automatically a covered member. However, it's the nature and extent of their involvement with the client that determines their status.

Sources

AI-generated content may contain errors. Please verify critical information