Prepare a statement showing distribution of cash by applying Excess Capital Method.

Understand the Problem

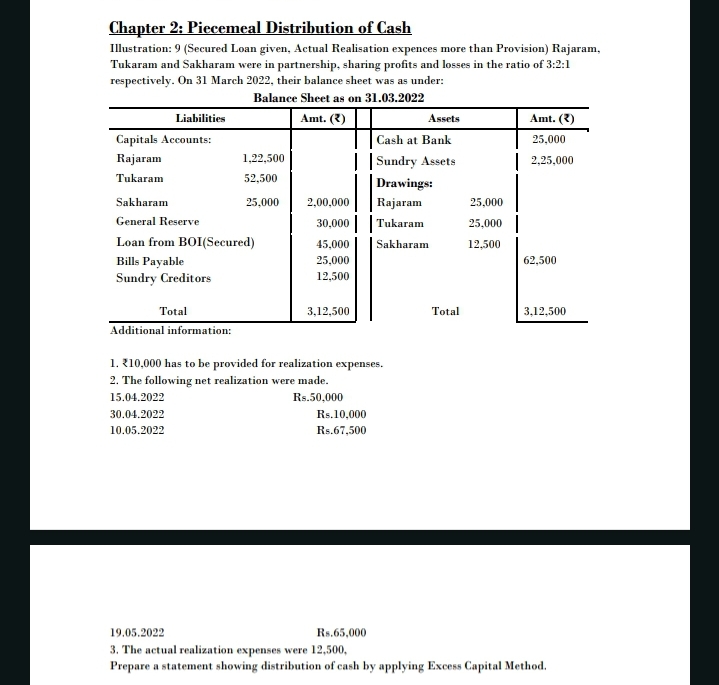

The question is asking for a statement showing the distribution of cash among Rajaram, Tukaram, and Sakharam using the Excess Capital Method, considering the provided balance sheet and additional information about realization expenses and net realizations.

Answer

Rajaram: $70,875$, Tukaram: $30,375$, Sakharam: $14,375$

Answer for screen readers

The distribution of cash is as follows:

- Rajaram: $70,875$

- Tukaram: $30,375$

- Sakharam: $14,375$

Steps to Solve

-

Calculate Net Realizations

Begin by adding up the total net realizations from the given dates:

$$ 50,000 + 10,000 + 67,500 = 127,500 $$ -

Deduct Realization Expenses

Subtract the total realization expenses from the total net realizations. The realization expenses total $12,500$:

$$ 127,500 - 12,500 = 115,000 $$ -

Determine Cash Available for Distribution

The amount available for distribution among Rajaram, Tukaram, and Sakharam is $115,000$. -

Calculate Individual Capital Contributions

Determine each partner's capital contribution using the balance sheet:

- Rajaram: $1,22,500$

- Tukaram: $52,500$

- Sakharam: $25,000$

-

Total Capital Contributions

Calculate the total capital contributions:

$$ 1,22,500 + 52,500 + 25,000 = 2,00,000 $$ -

Calculate Share of Cash According to Excess Capital Method

Calculate each partner's share based on their contribution ratio to total capital:

- Rajaram's share:

$$ \frac{1,22,500}{2,00,000} \times 115,000 = 70,875 $$ - Tukaram's share:

$$ \frac{52,500}{2,00,000} \times 115,000 = 30,375 $$ - Sakharam's share:

$$ \frac{25,000}{2,00,000} \times 115,000 = 14,375 $$

-

Prepare the Distribution Statement

Summarize the distribution shares in a clear statement format:

- Rajaram: $70,875$

- Tukaram: $30,375$

- Sakharam: $14,375$

The distribution of cash is as follows:

- Rajaram: $70,875$

- Tukaram: $30,375$

- Sakharam: $14,375$

More Information

This calculation demonstrates how to allocate cash among partners when their capital contributions vary. The Excess Capital Method ensures that partners receive distributions proportionate to their capital contributions.

Tips

- Forgetting to deduct realization expenses from net realizations; always ensure total expenses are accounted for.

- Not converting cash amounts into the same denomination. Ensure consistency when calculating shares.

AI-generated content may contain errors. Please verify critical information