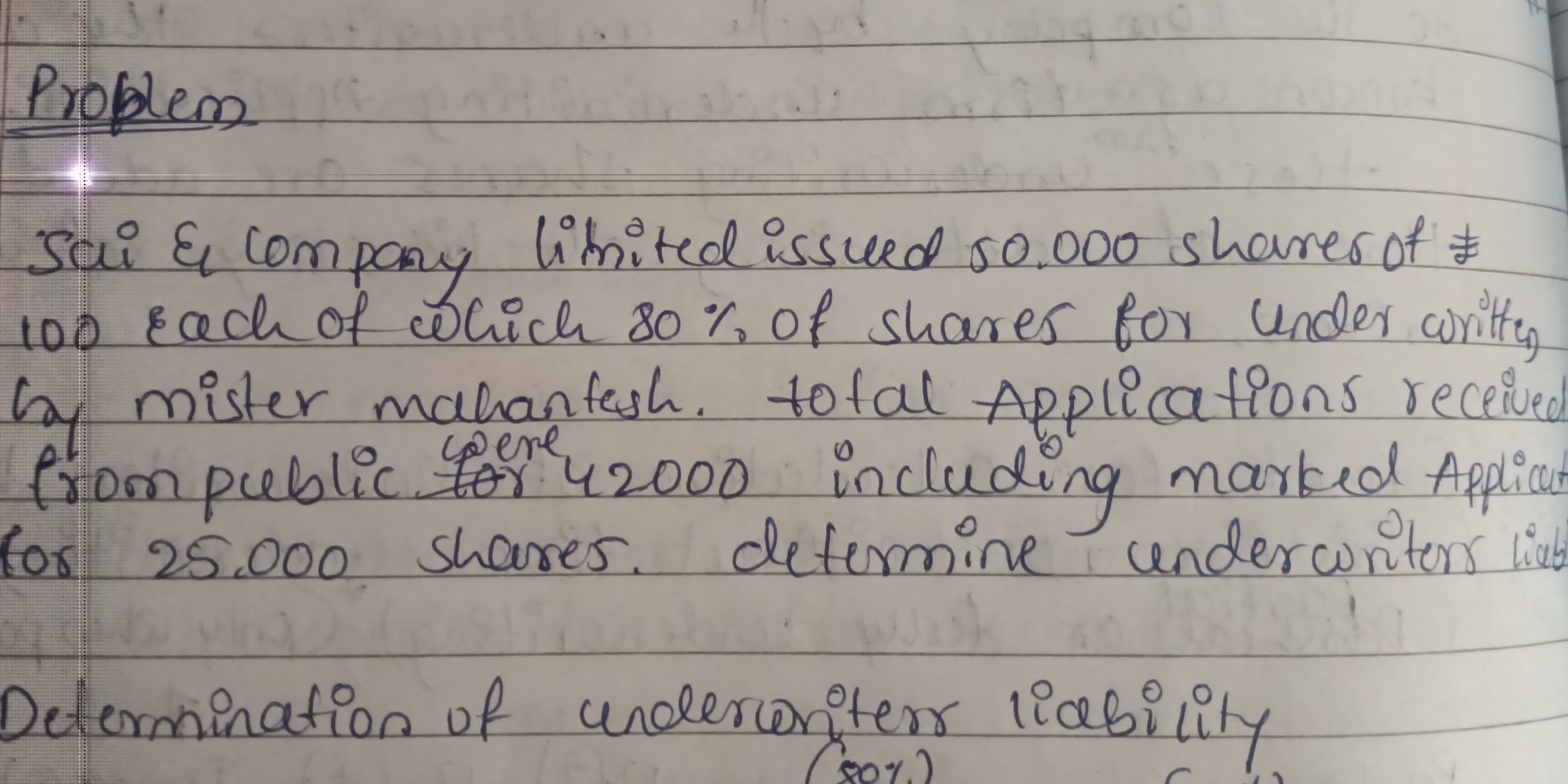

Sai & Company limited issued 50,000 shares of ₹100 each, of which 80% of shares are for underwriting by Mr. Mahantesh. Total applications received from public for 42,000 including... Sai & Company limited issued 50,000 shares of ₹100 each, of which 80% of shares are for underwriting by Mr. Mahantesh. Total applications received from public for 42,000 including marked applications for 25,000 shares. Determine underwriters' liability (80%).

Understand the Problem

The question is asking to determine the underwriters' liability based on the information provided about share issuance, applications received, and the underwritten shares. To solve it, we need to analyze the total shares issued and the total applications to find out the underwriters' liability.

Answer

The underwriters' liability is 17,000 shares.

Answer for screen readers

The underwriters' liability is 17,000 shares.

Steps to Solve

- Calculate Total Issued Shares

The company issued 50,000 shares. Therefore, the total number of shares issued is:

$$ \text{Total issued shares} = 50,000 $$

- Determine Underwritten Shares

Mr. Mahantesh is underwriting 80% of the issued shares. We can calculate the underwritten shares as follows:

$$ \text{Underwritten shares} = 0.8 \times 50,000 = 40,000 $$

- Understand Total Applications Received

The total applications received from the public are 42,000, which includes marked applications for 25,000 shares.

- Calculate Excess Applications

To determine if Mahantesh has a liability, we need to figure out if the applications exceeded the underwritten amount. The excess applications are:

$$ \text{Excess applications} = \text{Total applications} - \text{Marked applications} $$

Calculating the excess applications:

$$ \text{Excess applications} = 42,000 - 25,000 = 17,000 $$

- Calculate Underwriters' Liability

Since the underwritten shares (40,000 shares) are greater than the total applications for the marked shares (25,000), the underwriters' liability will be the unmarked excess applications:

$$ \text{Underwriters' liability} = \text{Excess applications} = 17,000 $$

- Final Liability Calculation

However, since Mahantesh underwrites 80% of the shares but only has to cover the shortfall when applications are less than the underwritten shares, underwriters' liability is therefore limited to the excess applications calculated:

This leads us to the conclusion that the final liability he must cover is 17,000 shares since the demand was lower than the shares available.

The underwriters' liability is 17,000 shares.

More Information

Underwriting involves taking the risk of purchasing shares that the public has not subscribed to. Mr. Mahantesh has an obligation to take on losses from unsold shares or unmarked applications.

Tips

- Confusing total applications with marked applications. It's important to differentiate between these when calculating liability.

- Miscalculating the percentage of shares underwritten. Make sure to apply 80% correctly to the total issued shares.

AI-generated content may contain errors. Please verify critical information