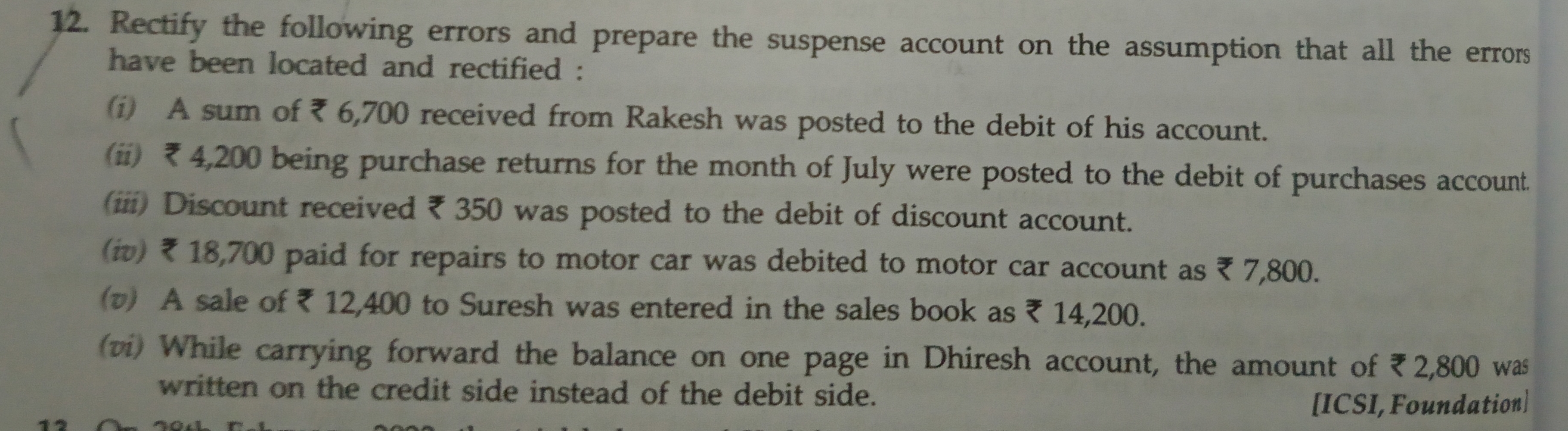

Rectify the following errors and prepare the suspense account on the assumption that all the errors have been located and rectified: (i) A sum of ₹ 6,700 received from Rakesh was p... Rectify the following errors and prepare the suspense account on the assumption that all the errors have been located and rectified: (i) A sum of ₹ 6,700 received from Rakesh was posted to the debit of his account. (ii) ₹ 4,200 being purchase returns for the month of July were posted to the debit of purchases account. (iii) Discount received ₹ 350 was posted to the debit of discount account. (iv) ₹ 18,700 paid for repairs to motor car was debited to motor car account as ₹ 7,800. (v) A sale of ₹ 12,400 to Suresh was entered in the sales book as ₹ 14,200. (vi) While carrying forward the balance on one page in Dhirish account, the amount of ₹ 2,800 was written on the credit side instead of the debit side.

Understand the Problem

The question requests a rectification of various accounting errors and the preparation of a suspense account based on those corrections.

Answer

The total adjustments for the suspense account amount to ₹ 34,550.

Answer for screen readers

The total needed for adjustments in the suspense account is ₹ 34,550.

Steps to Solve

-

Identify Each Error

We need to summarize the errors made in the accounts based on the provided information:

-

Error 1: ₹ 6,700 received from Rakesh was debited instead of credited.

-

Error 2: ₹ 4,200 purchase returns were debited to the purchases account instead of using the purchase returns account.

-

Error 3: Discount received ₹ 350 was posted to the discount account incorrectly.

-

Error 4: ₹ 18,700 paid for repairs was debited to motor car account instead of repairs account.

-

Error 5: Sale of ₹ 12,400 was incorrectly recorded as ₹ 14,200.

-

Error 6: An amount of ₹ 2,800 was incorrectly written on the credit side instead of the debit side in Dhirish's account.

-

-

Rectify Each Error

For each error, we need to identify the correct entry and calculate the effect on the suspense account.

-

Error 1:

- Correct Entry: Debit Rakesh’s account with ₹ 6,700 and credit the suspense account with ₹ 6,700.

-

Error 2:

- Correct Entry: Credit purchases return account with ₹ 4,200 and debit suspense account with ₹ 4,200.

-

Error 3:

- Correct Entry: Credit discount account with ₹ 350 and debit suspense account with ₹ 350.

-

Error 4:

- Correct Entry: Debit repairs account with ₹ 18,700 and credit suspense account with ₹ 18,700.

-

Error 5:

- Correct Entry: Debit sales account correctly with ₹ 12,400. Adjust suspense account by ₹ 1,800 (₹ 14,200 - ₹ 12,400).

-

Error 6:

- Correct Entry: Create a debit adjustment of ₹ 2,800 in Dhirish's account and credit suspense account with ₹ 2,800.

-

-

Prepare the Suspense Account

Now let’s close the suspense account by adding debits and credits we've just computed.

-

Total debits to suspense account:

- ₹ 6,700 (Error 1) + ₹ 4,200 (Error 2) + ₹ 350 (Error 3) + ₹ 18,700 (Error 4) + ₹ 1,800 (Error 5) + ₹ 2,800 (Error 6)

-

Total credits to suspense account:

- Same amounts as the above since they are offset each time an error is corrected.

-

-

Calculate Final Balance

The balance of the suspense account will show whether additional adjustments are needed or if the errors have balanced out.

$$ \text{Total Debits to Suspense Account} = 6,700 + 4,200 + 350 + 18,700 + 1,800 + 2,800 $$

-

Show the Final Calculation

After calculating the above expressions, ensure to present the final credit and debit totals in the suspense account.

The total needed for adjustments in the suspense account is ₹ 34,550.

More Information

A suspense account is used in accounting to temporarily hold discrepancies or errors until they can be properly allocated. It helps ensure that the financial statements remain balanced while errors are investigated and corrected.

Tips

- Ignoring double-entry accounting: Ensure that each correction applies the double-entry principle (debit and credit).

- Incorrect postings: Verify the correct accounts to which amounts should be posted.

- Miscalculating totals: Carefully add and deduct amounts, verifying calculations to avoid errors.