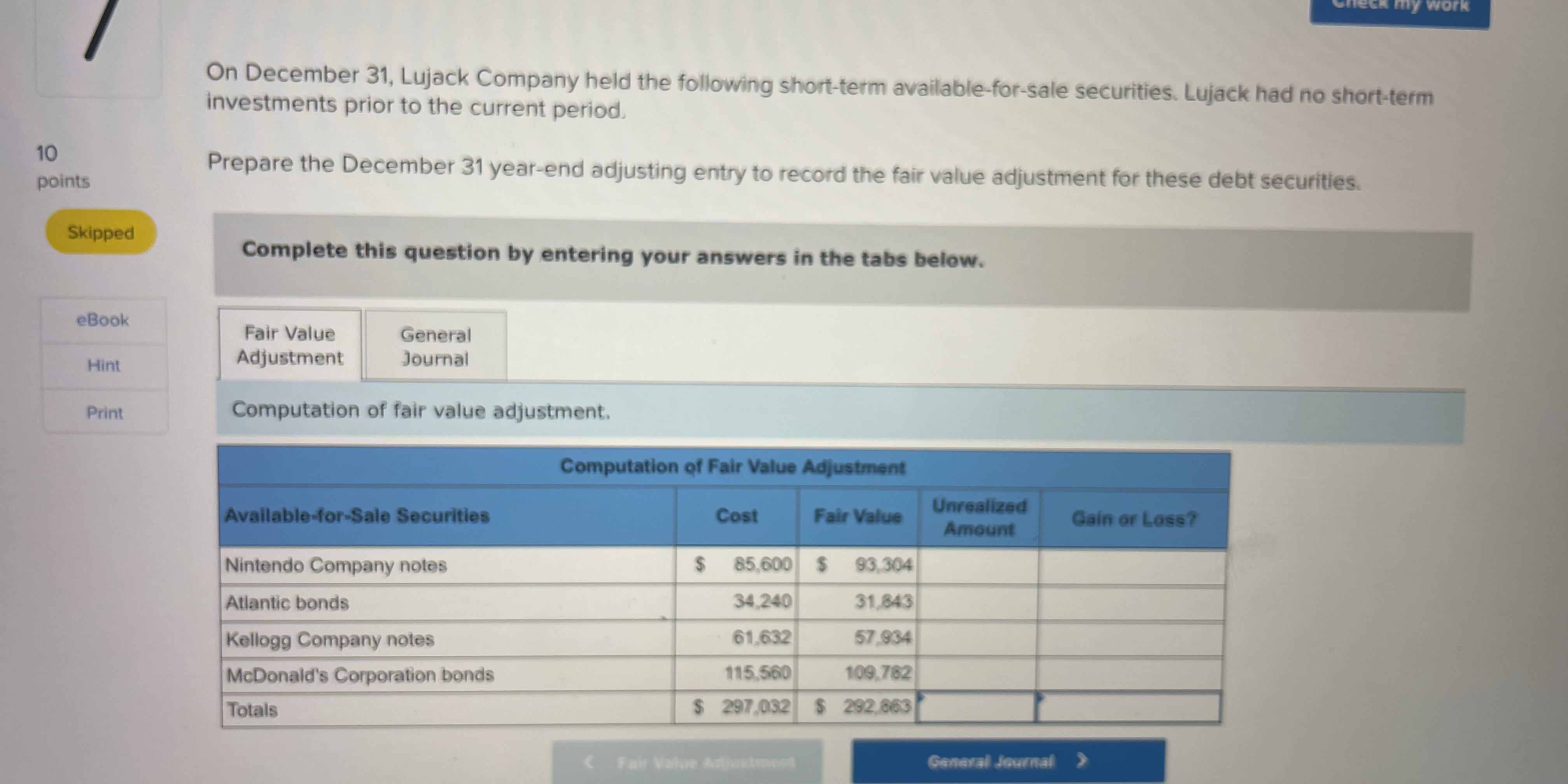

Prepare the December 31 year-end adjusting entry to record the fair value adjustment for these debt securities.

Understand the Problem

The question is asking to prepare a year-end adjusting entry for the fair value adjustment of short-term available-for-sale securities held by Lujack Company as of December 31.

Answer

The adjusting entry is: - **Debit**: Unrealized Loss on Fair Value Adjustments $4,189 - **Credit**: Fair Value Adjustment $4,189

Answer for screen readers

The December 31 year-end adjusting entry for Lujack Company is:

-

Debit: Unrealized Loss on Fair Value Adjustments $4,189

-

Credit: Fair Value Adjustment $4,189

Steps to Solve

- Identify Cost and Fair Value of Each Security

List out the costs and current fair values for each security:

- Nintendo Company notes: Cost = $85,600, Fair Value = $93,304

- Atlantic bonds: Cost = $34,240, Fair Value = $31,843

- Kellogg Company notes: Cost = $61,632, Fair Value = $57,934

- McDonald's Corporation bonds: Cost = $115,560, Fair Value = $109,762

- Calculate Unrealized Gains or Losses

Calculate the unrealized gain or loss for each security using the formula:

$$ \text{Unrealized Amount} = \text{Fair Value} - \text{Cost} $$

- Nintendo: $93,304 - $85,600 = $7,704 (Gain)

- Atlantic: $31,843 - $34,240 = -$2,397 (Loss)

- Kellogg: $57,934 - $61,632 = -$3,698 (Loss)

- McDonald's: $109,762 - $115,560 = -$5,798 (Loss)

- Sum Total Unrealized Gains and Losses

Add the unrealized gains and losses to find the total fair value adjustment:

Total Gain = $7,704

Total Loss = $2,397 + $3,698 + $5,798 = $11,893

Net Unrealized Adjustment:

$$ 7,704 - 11,893 = -4,189 $$ (Net Loss)

- Prepare the Adjusting Journal Entry

Record the adjusting journal entry for the total unrealized loss. Since it's a loss, it will reduce the fair value adjustment account.

The entry will be:

- Debit: Unrealized Loss on Fair Value Adjustments $4,189

- Credit: Fair Value Adjustment $4,189

The December 31 year-end adjusting entry for Lujack Company is:

-

Debit: Unrealized Loss on Fair Value Adjustments $4,189

-

Credit: Fair Value Adjustment $4,189

More Information

The fair value adjustment reflects the difference in asset value from when they were purchased to their current market price. This financial statement adjustment is necessary to provide an accurate representation of the company's financial position.

Tips

- Not calculating the unrealized gains and losses correctly. Always double-check subtraction to ensure accurate results.

- Forgetting to consider both gains and losses when summing total adjustments. Ensure to differentiate between the profit and loss when calculating net adjustment.

AI-generated content may contain errors. Please verify critical information