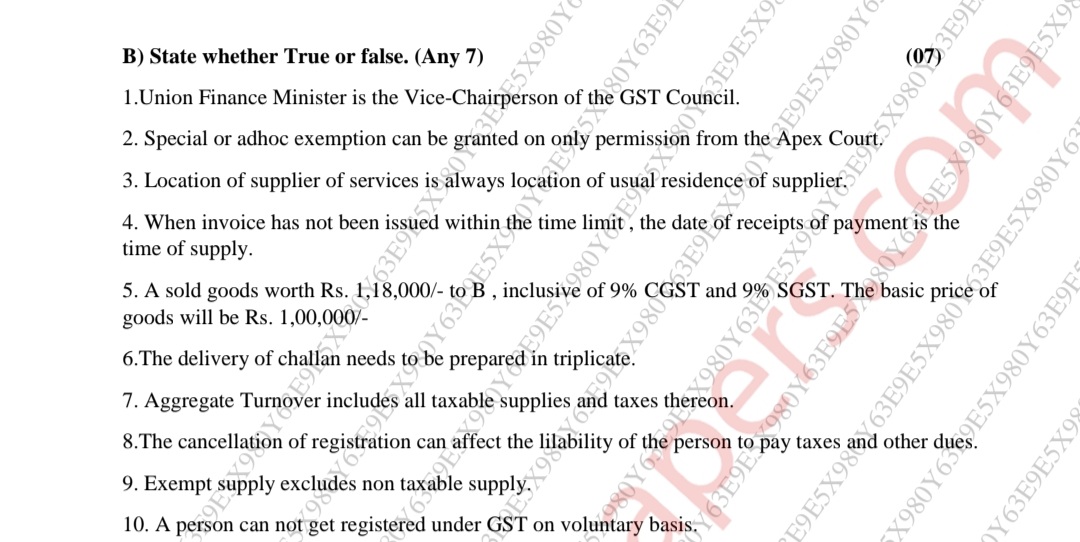

State whether True or false. 1. Union Finance Minister is the Vice-Chairperson of the GST Council. 2. Special or adhoc exemption can be granted on only permission from the Apex Cou... State whether True or false. 1. Union Finance Minister is the Vice-Chairperson of the GST Council. 2. Special or adhoc exemption can be granted on only permission from the Apex Court. 3. Location of supplier of services is always location of usual residence of supplier. 4. When invoice has not been issued within the time limit, the date of receipts of payment is the time of supply. 5. A sold goods worth Rs. 1,18,000/- to B, inclusive of 9% CGST and 9% SGST. The basic price of goods will be Rs. 1,00,000/-. 6. The delivery of challan needs to be prepared in triplicate. 7. Aggregate Turnover includes all taxable supplies and taxes thereon. 8. The cancellation of registration can affect the liability of the person to pay taxes and other dues. 9. Exempt supply excludes non-taxable supply. 10. A person can not get registered under GST on voluntary basis.

Understand the Problem

The question asks to determine the truth value (true or false) for seven statements regarding the GST (Goods and Services Tax) Council and its regulations. The user is likely seeking clarification on each statement's validity based on GST laws.

Answer

1. False, 2. False, 3. False, 4. True, 5. True, 6. True, 7. False, 8. False, 9. False, 10. False.

- False. 2. False. 3. False. 4. True. 5. True. 6. True. 7. False. 8. False. 9. False. 10. False.

Answer for screen readers

- False. 2. False. 3. False. 4. True. 5. True. 6. True. 7. False. 8. False. 9. False. 10. False.

More Information

- The Vice-Chair is chosen from members (not Union Finance Minister).

- Exemptions are granted by authorities, not Apex Court.

- The location depends on the type of supply, not always the supplier's residence.

- Exempt supply includes non-taxable supplies.

- Voluntary registration under GST is possible.

Tips

Misunderstanding the definitions and roles within the GST framework can lead to incorrect assumptions. Verifying each through reliable sources helps in correct assessment.

Sources

- Goods and Services Tax Council - GST Council - gstcouncil.gov.in

- FAQs on GST - gstdelhizone.gov.in