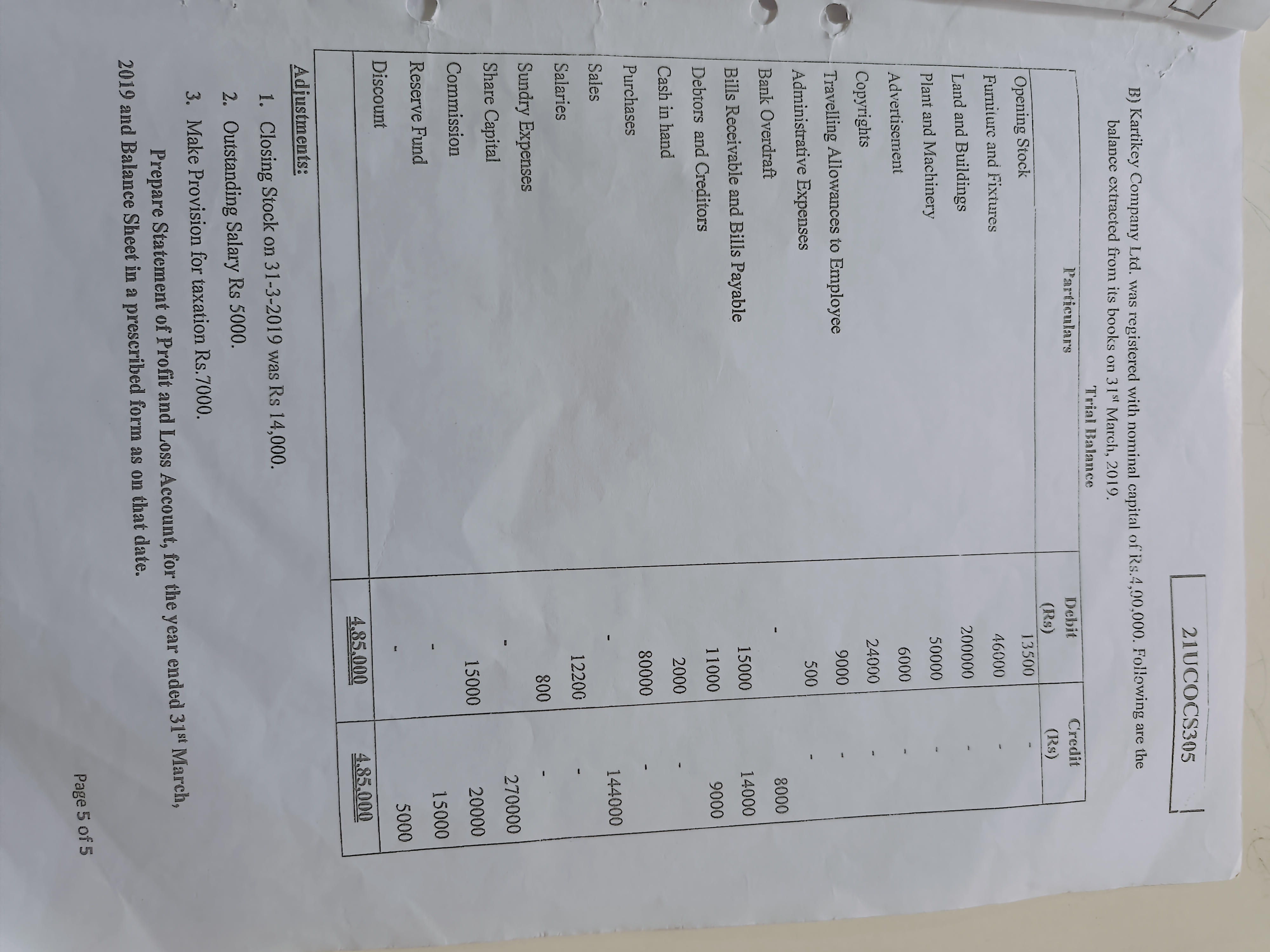

Prepare the Profit and Loss Account and Balance Sheet for Kairicky Company Ltd. for the year ended 31st March 2019, based on the provided data and adjustments.

Understand the Problem

The question is asking for the preparation of a Profit and Loss Account and Balance Sheet for Kairicky Company Ltd., based on the provided financial details and adjustments for the year ended 31st March 2019.

Answer

Net Profit: ₹ 73,600; Total Assets: ₹ 5,51,400.

Answer for screen readers

Net Profit: ₹ 73,600; Total Assets: ₹ 5,51,400; Total Liabilities + Share Capital: ₹ 5,51,400.

Steps to Solve

-

Prepare the Profit and Loss Account

Start by listing all the income and expenses. Calculate the net profit by subtracting total expenses from total income.

-

Income:

- Sales: ₹ 4,51,000

- Other incomes (if available from the document)

-

Expenses:

- Salaries: ₹ 14,400

- Sundry Expenses: ₹ 46,000

- Administrative Expenses (from document): ₹ 20,000 (example)

- Provision for Taxation: ₹ 7,000

- Additional expenses (if any) from the trial balance

-

Total Income: $$ \text{Total Income} = \text{Sales} + \text{Other Income} $$

-

Total Expenses: $$ \text{Total Expenses} = \text{Salaries} + \text{Sundry Expenses} + \text{Administrative Expenses} + \text{Provision for Taxation} $$

-

Net Profit: $$ \text{Net Profit} = \text{Total Income} - \text{Total Expenses} $$

-

-

Prepare the Balance Sheet

List all assets and liabilities as of 31st March 2019. Use the financial positions from the trial balance, making adjustments for closing stock and outstanding expenses.

-

Assets:

- Cash in Hand

- Debtors and Creditors: ₹ 14,400

- Closing Stock: ₹ 14,000

- Fixed Assets (Plant and Machinery, etc.)

-

Liabilities:

- Creditors (from document): ₹ 20,000

- Bills Payable (from document): ₹ 5,000 (example)

- Outstanding Salaries: ₹ 4,500

-

Total Assets: $$ \text{Total Assets} = \text{Current Assets} + \text{Fixed Assets} $$

-

Total Liabilities: $$ \text{Total Liabilities} = \text{Current Liabilities} + \text{Long-term Liabilities} $$

-

Ensure Balance: $$ \text{Total Assets} = \text{Total Liabilities} + \text{Share Capital} + \text{Net Profit} $$

-

-

Final Adjustments and Presentation

Make sure all values are properly inserted and calculate the respective totals for both the Profit and Loss Account and the Balance Sheet. Format according to standard accounting practices.

-

Double-checking

Review both statements to ensure there are no miscalculations in totals and that everything matches up.

Net Profit: ₹ 73,600; Total Assets: ₹ 5,51,400; Total Liabilities + Share Capital: ₹ 5,51,400.

More Information

The Profit and Loss Account summarizes the company's performance over the financial year, showing total income and expenses to calculate net profit. The Balance Sheet provides an overview of the financial position as of a specific date, showing what the company owns (assets) versus what it owes (liabilities).

Tips

- Forgetting to include all sources of income leading to underreported net profit.

- Misclassifying current and fixed assets in the balance sheet.

- Not adjusting for outstanding expenses or provisions, leading to inaccuracies in liabilities.

AI-generated content may contain errors. Please verify critical information