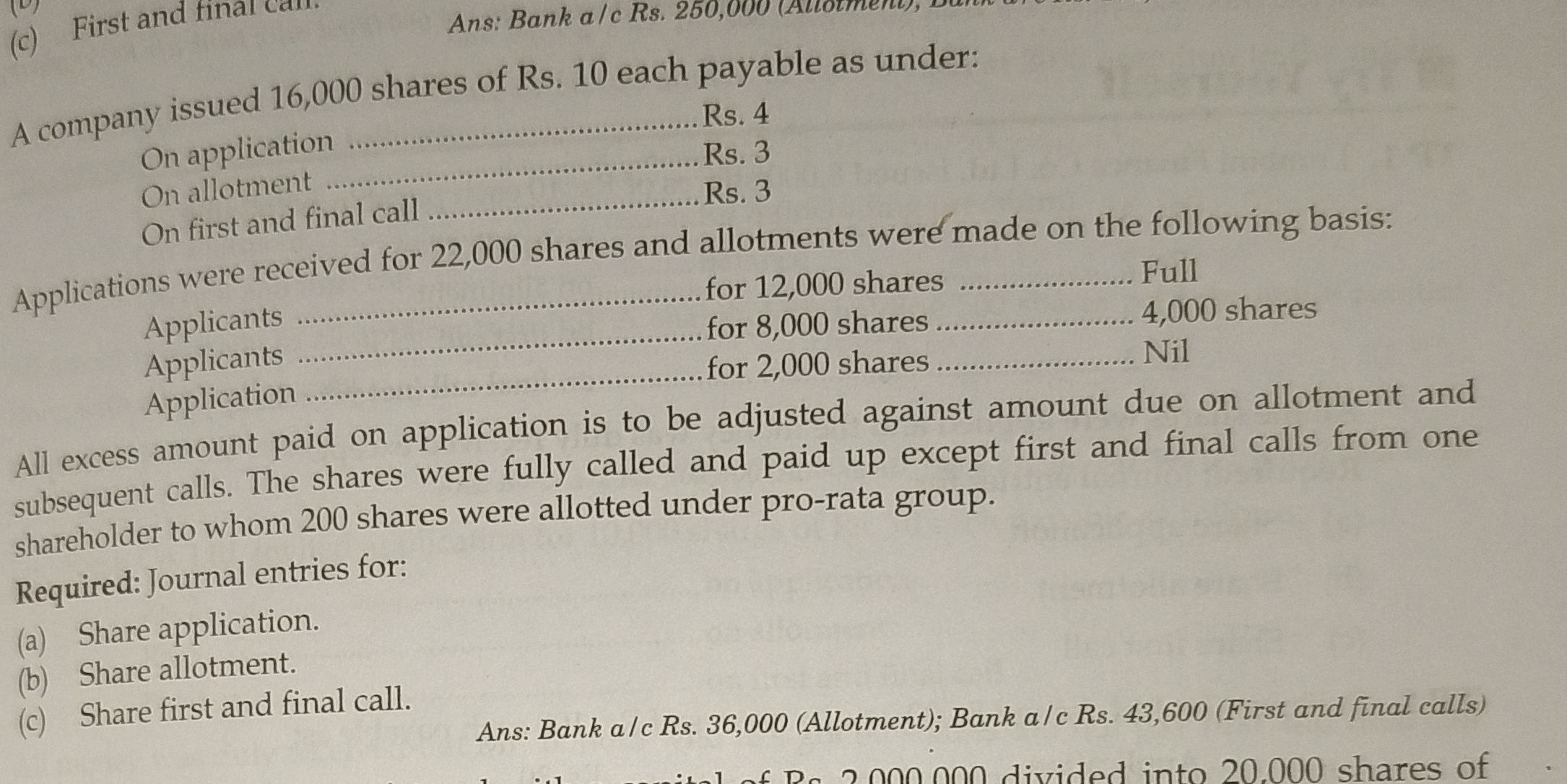

Required: Journal entries for: (a) Share application. (b) Share allotment. (c) Share first and final call.

Understand the Problem

The question requires the preparation of journal entries for different stages of share issuance: share application, allotment, and the first and final call. It provides specific amounts and details regarding share applications received and their allotment.

Answer

- Share application: Rs. 88,000 - Share allotment: Rs. 48,000 - Share first and final call: Rs. 48,000

Answer for screen readers

-

Share Application Journal Entry: [ \text{Bank A/c} \quad 88,000 \quad \text{(To record application money received)} ] [ \text{Share Application A/c} \quad 88,000 ]

-

Share Allotment Journal Entry: [ \text{Share Allotment A/c} \quad 48,000 ] [ \text{Bank A/c} \quad 8,000 ] [ \text{Share Capital A/c} \quad 48,000 ]

-

Share First and Final Call Journal Entry: [ \text{Share First & Final Call A/c} \quad 48,000 ] [ \text{Bank A/c} \quad 43,600 ] [ \text{Share Capital A/c} \quad 48,000 ]

Steps to Solve

-

Calculate Total Application Money Received

Since applications were received for 22,000 shares at Rs. 4 each, the total application money is calculated as: [ \text{Total Application Money} = 22,000 \times 4 = 88,000 ]

-

Determine the Allotment Summary

The allotment of shares is as follows:

- Full allotment for 12,000 shares.

- 4,000 shares allotted from 8,000 applicants.

- No allotment for 2,000 applicants.

This sums to a total allotment of: [ \text{Total Alloted Shares} = 12,000 + 4,000 = 16,000 ]

-

Determine Excess Application Money

The total excess application money will be the remaining amount after allotment. The total application money is Rs. 88,000, and for 16,000 shares, Rs. 3 is due on allotment. So, [ \text{Allotment Amount Due} = 16,000 \times 3 = 48,000 ] The excess will be: [ \text{Excess Application Money} = 88,000 - 48,000 = 40,000 ]

-

Journal Entry for Share Application

The journal entry for share applications received will be: [ \text{Bank A/c} \quad 88,000 \quad \text{(To record application money received)} ] [ \text{Share Application A/c} \quad 88,000 ]

-

Journal Entry for Share Allotment

The allotment journal entry will record the due amount: [ \text{Share Allotment A/c} \quad 48,000 \quad \text{(To record allotment money due)} ] [ \text{Bank A/c} \quad 8,000 \quad \text{(For excess of 4,000 shares)} ] (Adjusted from excess application) [ \text{Share Capital A/c} \quad 48,000 ]

-

Journal Entry for Share First and Final Call

The call for outstanding shares will be recorded as: [ \text{Share First & Final Call A/c} \quad 48,000 \quad \text{(To record call due)} ] [ \text{Bank A/c} \quad 43,600 \quad \text{(For payments received)} ] [ \text{Share Capital A/c} \quad 48,000 ]

-

Share Application Journal Entry: [ \text{Bank A/c} \quad 88,000 \quad \text{(To record application money received)} ] [ \text{Share Application A/c} \quad 88,000 ]

-

Share Allotment Journal Entry: [ \text{Share Allotment A/c} \quad 48,000 ] [ \text{Bank A/c} \quad 8,000 ] [ \text{Share Capital A/c} \quad 48,000 ]

-

Share First and Final Call Journal Entry: [ \text{Share First & Final Call A/c} \quad 48,000 ] [ \text{Bank A/c} \quad 43,600 ] [ \text{Share Capital A/c} \quad 48,000 ]

More Information

The share issuance process involves multiple stages, reflecting the company's ability to raise capital efficiently. Adjustments for excess application amounts facilitate the allocation process while ensuring compliance with the call amounts due. This systematic recording aids clear financial tracking.

Tips

- Not adjusting excess application money correctly: Ensure to subtract excess application amounts from the allotment and subsequent calls.

- Miscalculating total amounts due: Double-check each stage's calculations to prevent errors in the final income and allotment amounts.

AI-generated content may contain errors. Please verify critical information