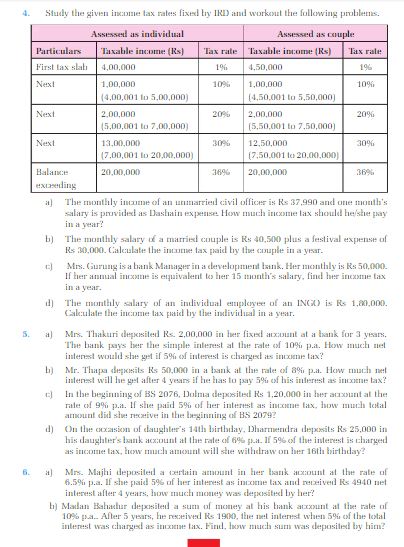

Study the given income tax rates fixed by IRD and work out the following problems:

Understand the Problem

The question is asking us to apply given income tax rates to calculate various tax-related problems for different individuals and couples based on specified income scenarios.

Answer

- Individual Income Tax: Rs 14,796 - Couple Income Tax: Rs 4,800 - Mrs. G

Answer for screen readers

-

Income tax for unmarried civil officer: Rs 14,796

-

Income tax for married couple: Rs 4,800

-

Net interest earned by Mrs. Gana: Rs 120

-

Total amount for Mr. Tusal after 1 year: Rs 1,272

-

Total amount received by Mrs. Thakuri after 3 years: Rs 2,360

-

Money deposited by Mrs. Malla: Rs 5,000

Steps to Solve

- Calculate Tax for the Unmarried Civil Officer

First, we need to find the total income of the unmarried civil officer:

- Monthly income = Rs 37,990

- Dashain expense = Rs 37,990 (one month's salary)

Total income = $37,990 + 37,990 = Rs 75,980$

Now, we apply the tax rates based on the taxable income brackets for individuals.

Breakdown:

-

First Rs 40,000 taxed at 19%: $$ 40,000 \times 0.19 = Rs 7,600 $$

-

Next Rs 35,980 taxed at 20% (as $75,980 - 40,000 = 35,980$): $$ 35,980 \times 0.20 = Rs 7,196 $$

Total tax: $$ Tax_{individual} = Rs 7,600 + Rs 7,196 = Rs 14,796 $$

- Calculate Tax for the Married Couple

For the couple:

- Monthly income = Rs 40,500

- Festival expense = Rs 6,000

Total income = $40,500 + 6,000 = Rs 46,500$

Now, applying the tax rates:

-

First Rs 45,000 taxed at 10%: $$ 45,000 \times 0.10 = Rs 4,500 $$

-

Remaining Rs 1,500 taxed at 20% ($46,500 - 45,000$): $$ 1,500 \times 0.20 = Rs 300 $$

Total tax: $$ Tax_{couple} = Rs 4,500 + Rs 300 = Rs 4,800 $$

- Calculate Net Interest Earned by Mrs. Gana

Mrs. Gana deposited Rs 2,000 at a rate of 6% per annum.

Net interest earned in one year: $$ Interest = Principal \times Rate \times Time = 2000 \times 0.06 \times 1 = Rs 120 $$

- Calculate Total Amount for Mr. Tusal

Mr. Tusal's deposit: Principal = Rs 1,200 at 6% for 1 year.

Total amount after 1 year: $$ Total = Principal + Interest = 1200 + (1200 \times 0.06) = 1200 + 72 = Rs 1,272 $$

- Calculate Amount Received by Mrs. Thakuri

Assuming Mrs. Thakuri's deposit at the highest interest rate of 6% for 3 years on Rs 2,000.

Interest after 3 years: $$ Total Interest = Principal \times Rate \times Time = 2000 \times 0.06 \times 3 = Rs 360 $$

Total amount received: $$ Total = Principal + Total Interest = 2000 + 360 = Rs 2,360 $$

- Determine Money Deposited by Mrs. Malla

Mrs. Malla paid Rs 1,000 as tax and repaid Rs 1,300.

The difference charged as income tax is: $$ 1,300 - 1,000 = Rs 300 $$

This amount is the interest on the tax owed. To find the original deposited money (denote as $x$), we consider:

- Total paid = Principal + Interest.

Assuming the interest rate is 6%: $$ 300 = x \times 0.06 $$ Thus, solving for $x$ gives: $$ x = \frac{300}{0.06} = Rs 5,000 $$

-

Income tax for unmarried civil officer: Rs 14,796

-

Income tax for married couple: Rs 4,800

-

Net interest earned by Mrs. Gana: Rs 120

-

Total amount for Mr. Tusal after 1 year: Rs 1,272

-

Total amount received by Mrs. Thakuri after 3 years: Rs 2,360

-

Money deposited by Mrs. Malla: Rs 5,000

More Information

These calculations illustrate how to apply tax rates based on income brackets and interest calculations for deposits in banks. Proper understanding of tax computation is essential for financial management.

Tips

- Misapplying tax brackets by not considering all income portions correctly.

- Forgetting to add up interest over multiple years accurately.

- Not properly understanding the relationship between principal, interest, and total amounts.