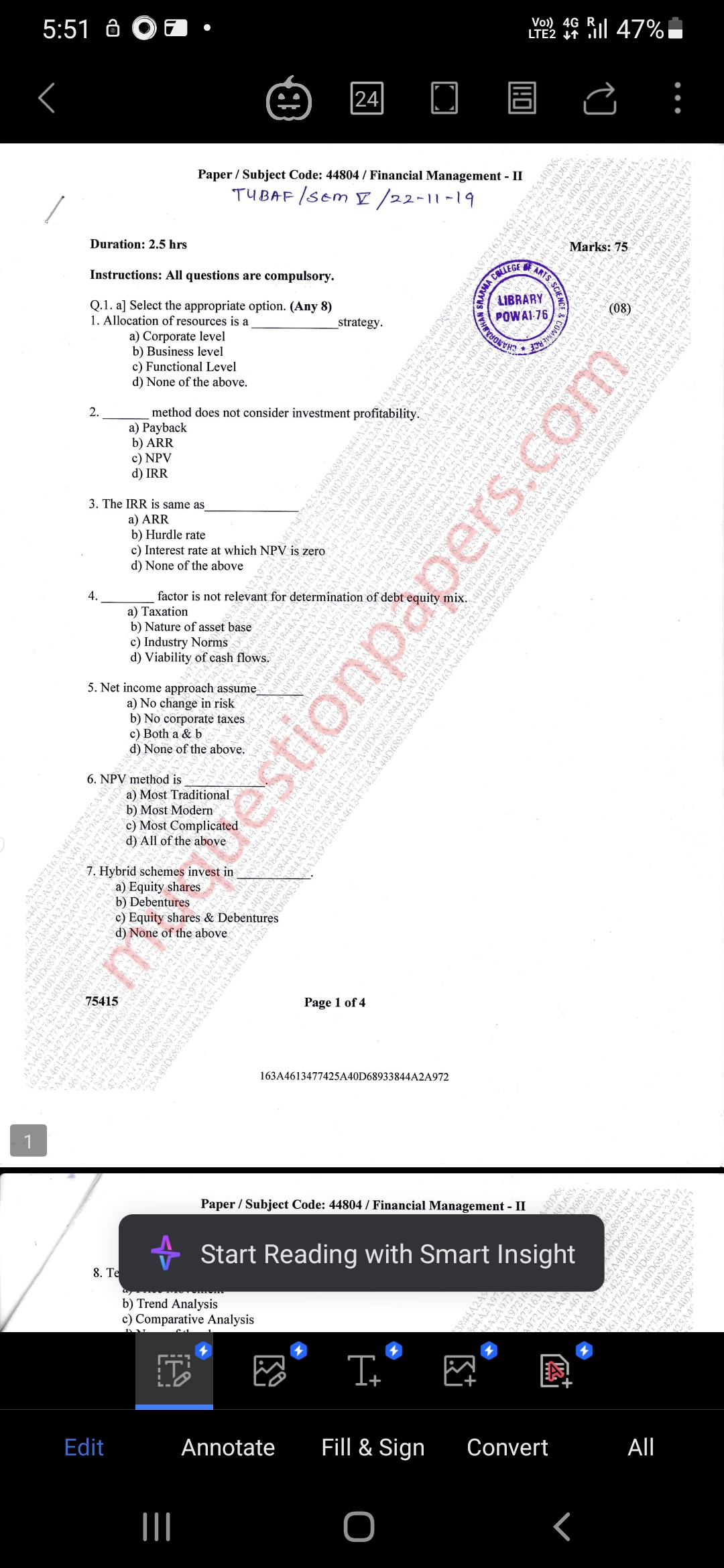

Select the appropriate option. Allocation of resources is a __________ strategy. The method that does not consider investment profitability. The IRR is the same as __________. Fact... Select the appropriate option. Allocation of resources is a __________ strategy. The method that does not consider investment profitability. The IRR is the same as __________. Factor not relevant for debt equity mix. NPV method is __________. Hybrid schemes invest in __________.

Understand the Problem

The question is related to financial management topics such as resource allocation strategies, investment profitability methods, and debt equity mix considerations. It seems to involve multiple-choice questions (MCQs) from an examination paper.

Answer

1. Business level, 2. Payback, 3. Interest rate at which NPV is zero, 4. Viability of cash flows, 5. No corporate taxes, 6. Most Modern, 7. Equity shares & Debentures.

- Business level, 2. Payback, 3. Interest rate at which NPV is zero, 4. Viability of cash flows, 5. No corporate taxes, 6. Most Modern, 7. Equity shares & Debentures.

Answer for screen readers

- Business level, 2. Payback, 3. Interest rate at which NPV is zero, 4. Viability of cash flows, 5. No corporate taxes, 6. Most Modern, 7. Equity shares & Debentures.

More Information

These options are derived from standard financial management knowledge, such as how the IRR relates to the NPV and traditional views on certain financial strategies.

Tips

Common mistakes include confusing NPV and IRR applications and not understanding the implications of investment profitability on method selections.

Sources

- NPV vs IRR - Overview, Similarities and Differences, Conflicts - corporatefinanceinstitute.com

- Internal Rate of Return (IRR) - Calculator & Formula - corporatefinanceinstitute.com

AI-generated content may contain errors. Please verify critical information