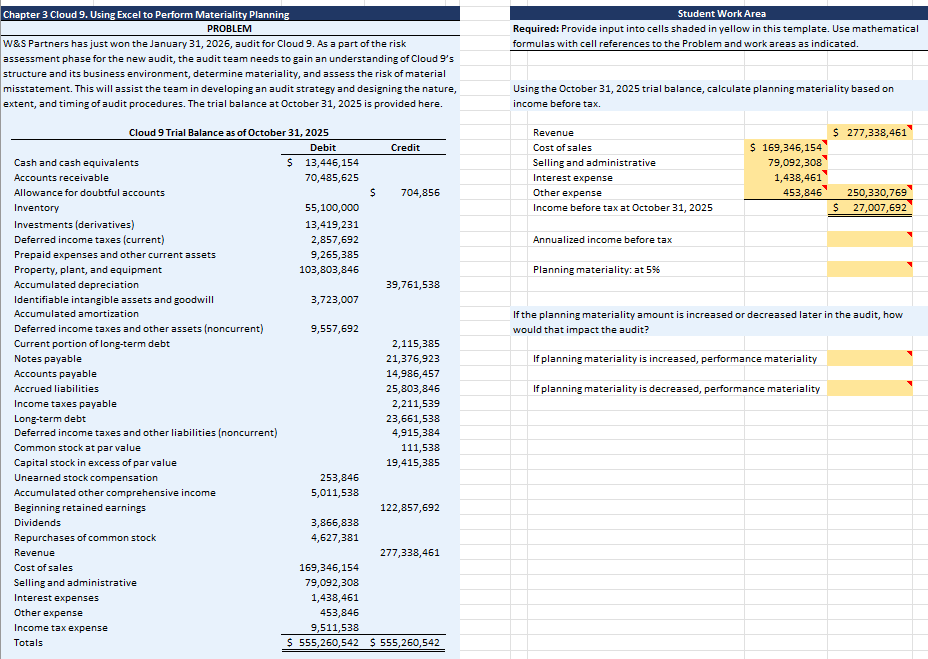

Using the October 31, 2025 trial balance, calculate planning materiality based on income before tax. If planning materiality is increased or decreased later in the audit, how would... Using the October 31, 2025 trial balance, calculate planning materiality based on income before tax. If planning materiality is increased or decreased later in the audit, how would that impact performance materiality?

Understand the Problem

The question is asking to calculate planning materiality based on the income before tax, using provided financial data and a specified percentage. It also inquires about the impact of changing planning materiality on the performance materiality in an audit context.

Answer

The planning materiality based on income before tax is $1,350,384.60.

Answer for screen readers

The planning materiality based on income before tax is $1,350,384.60.

Steps to Solve

- Determine Income Before Tax

The income before tax was already provided in the trial balance, which is $27,007,692.

- Calculate Planning Materiality

To find the planning materiality, multiply the income before tax by the specified percentage (5%).

$$ \text{Planning materiality} = \text{Income before tax} \times 0.05 = 27,007,692 \times 0.05 $$

- Perform the Calculation

Calculate the result:

$$ \text{Planning materiality} = 27,007,692 \times 0.05 = 1,350,384.60 $$

- Analyze the Impact on Performance Materiality

If planning materiality is increased or decreased, performance materiality, which is generally set as a percentage of planning materiality, would also increase or decrease proportionally.

$$ \text{Performance materiality} = \text{Planning materiality} \times \text{Percentage factor} $$

Considerations

- If planning materiality is increased, performance materiality will increase.

- If planning materiality is decreased, performance materiality will decrease accordingly.

The planning materiality based on income before tax is $1,350,384.60.

More Information

Planning materiality is an important measure in an audit context as it helps auditors assess the level of misstatement that can be tolerated without affecting the decision-making of financial statement users. This value directly influences the audit strategy and procedures.

Tips

- Miscalculating the percentage of planning materiality based on income before tax.

- Forgetting to apply the correct percentage when determining performance materiality based on planning materiality.

AI-generated content may contain errors. Please verify critical information