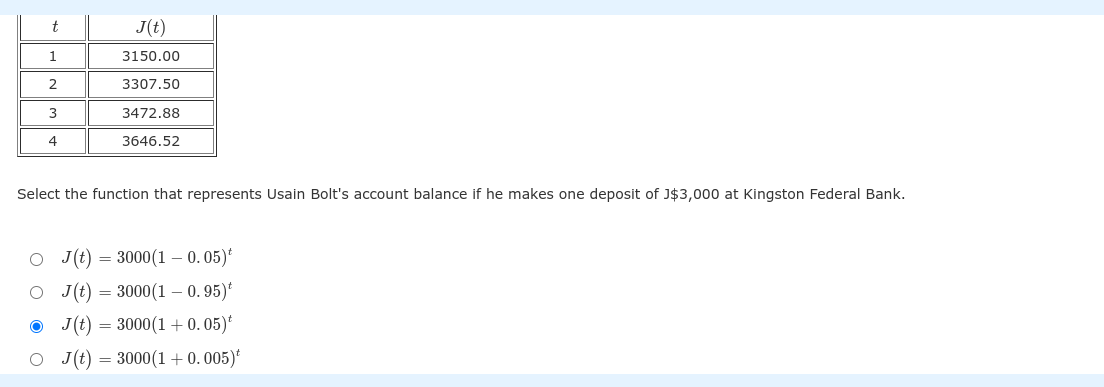

Select the function that represents Usain Bolt's account balance if he makes one deposit of J$3,000 at Kingston Federal Bank.

Understand the Problem

The question is asking to select the correct function that represents Usain Bolt's account balance after making a deposit of J$3,000 at Kingston Federal Bank. The options provided involve exponential growth equations that relate to how the account balance increases over time.

Answer

$$ J(t) = 3000(1 + 0.05)^t $$

Answer for screen readers

$$ J(t) = 3000(1 + 0.05)^t $$

Steps to Solve

- Understanding the growth model

The account balance grows according to a compound growth function. The general form of the compound interest formula is:

$$ J(t) = P(1 + r)^t $$

where

- ( J(t) ) is the amount in the account at time ( t ),

- ( P ) is the principal amount (initial deposit),

- ( r ) is the growth rate per time period, and

- ( t ) is the number of time periods.

In this case, the initial deposit ( P ) is J$3,000.

- Identifying the correct growth rate

To analyze the provided data, we need to determine the growth rate from the account balances at different times:

- From J$3,000 to J$3,150 at ( t = 1 ):

- Growth = J$3,150 - J$3,000 = J$150

- Growth rate: ( \frac{150}{3000} = 0.05 ) (or 5%)

This indicates that the ( r ) in our model is 0.05.

- Formulating the balance function

Using the growth rate of 0.05 in the compound interest formula, we get:

$$ J(t) = 3000(1 + 0.05)^t $$

This matches one of the options provided in the question.

- Examining the other options

- ( J(t) = 3000(1 - 0.05)^t ) represents a decrease.

- ( J(t) = 3000(1 - 0.95)^t ) doesn't make sense in this context.

- ( J(t) = 3000(1 + 0.005)^t ) suggests a much lower growth rate (0.5%), which does not align with the data.

$$ J(t) = 3000(1 + 0.05)^t $$

More Information

The function ( J(t) = 3000(1 + 0.05)^t ) represents continuous growth at a rate of 5% annually. This is a standard way to express compound interest and accurately reflects the given cumulative balances over time.

Tips

- Confusing the growth rate: Be careful not to misinterpret the data as a decrease (negative growth).

- Miscalculating the growth rate from the provided balances, which could lead to selecting the wrong formula.

AI-generated content may contain errors. Please verify critical information