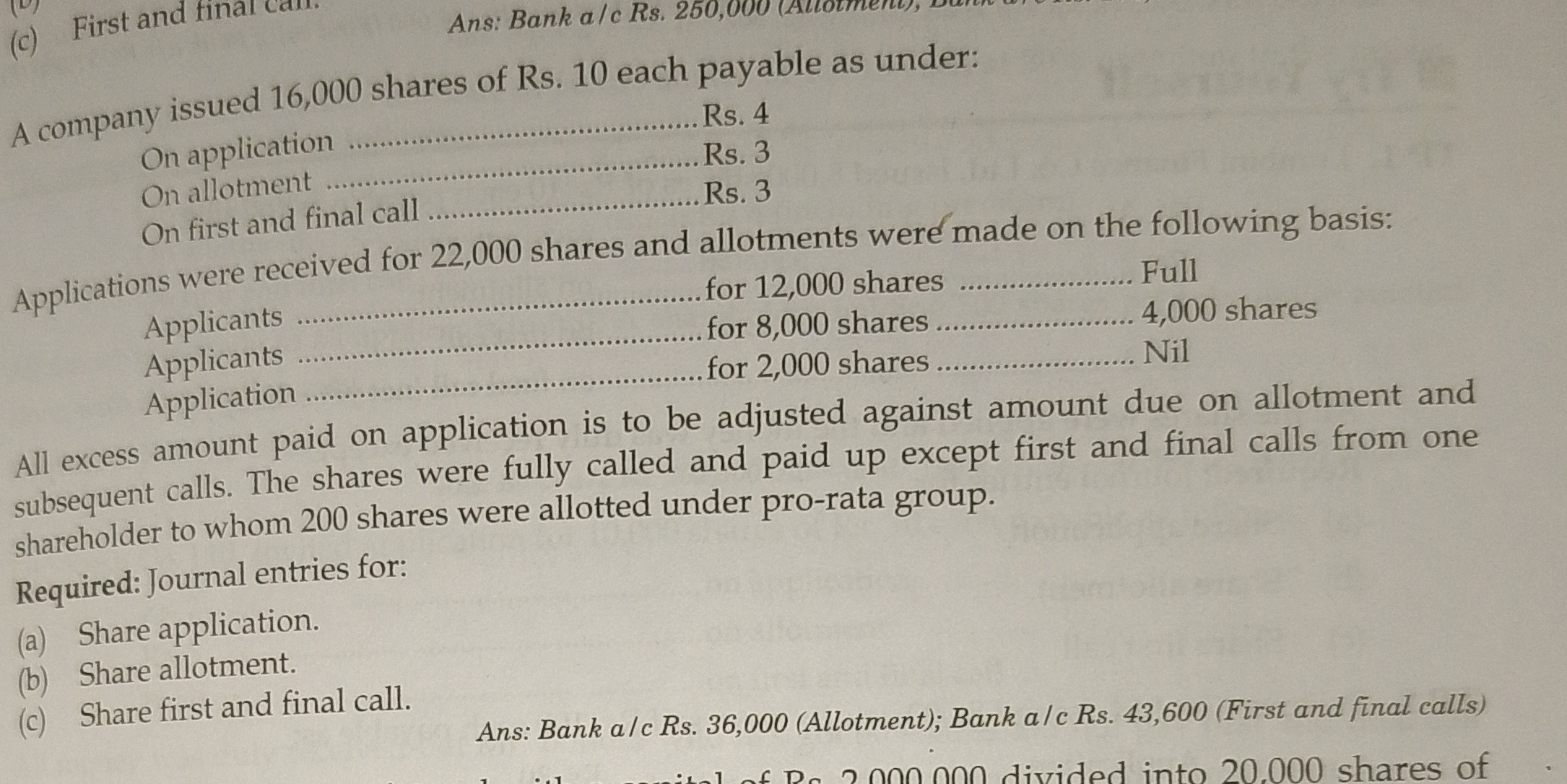

Required: Journal entries for: (a) Share application. (b) Share allotment. (c) Share first and final call.

Understand the Problem

The question is asking for the journal entries related to the issuance of shares for a company, specifically on the aspects of share application, share allotment, and share first and final call.

Answer

The journal entries for share application, allotment, and calls include bank debits and share capital credits reflecting amounts received as per the stated process.

Answer for screen readers

Journal Entries:

-

Share Application

- Bank A/c Dr. Rs. 88,000

- To Share Application A/c Rs. 88,000

-

Share Allotment

- Share Allotment A/c Dr. Rs. 60,000

- To Bank A/c Rs. 60,000

-

Share First and Final Call

- Share First and Final Call A/c Dr. Rs. 48,000

- To Bank A/c Rs. 48,000

-

Adjustments for Excess Application Money

- Share Application A/c Dr. Rs. 28,000

- To Share Allotment A/c Rs. 28,000

Steps to Solve

-

Share Application Entry

Record the amounts received from the share application.

The company received applications for 22,000 shares at Rs. 4 each:

$$ \text{Amount} = 22,000 \text{ shares} \times Rs. 4 = Rs. 88,000 $$ -

Share Allotment Entry

Record the allotment entries based on the shares allotted:

- Full payment for 12,000 shares:

$$ 12,000 \text{ shares} \times Rs. 3 = Rs. 36,000 $$ - For 8,000 shares where Rs. 3 was paid, the amount is:

$$ 8,000 \text{ shares} \times Rs. 3 = Rs. 24,000 $$ - For 2,000 shares, they are allotted but paid nil.

Total allotment amount received is:

$$ Rs. 36,000 + Rs. 24,000 = Rs. 60,000 $$

-

Share First and Final Call Entry

Record the first and final call amounts per share.

All shares have a call of Rs. 3 each, totaling:

$$ 16,000 \text{ shares} \times Rs. 3 = Rs. 48,000 $$

Amount received for the call is recorded as:

- For the allotment of the full 12,000 shares:

$$ 12,000 \text{ shares} \times Rs. 3 = Rs. 36,000 $$ - For the 8,000 shares:

$$ 4,000 \text{ shares} \times Rs. 3 = Rs. 12,000 $$ - For the nil share payment in 2,000, that remains nil.

Total amount from the first and final call should be recorded as:

$$ Rs. 36,000 + Rs. 12,000 = Rs. 48,000 $$

-

Adjustment of Excess Application Money

The excess amount received on application is adjusted against the allotment and future calls.

Total application amount was Rs. 88,000, and total demand was Rs. 60,000 (allotment) + Rs. 48,000 (calls) = Rs. 108,000.

Since all calls are due, we can adjust as:

$$ Rs. 88,000 - Rs. 60,000 = Rs. 28,000 \text{ (excess amount)} $$ -

Final Journal Entries

We finalize the journal entries for share application, allotment, and final call.

- Debit Bank and Credit Share Capital for each part of the process above.

Journal Entries:

-

Share Application

- Bank A/c Dr. Rs. 88,000

- To Share Application A/c Rs. 88,000

-

Share Allotment

- Share Allotment A/c Dr. Rs. 60,000

- To Bank A/c Rs. 60,000

-

Share First and Final Call

- Share First and Final Call A/c Dr. Rs. 48,000

- To Bank A/c Rs. 48,000

-

Adjustments for Excess Application Money

- Share Application A/c Dr. Rs. 28,000

- To Share Allotment A/c Rs. 28,000

More Information

The share issue process includes initial applications, followed by allotment and calling for the remaining amounts due. The company addresses excess funds at each stage by adjusting them against future dues.

Tips

- Failing to adjust excess application money correctly against subsequent calls.

- Not clearly separating amounts received for different share categories.

- Not checking totals for accuracy when recording transactions.

AI-generated content may contain errors. Please verify critical information