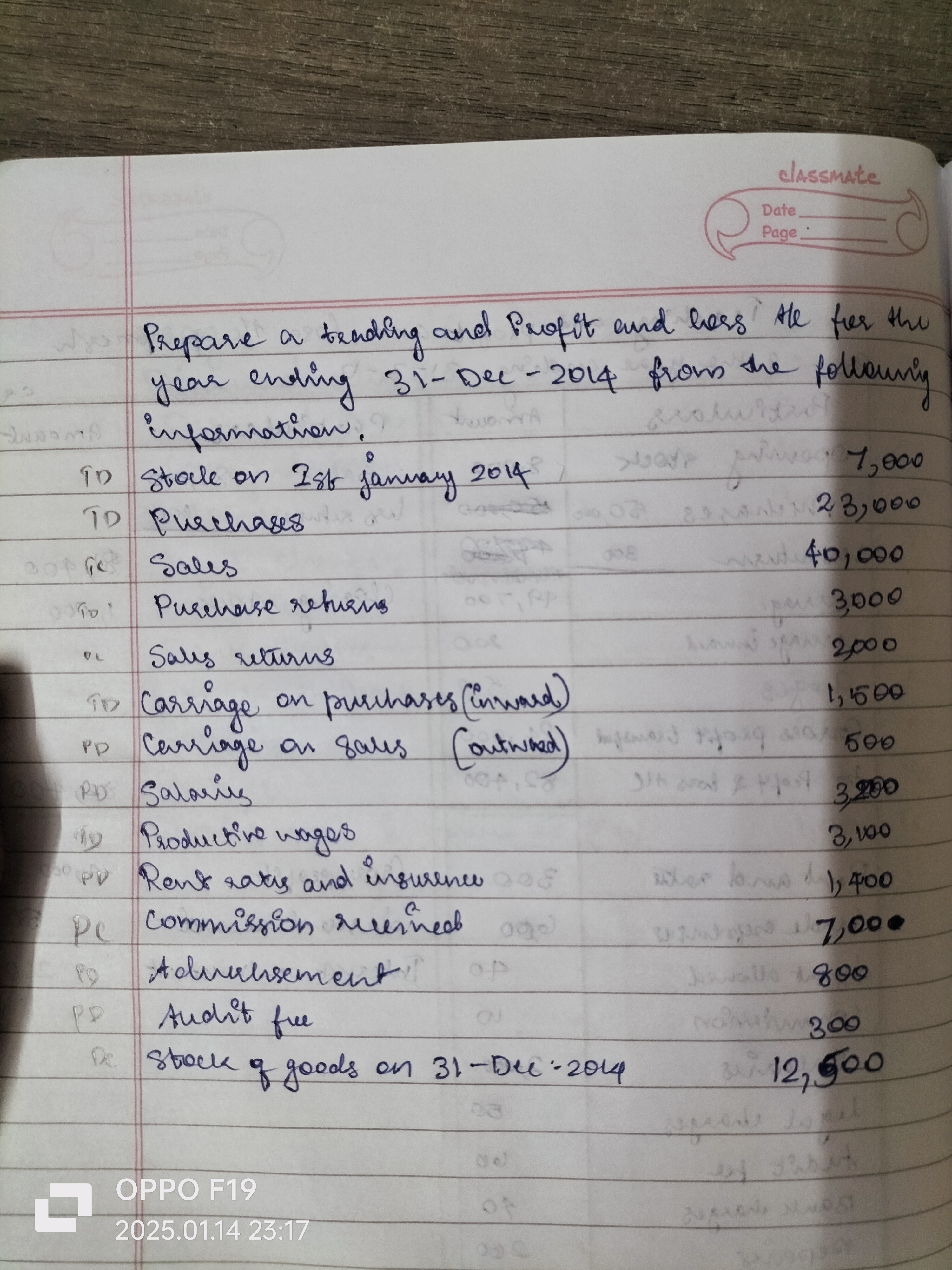

Prepare a trading and profit and loss account for the year ending 31-Dec-2014 from the following information.

Understand the Problem

The question is asking to prepare a trading and profit and loss account for the year ending December 31, 2014, based on the provided financial information. This involves organizing and calculating various income and expense items to determine profitability.

Answer

The net profit for the year ending December 31, 2014, is $11,100.

Answer for screen readers

The net profit for the year ending December 31, 2014, is $11,100.

Steps to Solve

-

Calculate Net Sales To find the net sales, subtract sales returns from total sales.

$$ \text{Net Sales} = \text{Sales} - \text{Sales Returns} $$ $$ \text{Net Sales} = 40,000 - 2,000 = 38,000 $$

-

Calculate Total Purchases Total purchases are calculated by taking the total purchases and subtracting purchase returns. Then add carriage on purchases.

$$ \text{Total Purchases} = \text{Purchases} - \text{Purchase Returns} + \text{Carriage on Purchases} $$ $$ \text{Total Purchases} = 23,000 - 3,000 + 1,500 = 21,500 $$

-

Calculate Cost of Goods Sold (COGS) COGS is determined by adding the opening stock to total purchases and then subtracting the closing stock.

$$ \text{COGS} = \text{Opening Stock} + \text{Total Purchases} - \text{Closing Stock} $$ $$ \text{COGS} = 7,000 + 21,500 - 12,500 = 16,000 $$

-

Calculate Gross Profit Gross profit is calculated by subtracting COGS from net sales.

$$ \text{Gross Profit} = \text{Net Sales} - \text{COGS} $$ $$ \text{Gross Profit} = 38,000 - 16,000 = 22,000 $$

-

Calculate Total Operating Expenses Total operating expenses include salaries, productive wages, rent, advertisement, audit fee, and carriage on sales.

$$ \text{Total Expenses} = \text{Salaries} + \text{Productive Wages} + \text{Rent} + \text{Advertisement} + \text{Audit Fee} + \text{Carriage on Sales} $$ $$ \text{Total Expenses} = 3,800 + 3,100 + 1,400 + 800 + 300 + 500 = 10,900 $$

-

Calculate Net Profit Finally, subtract total operating expenses from gross profit to find net profit.

$$ \text{Net Profit} = \text{Gross Profit} - \text{Total Expenses} $$ $$ \text{Net Profit} = 22,000 - 10,900 = 11,100 $$

The net profit for the year ending December 31, 2014, is $11,100.

More Information

This trading and profit and loss account summarizes the financial performance of a business over a specific period. It includes key components like gross profit and net profit, which are vital for assessing financial health.

Tips

- Forgetting to subtract sales returns from total sales, leading to an overestimation of net sales.

- Not considering both opening and closing stock when calculating the cost of goods sold.

AI-generated content may contain errors. Please verify critical information