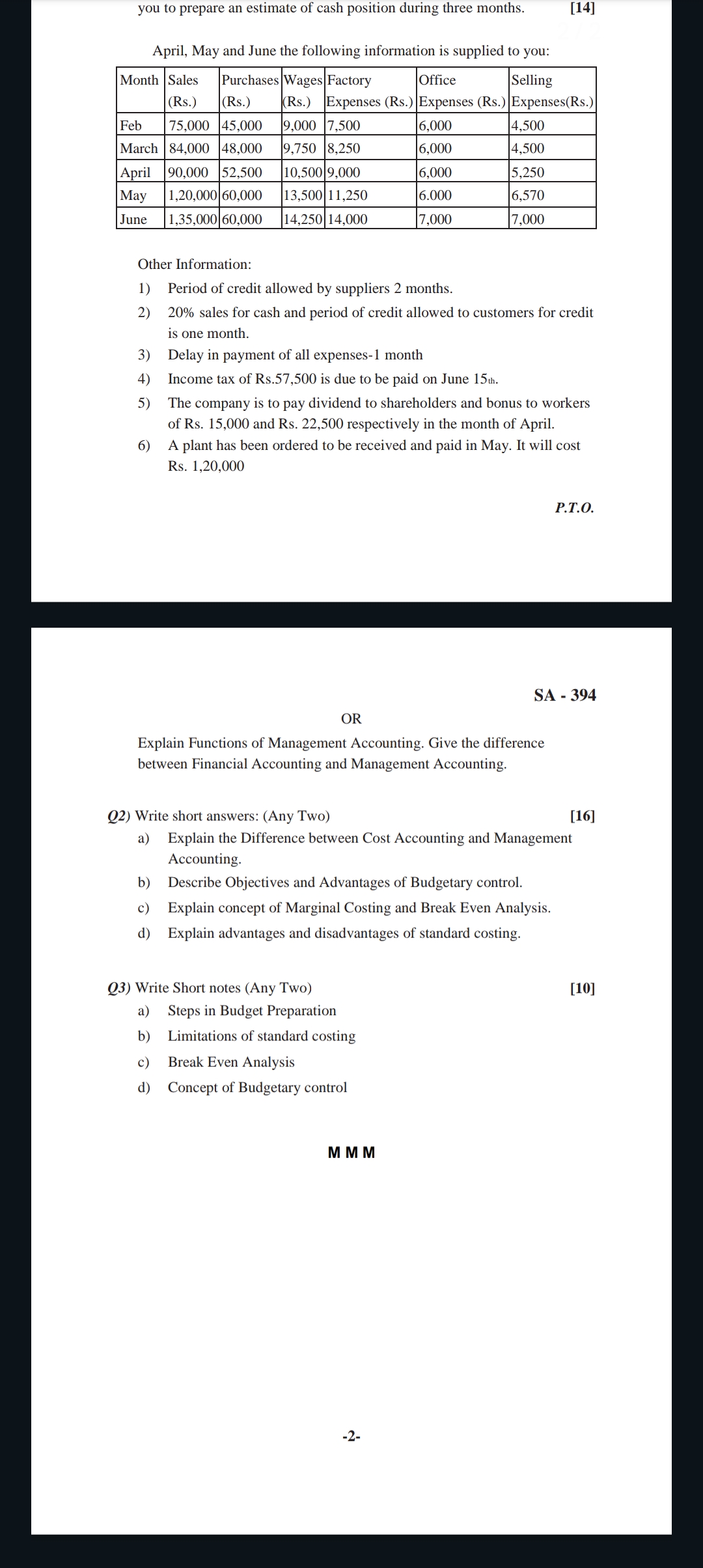

Prepare an estimate of cash position during three months based on the given financial data for April, May, and June.

Understand the Problem

The question is asking to prepare an estimate of the cash position for the months of April, May, and June based on the provided financial data, to analyze the cash inflows and outflows accurately.

Answer

April: Rs. -7,050, May: Rs. -17,250, June: Rs. 30,250.

Answer for screen readers

The estimated cash positions for the months are as follows:

- April: Rs. -7,050 (Deficit)

- May: Rs. -17,250 (Deficit)

- June: Rs. 30,250 (Surplus)

Steps to Solve

- Calculate Cash Inflows and Outflows for Each Month

Firstly, determine the cash inflows from sales and calculate the cash outflows from purchases, wages, and other expenses for April, May, and June.

-

For cash inflows from sales:

- April: Cash sales = 20% of sales = $0.2 \times 90,000 = Rs. 18,000$

- May: Cash sales = $0.2 \times 120,000 = Rs. 24,000$

- June: Cash sales = $0.2 \times 135,000 = Rs. 27,000$

Total cash inflows will also include receivables from the previous month sales (80%):

- April: Receivables from March = $0.8 \times 84,000 = Rs. 67,200$

- May: Receivables from April = $0.8 \times 90,000 = Rs. 72,000$

- June: Receivables from May = $0.8 \times 120,000 = Rs. 96,000$

- Sum the Total Cash Inflows

Next, sum the cash inflows for each month.

- Cash inflows for each month:

- April: Total = $18,000 + 67,200 = Rs. 85,200$

- May: Total = $24,000 + 72,000 = Rs. 96,000$

- June: Total = $27,000 + 96,000 = Rs. 123,000$

- Calculate Total Cash Outflows for Each Month

Calculate total outflows from purchases, wages, factory expenses, office expenses, dividends, tax, and other payments.

Cash outflows will include:

-

April:

- Purchases = Rs. 52,500 + Wages = Rs. 10,500 + Factory Expenses = Rs. 9,000 + Office Expenses = Rs. 5,250 + Dividends = Rs. 15,000 (for April)

- Total Outflow = $52,500 + 10,500 + 9,000 + 5,250 + 15,000 = Rs. 92,250$

-

May:

- Purchases = Rs. 60,000 + Wages = Rs. 13,500 + Factory Expenses = Rs. 11,250 + Office Expenses = Rs. 6,000 + Bonus = Rs. 22,500

- Total Outflow = $60,000 + 13,500 + 11,250 + 6,000 + 22,500 = Rs. 113,250$

-

June:

- Purchases = Rs. 14,250 + Wages = Rs. 14,000 + Office Expenses = Rs. 7,000 + Income Tax = Rs. 57,500

- Total Outflow = $14,250 + 14,000 + 7,000 + 57,500 = Rs. 92,750$

- Sum the Total Cash Outflows

Now sum the total outflows for each month.

- Calculate Cash Position for Each Month

Finally, calculate the cash position for each month by subtracting outflows from inflows.

-

Cash Position = Cash Inflow - Cash Outflow

-

April: $85,200 - 92,250 = Rs. -7,050$ (Deficit)

-

May: $96,000 - 113,250 = Rs. -17,250$ (Deficit)

-

June: $123,000 - 92,750 = Rs. 30,250$ (Surplus)

The estimated cash positions for the months are as follows:

- April: Rs. -7,050 (Deficit)

- May: Rs. -17,250 (Deficit)

- June: Rs. 30,250 (Surplus)

More Information

The analysis shows that the company experiences cash deficits in the first two months, which may necessitate temporary financing. However, in June, it recovers with a surplus, indicating improved cash flow management or increased sales.

Tips

- Not accounting for cash inflows from previous months properly.

- Forgetting to include all types of outflows (like dividends or taxes).

- Miscalculating percentages while determining cash sales.

AI-generated content may contain errors. Please verify critical information