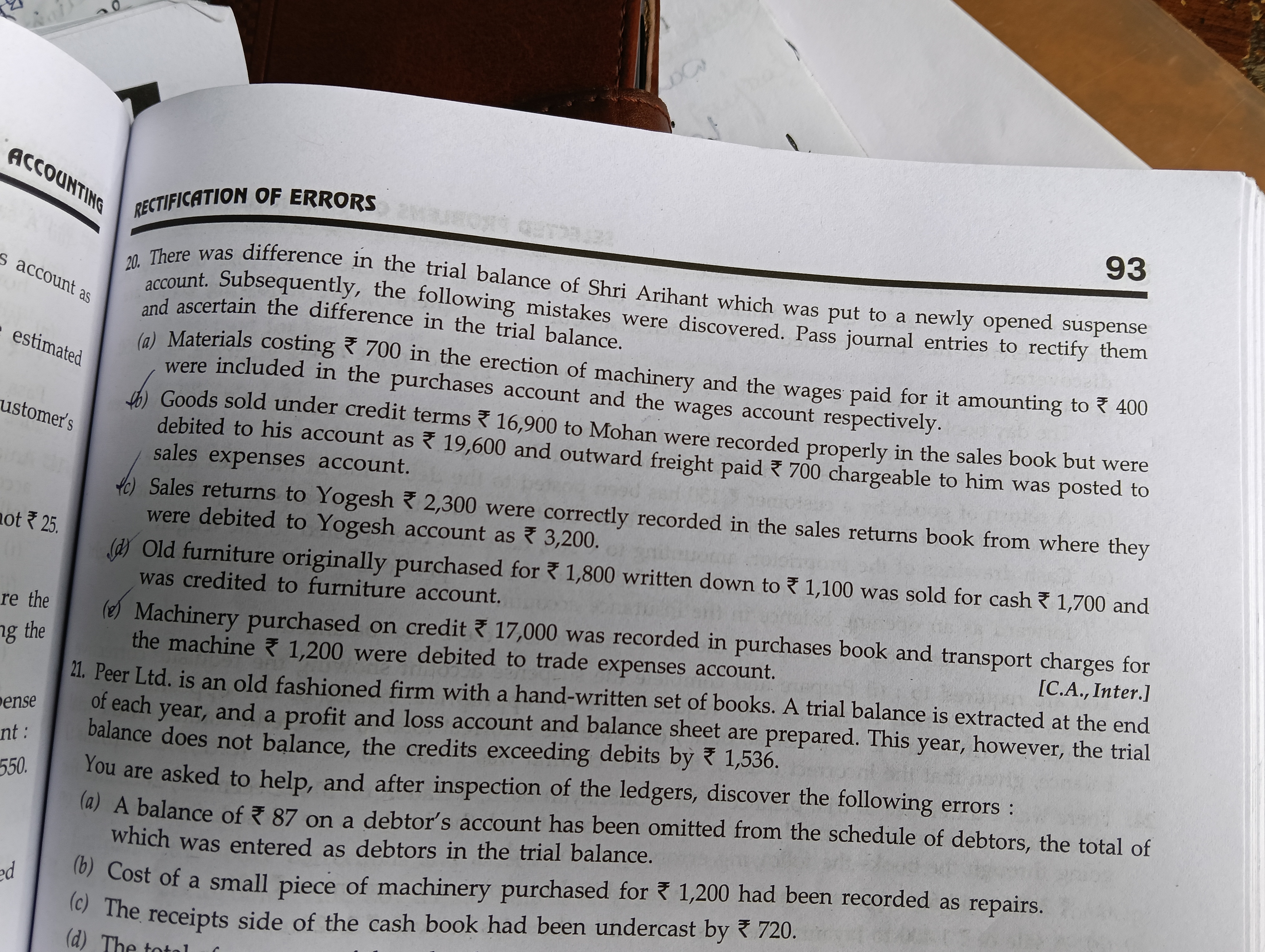

There was a difference in the trial balance of Shri Arihant which was put to a newly opened suspense account. Subsequently, the following mistakes were discovered. Pass journal ent... There was a difference in the trial balance of Shri Arihant which was put to a newly opened suspense account. Subsequently, the following mistakes were discovered. Pass journal entries to rectify them: (a) Materials costing ₹ 700 in the erection of machinery and the wages paid for it amounting to ₹ 400 were included in the purchases account. (b) Goods sold under credit terms ₹ 16,900 to Mohan were recorded properly in the sales book but were debited to his account as ₹ 19,600 and freight paid ₹ 700 chargeable to him was posted to sales expenses account. (c) Sales returns to Yogesh ₹ 2,300 were correctly recorded in the sales returns book from where they were debited to Yogesh account as ₹ 3,200. (d) Old furniture originally purchased for ₹ 1,800 written down to ₹ 1,100 was sold for cash ₹ 1,700 and the machine ₹ 1,200 were debited to trade expenses account. (e) A balance of ₹ 87 on a debtor's account has been omitted from the schedule of debtors, the total of which was entered as debtors in the trial balance. (f) Cost of a small piece of machinery purchased for ₹ 1,200 had been recorded as repairs.

Understand the Problem

The question is asking for assistance in passing journal entries to rectify errors found in the trial balance of an accounting scenario. It involves identifying specific mistakes and making the necessary corrections in accounting records.

Answer

The corrected journal entries rectify the accounting errors to maintain accurate financial reporting.

Answer for screen readers

The journal entries to rectify the errors are as follows:

-

Error (a):

- Dr Machinery account ₹700

- Cr Purchases account ₹700

-

Error (b):

- Dr Sales account ₹2,700

- Cr Sales expenses account ₹2,700

-

Error (c):

- Dr Sales Returns account ₹900

- Cr Yogesh account ₹900

-

Error (d):

- Dr Cash account ₹1,700

- Cr Furniture account ₹700

- Cr Profit on Sale of Furniture ₹1,000

-

Error (e):

- Dr Purchases account ₹17,000

- Dr Transport expenses account ₹1,200

- Cr Trade Payables account ₹18,200

Steps to Solve

-

Identify the errors

Examine the trial balance to identify each error. The errors are:

(a) Materials costing ₹700 included in the purchases account instead of the machinery account.

(b) Goods sold to Mohan of ₹16,900 recorded as ₹19,600 and debited to sales expenses.

(c) Sales returns of ₹2,300 correctly recorded but out of ₹3,200 in the sales returns book.

(d) Old furniture sold incorrectly reported in the furniture account.

(e) Machinery purchased recorded incorrectly along with transport charges. -

Pass journal entries for each error

For each error, pass the necessary journal entries to correct it.-

For error (a):

Debit Machinery account and credit Purchases account.

$$ \text{Machinery account} \quad \text{Dr} \quad ₹700 $$

$$ \text{Purchases account} \quad \text{Cr} \quad ₹700 $$ -

For error (b):

Correct the sales amount and adjust the sales expenses.

$$ \text{Sales account} \quad \text{Dr} \quad ₹2,700 $$

$$ \text{Sales expenses account} \quad \text{Cr} \quad ₹2,700 $$ -

For error (c):

Adjust the Sales Returns account.

$$ \text{Sales Returns account} \quad \text{Dr} \quad ₹900 $$

$$ \text{Yogesh account} \quad \text{Cr} \quad ₹900 $$ -

For error (d):

Correct the furniture sale entry.

$$ \text{Cash account} \quad \text{Dr} \quad ₹1,700 $$

$$ \text{Furniture account} \quad \text{Cr} \quad ₹700 $$

$$ \text{Profit on sale of furniture} \quad \text{Cr} \quad ₹1,000 $$ -

For error (e):

Correct the records for machinery and transport.

$$ \text{Purchases account} \quad \text{Dr} \quad ₹17,000 $$

$$ \text{Transport expenses account} \quad \text{Dr} \quad ₹1,200 $$

$$ \text{Trade Payables account} \quad \text{Cr} \quad ₹18,200 $$

-

-

Summarize the adjustments

Ensure each correction is properly recorded to adjust the trial balance. Check the correctness of the balances after all entries are made.

The journal entries to rectify the errors are as follows:

-

Error (a):

- Dr Machinery account ₹700

- Cr Purchases account ₹700

-

Error (b):

- Dr Sales account ₹2,700

- Cr Sales expenses account ₹2,700

-

Error (c):

- Dr Sales Returns account ₹900

- Cr Yogesh account ₹900

-

Error (d):

- Dr Cash account ₹1,700

- Cr Furniture account ₹700

- Cr Profit on Sale of Furniture ₹1,000

-

Error (e):

- Dr Purchases account ₹17,000

- Dr Transport expenses account ₹1,200

- Cr Trade Payables account ₹18,200

More Information

These journal entries correct specific misclassifications in the accounting records and should reflect in the financial statements accurately. The correction of these errors is crucial for the integrity of the financial reports.

Tips

- Misclassifying accounts: Ensure each transaction is correctly classified to avoid further adjustments.

- Neglecting to check balances after adjustments: Always verify that the trial balance remains balanced after making corrections.

- Failure to document corrections: Properly document each journal entry to maintain clarity for future reference.

AI-generated content may contain errors. Please verify critical information