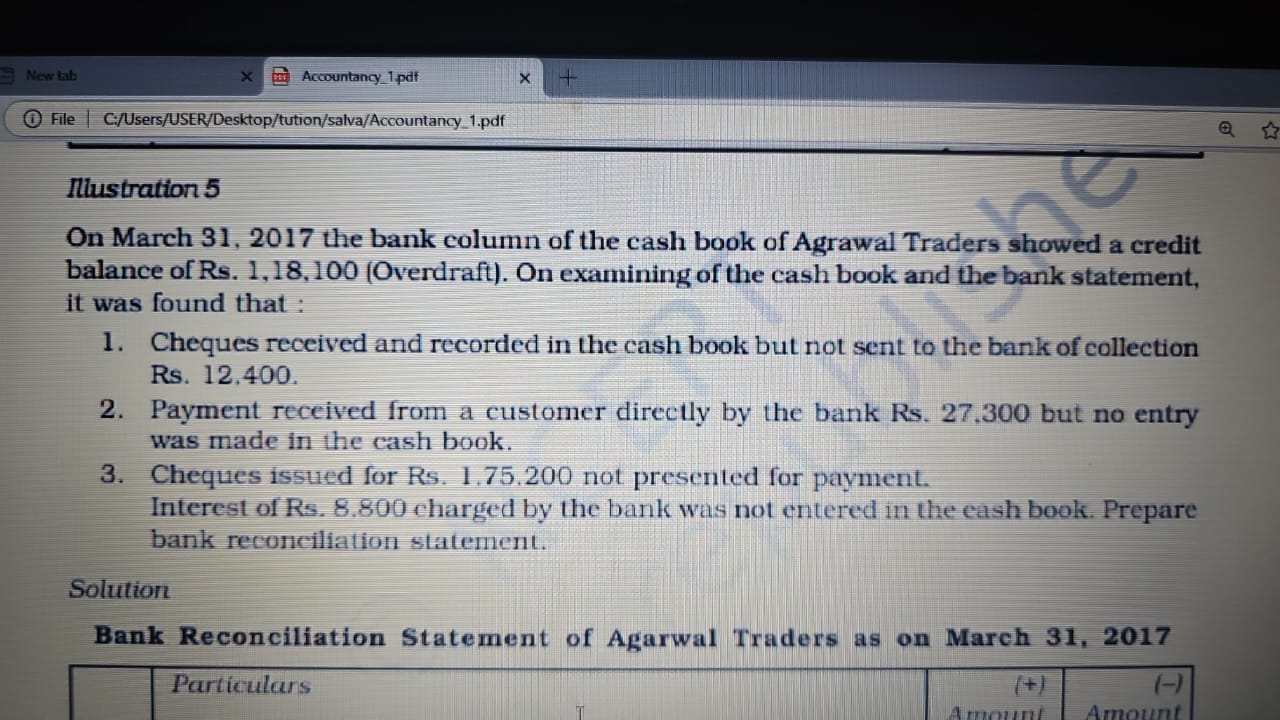

Prepare a bank reconciliation statement for Agrawal Traders as of March 31, 2017.

Understand the Problem

The question is asking to prepare a bank reconciliation statement based on the provided information about the cash book and the bank statement of Agrawal Traders as of March 31, 2017. It involves adjustments for cheques issued and received, payments made directly to the bank, and bank charges.

Answer

Rs. -51,000 (Overdraft)

Answer for screen readers

The final reconciled balance as of March 31, 2017, is Rs. -51,000 (Overdraft).

Steps to Solve

- Identify the Bank Overdraft Balance

The bank column of the cash book shows an overdraft balance of Rs. 1,18,100. This represents the starting point for our reconciliation.

- Adjust for Cheques Received Not Deposited

Cheques received and recorded in the cash book but not yet sent to the bank amount to Rs. 12,400. Since this amount is not reflected in the bank's records, we will add it to the overdraft balance.

$$ \text{Adjusted Balance} = \text{Overdraft} + \text{Cheques Not Deposited} $$

$$ = (1,18,100) + 12,400 = 1,05,700 $$

- Account for Payment Directly Received by the Bank

A payment of Rs. 27,300 was received by the bank directly and not recorded in the cash book. Therefore, we need to add this amount to our adjusted balance.

$$ \text{Updated Balance} = \text{Adjusted Balance} + \text{Payment Received} $$

$$ = 1,05,700 + 27,300 = 1,33,000 $$

- Adjust for Cheques Issued Not Presented

Cheques issued but not yet presented for payment total Rs. 1,75,200. Since these cheques reduce the available balance, we subtract this amount.

$$ \text{New Balance} = \text{Updated Balance} - \text{Cheques Issued Not Presented} $$

$$ = 1,33,000 - 1,75,200 = -42,200 $$

- Account for Bank Charges Not Recorded

Lastly, we have bank charges of Rs. 8,800 that weren't entered in the cash book. This will also reduce the balance.

$$ \text{Final Reconciled Balance} = \text{New Balance} - \text{Bank Charges} $$

$$ = -42,200 - 8,800 = -51,000 $$

The final reconciled balance as of March 31, 2017, is Rs. -51,000 (Overdraft).

More Information

In this case, the negative sign indicates an overdraft, meaning Agrawal Traders owes the bank Rs. 51,000 after adjustments are made. This reconciliation process ensures that all transactions are accurately reflected in both the cash book and bank records.

Tips

- Forgetting to adjust for any item: It’s essential to account for all transactions affecting the bank balance.

- Incorrectly calculating totals: Double-check mathematical calculations to ensure accuracy.

AI-generated content may contain errors. Please verify critical information