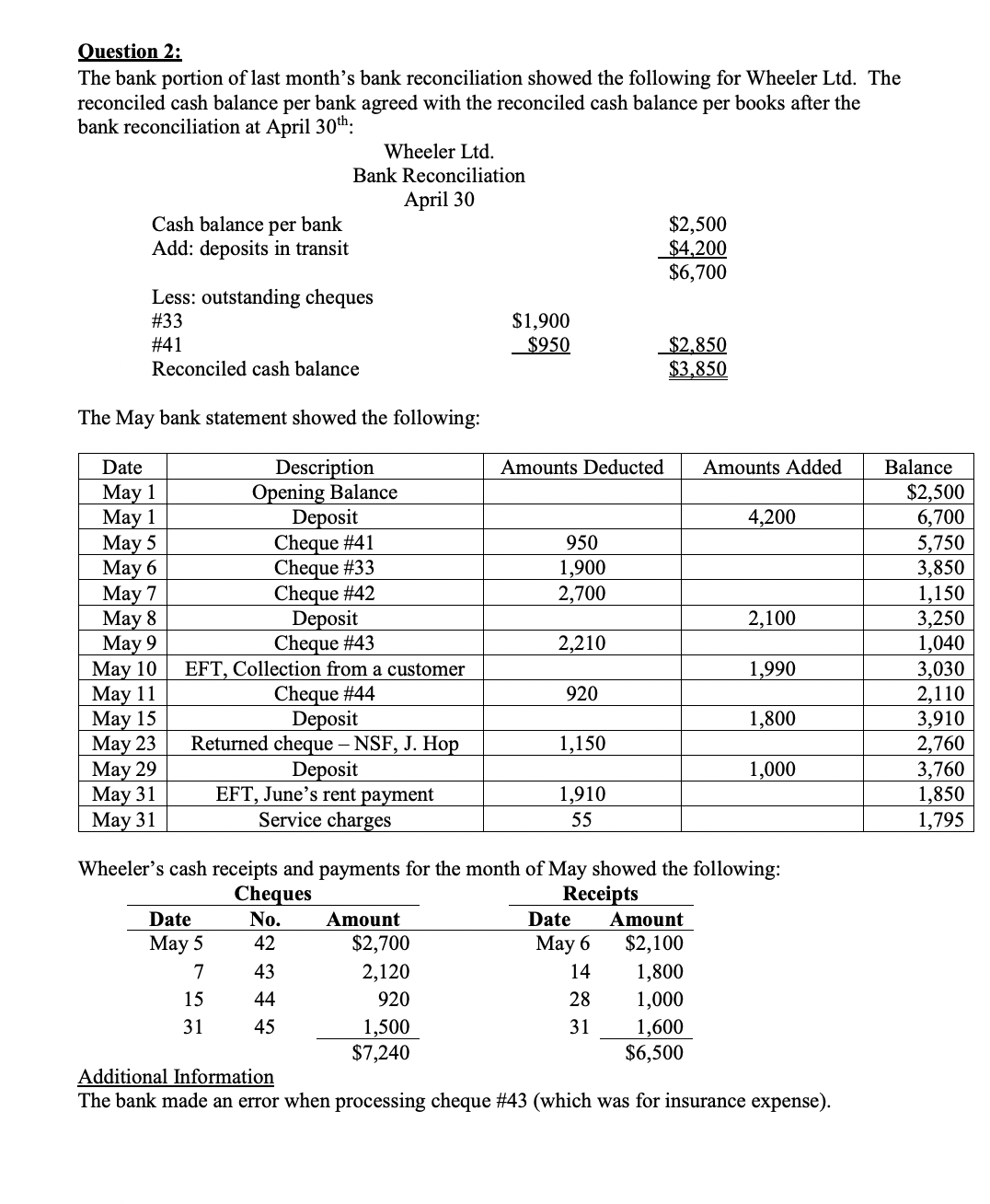

The bank portion of last month’s bank reconciliation showed the following for Wheeler Ltd. The reconciled cash balance per bank agreed with the reconciled cash balance per books af... The bank portion of last month’s bank reconciliation showed the following for Wheeler Ltd. The reconciled cash balance per bank agreed with the reconciled cash balance per books after the bank reconciliation at April 30th. Based on the data, perform the necessary calculations for bank reconciliation.

Understand the Problem

The question is asking for a bank reconciliation process to be applied using the provided financial data for Wheeler Ltd. This includes identifying the cash balances, outstanding cheques, and other transactions within a specific timeframe.

Answer

The reconciled cash balance is $3,850.

Answer for screen readers

The reconciled cash balance for Wheeler Ltd. on April 30 is $3,850.

Steps to Solve

-

Identify the Cash Balance Per Bank

From the reconciliation, the cash balance per bank as of April 30 is given as $2,500.

-

Identify Deposits in Transit

The deposits in transit shown are $4,200. This is the amount that needs to be added to the cash balance per bank.

-

Calculate Total Cash Balance Per Bank Before Outstanding Cheques

Add the cash balance per bank and deposits in transit: $$ 2,500 + 4,200 = 6,700 $$

-

Identify Outstanding Cheques

The outstanding cheques are $1,900 (Cheque #33) and $950 (Cheque #41). Subtract these amounts from the total cash balance calculated in step 3.

-

Calculate Reconciled Cash Balance

Deduct the outstanding cheques from the total cash balance: $$ 6,700 - (1,900 + 950) = 6,700 - 2,850 = 3,850 $$

-

Verify the Reconciled Cash Balance

Confirm that the computed reconciled cash balance of $3,850 aligns with the one stated in the problem.

The reconciled cash balance for Wheeler Ltd. on April 30 is $3,850.

More Information

In bank reconciliations, it's essential to account for all outstanding deposits and cheques to ensure that the recorded balances match the bank's records. This practice provides insights into cash flow and can identify discrepancies.

Tips

- Failing to Include All Outstanding Cheques: Ensure that all outstanding cheques are accounted for in the reconciliation process.

- Not Adding Deposits in Transit: Forgetting to add deposits that have been made but not yet reflected in the bank balance can lead to inaccuracies.