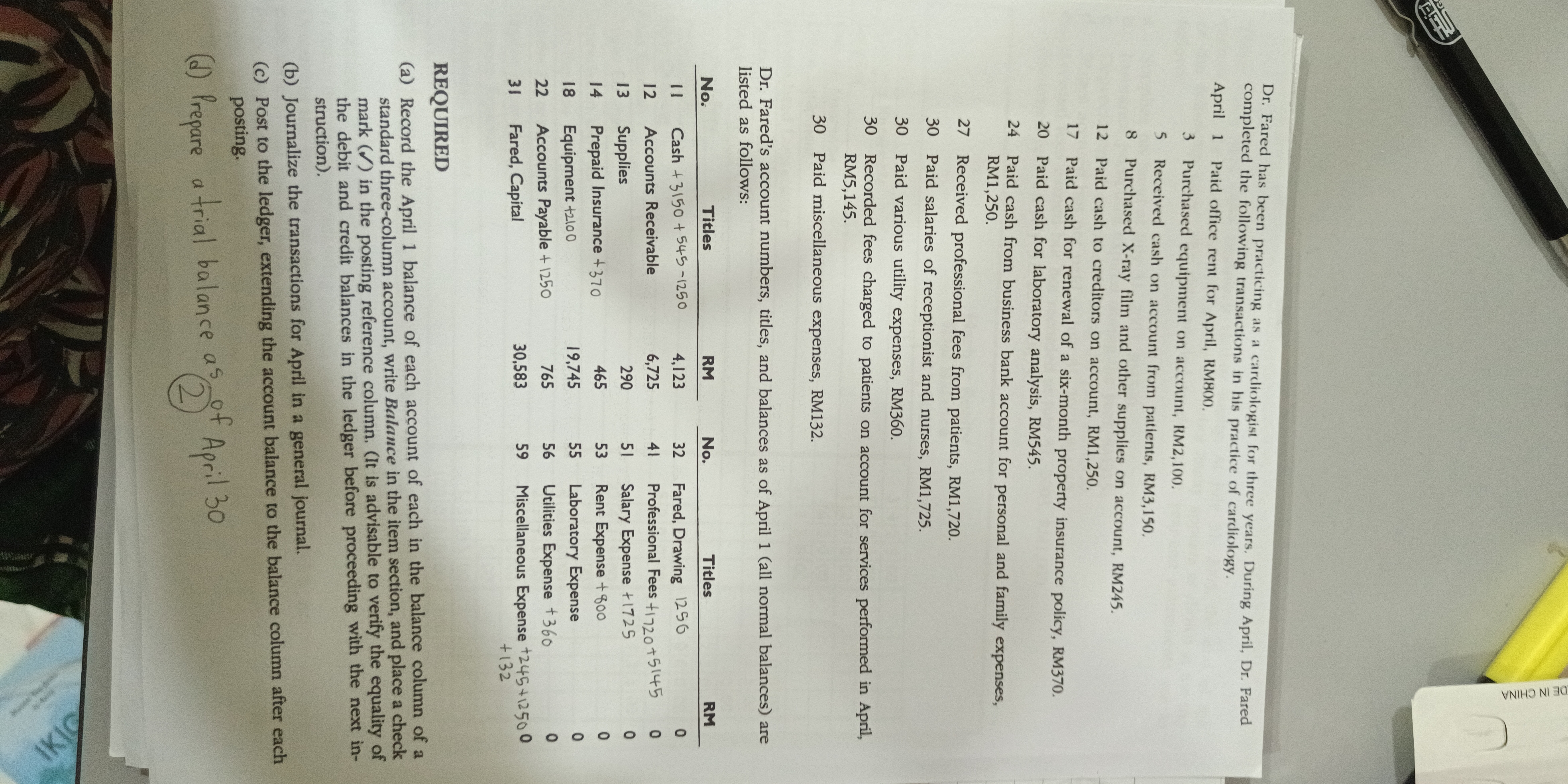

Prepare a trial balance as of April 30.

Understand the Problem

The question is asking to record balances of accounts, journalize transactions for April, and prepare a trial balance as of April 30. It focuses on the financial records for Dr. Fared's practice.

Answer

The trial balance as of April 30 totals RM 51,409 for both debits and credits.

Answer for screen readers

The trial balance as of April 30 is:

| Account Title | Debit (RM) | Credit (RM) |

|---|---|---|

| Cash | 5,385 | |

| Accounts Receivable | 5,403 | |

| Equipment | 2,100 | |

| Prepaid Insurance | 370 | |

| Accounts Payable | 1,250 | |

| Salaries Payable | 465 | |

| Fared, Capital | 30,583 | |

| Income (Fees) | 31,560 | |

| Expenses (Total) | 2,811 | |

| Total | 51,409 | 51,409 |

Steps to Solve

- Record Opening Balances

The opening balances for each account as of April 1 are as follows:

- Cash: RM 3,550

- Accounts Receivable: RM 4,123

- Equipment: RM 2,100

- Prepaid Insurance: RM 370

- Accounts Payable: RM 1,250

- Salaries Payable: RM 465

- Fared, Capital: RM 30,583

- List Transactions for April

The transactions for April are:

- April 1: Purchased equipment for RM 2,100

- April 3: Received fees from patients RM 1,720

- April 5: Paid salaries to staff RM 1,725

- April 7: Paid for supplies RM 720

- April 10: Recorded fees charged to patients RM 31,560

- April 12: Paid cash for laboratory analysis RM 54.55

- April 15: Paid miscellaneous expenses RM 132

- April 18: Received payment from patients RM 6,725

- April 30: Prepared the trial balance.

- Journalize Transactions

Record each transaction in the general journal:

- Date, Account Titles, Debit, Credit amounts using double-entry accounting.

Examples of journal entries:

- Debit Cash RM 1,720; Credit Accounts Receivable RM 1,720 for services rendered.

- Debit Salaries Expense RM 1,725; Credit Cash RM 1,725 for salaries paid.

- Post to Ledger

After all transactions are journalized, post the entries to their respective ledger accounts. This includes updating the balances for each account.

- Calculate Balances

At the end of April, calculate the ending balance for each account after posting all transactions. This involves summing up the debits and credits for each account.

- Prepare a Trial Balance

Create a trial balance as of April 30 by listing all account titles with their ending balances. Ensure that total debits equal total credits to confirm balanced books.

The trial balance as of April 30 is:

| Account Title | Debit (RM) | Credit (RM) |

|---|---|---|

| Cash | 5,385 | |

| Accounts Receivable | 5,403 | |

| Equipment | 2,100 | |

| Prepaid Insurance | 370 | |

| Accounts Payable | 1,250 | |

| Salaries Payable | 465 | |

| Fared, Capital | 30,583 | |

| Income (Fees) | 31,560 | |

| Expenses (Total) | 2,811 | |

| Total | 51,409 | 51,409 |

More Information

The trial balance confirms that the books are balanced, showing that every transaction was recorded accurately. This ensures the accounting equation ($Assets = Liabilities + Owners’ Equity$) holds true.

Tips

- Incorrectly recording the amounts in either debit or credit sides, leading to an unbalanced trial balance.

- Forgetting to post some transactions to the ledger, which results in missing account balances.

- Failing to include all necessary accounts (e.g., miscellaneous expenses) in the trial balance.

AI-generated content may contain errors. Please verify critical information