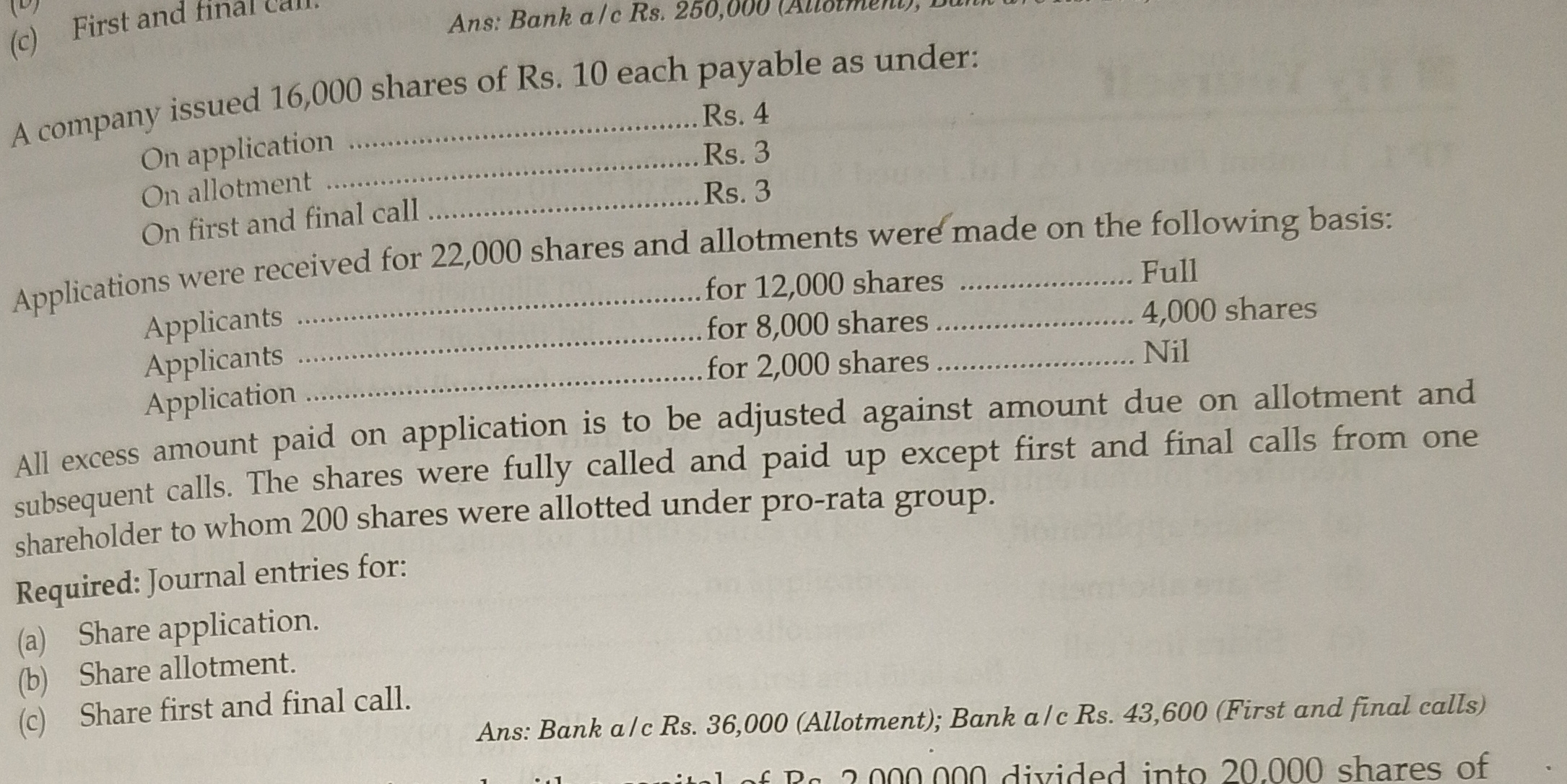

Required: Journal entries for: (a) Share application. (b) Share allotment. (c) Share first and final call.

Understand the Problem

The question is asking for the journal entries related to share application, allotment, and the first and final call for a company that issued shares. This involves recording financial transactions in accordance with accounting principles related to the issuance of shares and handling the amounts received from shareholders based on their applications.

Answer

The journal entries are: 1. For Share Application: ``` Bank A/c Dr. 88,000 To Share Application A/c 88,000 ``` 2. For Share Allotment: ``` Share Application A/c Dr. 48,000 To Share Allotment A/c 48,000 ``` 3. For First and Final Call: ``` Share Allotment A/c Dr. 48,000 To Share First and Final Call A/c 48,000 ``` 4. Bank Receipt from Call: ``` Bank A/c Dr. 43,600 To Share First and Final Call A/c 43,600 ```

Answer for screen readers

The journal entries for share application, allotment, and first & final call are:

- For Share Application:

Bank A/c Dr. 88,000

To Share Application A/c 88,000

- For Share Allotment:

Share Application A/c Dr. 48,000

To Share Allotment A/c 48,000

- For First and Final Call:

Share Allotment A/c Dr. 48,000

To Share First and Final Call A/c 48,000

- For Bank Receipts from First and Final Call:

Bank A/c Dr. 43,600

To Share First and Final Call A/c 43,600

Steps to Solve

-

Calculate Application Amounts We first determine how much was received from applicants. Since applications were received for 22,000 shares at Rs. 4 per share: $$ \text{Total application received} = 22,000 , \text{shares} \times 4 , \text{Rs/share} = 88,000 , \text{Rs} $$

-

Journal Entry for Share Application The journal entry for share applications would record cash received and the share application account. The amount needs to be debited to bank and credited to the share application account.

Bank A/c Dr. 88,000

To Share Application A/c 88,000

- Allocate Shares According to Applications Next, we apply shares based on the allotment numbers given:

- 12,000 shares (full)

- 8,000 shares (only 4,000 out of 8,000 received)

- 2,000 shares (not allotted)

This means only 16,000 shares will be allotted out of the 22,000 applied for.

-

Calculate Allotment Amounts For the 16,000 shares allotted, the allotment amount due is Rs. 3 per share. Therefore: $$ \text{Total allotment amount} = 16,000 , \text{shares} \times 3 , \text{Rs/share} = 48,000 , \text{Rs} $$

-

Journal Entry for Share Allotment The journal entry for the allotment of shares will show the amount due from the shareholders and show the transfer from the share application account to share allotment account.

Share Application A/c Dr. 48,000

To Share Allotment A/c 48,000

- Clear Out Unallocated Amounts For the remaining amount not allotted, i.e., for 8,000 shares:

- 4,000 shares will receive an additional call

- There will be no calls for the 2,000 shares not allocated.

The bank will receive the remaining amounts per the calls made.

-

Calculate First and Final Call Amounts For the first and final call, each share is Rs. 3. For 16,000 shares: $$ \text{Total for first and final call} = 16,000 , \text{shares} \times 3 , \text{Rs/share} = 48,000 , \text{Rs} $$

-

Journal Entry for First and Final Call

Share Allotment A/c Dr. 48,000

To Share First and Final Call A/c 48,000

- Update Bank for Received Amounts Once calls are made and received, the bank needs to reflect this:

Bank A/c Dr. 43,600

To Share First and Final Call A/c 43,600

The journal entries for share application, allotment, and first & final call are:

- For Share Application:

Bank A/c Dr. 88,000

To Share Application A/c 88,000

- For Share Allotment:

Share Application A/c Dr. 48,000

To Share Allotment A/c 48,000

- For First and Final Call:

Share Allotment A/c Dr. 48,000

To Share First and Final Call A/c 48,000

- For Bank Receipts from First and Final Call:

Bank A/c Dr. 43,600

To Share First and Final Call A/c 43,600

More Information

These journal entries reflect the standard procedure of accounting for share applications, allotments, and calls, ensuring all transactions are recorded according to accepted financial principles.

Tips

- Failing to adjust for excess application amounts.

- Not accurately calculating the amounts due on calls or allotments.

- Missing out on entries for the amounts not fully allocated.

AI-generated content may contain errors. Please verify critical information