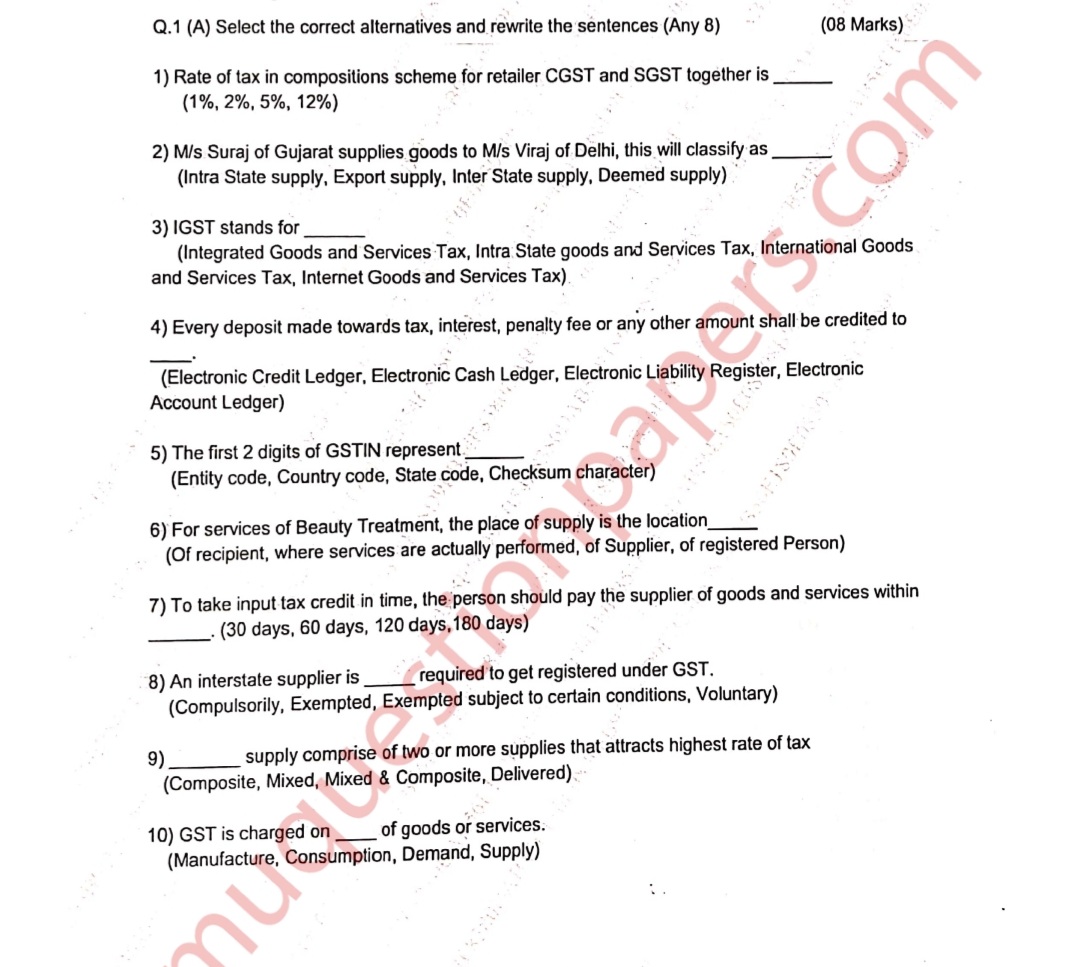

Select the correct alternatives and rewrite the sentences (Any 8). 1) Rate of tax in compositions scheme for retailer CGST and SGST together is ____ 2) M/s Suraj of Gujarat supplie... Select the correct alternatives and rewrite the sentences (Any 8). 1) Rate of tax in compositions scheme for retailer CGST and SGST together is ____ 2) M/s Suraj of Gujarat supplies goods to M/s Viraj of Delhi, this will classify as ____ 3) IGST stands for ____ 4) Every deposit made towards tax, interest, penalty fee or any other amount shall be credited to ____. 5) The first 2 digits of GSTIN represent ____. 6) For services of Beauty Treatment, the place of supply is the location ____. 7) To take input tax credit in time, the person should pay the supplier of goods and services within ______. 8) An interstate supplier is ______ required to get registered under GST. 9) ______ supply comprise of two or more supplies that attract highest rate of tax. 10) GST is charged on ______ of goods or services.

Understand the Problem

The question is asking to select the correct alternatives and rewrite the sentences related to GST (Goods and Services Tax) concepts. It requires knowledge in GST terminology and regulations.

Answer

1) 1%, 2) Inter State supply, 3) Integrated Goods and Services Tax, 4) Electronic Cash Ledger, 5) State code, 6) where services are actually performed, 7) 180 days, 8) Compulsorily, 9) Mixed, 10) Supply

- 1%, 2) Inter State supply, 3) Integrated Goods and Services Tax, 4) Electronic Cash Ledger, 5) State code, 6) where services are actually performed, 7) 180 days, 8) Compulsorily, 9) Mixed, 10) Supply

Answer for screen readers

- 1%, 2) Inter State supply, 3) Integrated Goods and Services Tax, 4) Electronic Cash Ledger, 5) State code, 6) where services are actually performed, 7) 180 days, 8) Compulsorily, 9) Mixed, 10) Supply

More Information

These answers are based on the general understanding of GST rules and structure in India.

Tips

Ensure you are familiar with the GST terminology and structure. Carefully read each option before selecting.

AI-generated content may contain errors. Please verify critical information