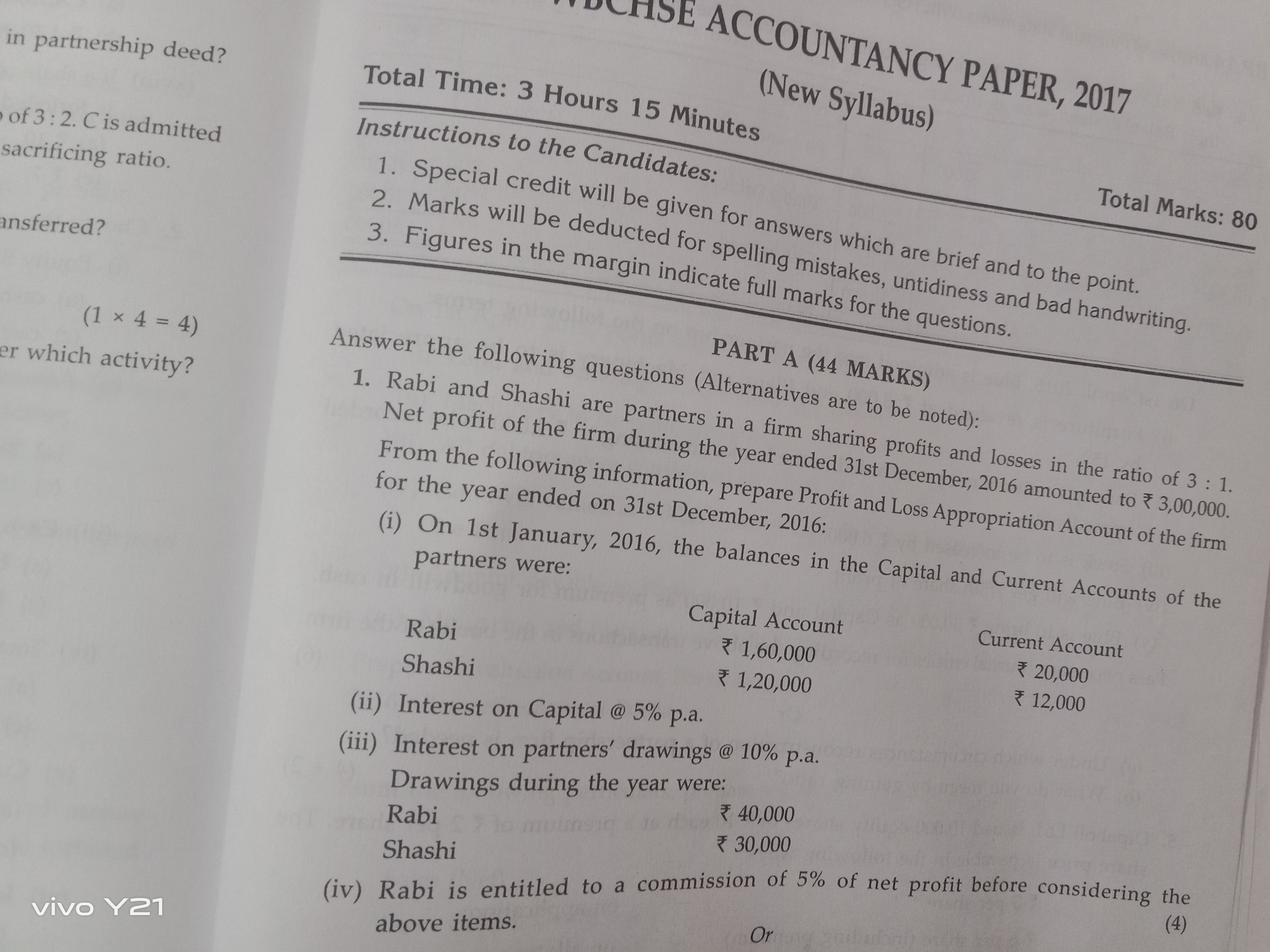

Rabi and Shashi are partners in a firm sharing profits and losses in the ratio of 3:1. Prepare Profit and Loss Appropriation Account based on the provided information for the year... Rabi and Shashi are partners in a firm sharing profits and losses in the ratio of 3:1. Prepare Profit and Loss Appropriation Account based on the provided information for the year ended 31st December 2016.

Understand the Problem

The question is asking for the preparation of a Profit and Loss Appropriation Account for partners Rabi and Shashi based on their share of profits and provided financial details. This involves accounting principles and calculations related to profit distribution.

Answer

Appropriate net profit considering interests, commission, and distribute 3:1.

The profit and loss appropriation account includes interest on capital, interest on drawings, Rabi’s commission, and distribution of remaining profit in a 3:1 ratio.

Answer for screen readers

The profit and loss appropriation account includes interest on capital, interest on drawings, Rabi’s commission, and distribution of remaining profit in a 3:1 ratio.

More Information

A Profit and Loss Appropriation Account is used to distribute the net profit among partners after making adjustments for interest, commission, etc. It ensures that all terms of the partnership agreement are met.

Tips

Ensure that interests on capital and drawings are calculated correctly to avoid errors in distribution.

Sources

- Difference between Profit and Loss Account And ... - GeeksforGeeks - geeksforgeeks.org

AI-generated content may contain errors. Please verify critical information