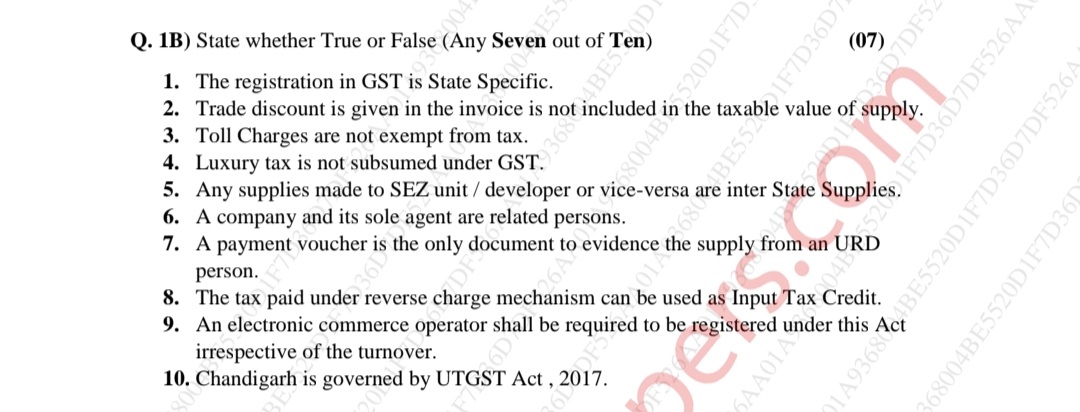

State whether True or False (Any seven out of ten) regarding the statements about GST.

Understand the Problem

The question is asking to determine whether each of the ten statements related to GST (Goods and Services Tax) is true or false, and to identify seven correct responses.

Answer

1. True, 2. True, 3. False, 4. True, 5. True, 6. True, 7. False, 8. True, 9. True, 10. True

["1. True","2. True","3. False","4. True","5. True","6. True","7. False","8. True","9. True","10. True"]

Answer for screen readers

["1. True","2. True","3. False","4. True","5. True","6. True","7. False","8. True","9. True","10. True"]

More Information

Several provisions and regulations under the GST cover aspects such as state-specific registration, input tax credit, and special cases like SEZ and electronic commerce operators.

Tips

A common mistake is misunderstanding which taxes are subsumed under GST, such as the luxury tax. Ensure clarity on unique provisions like reverse charge mechanisms and interstate transactions involving SEZ.

Sources

- Goods and Services Tax (India) - Wikipedia - en.wikipedia.org

- Frequently Asked Questions - CBIC-GST - cbic-gst.gov.in

AI-generated content may contain errors. Please verify critical information