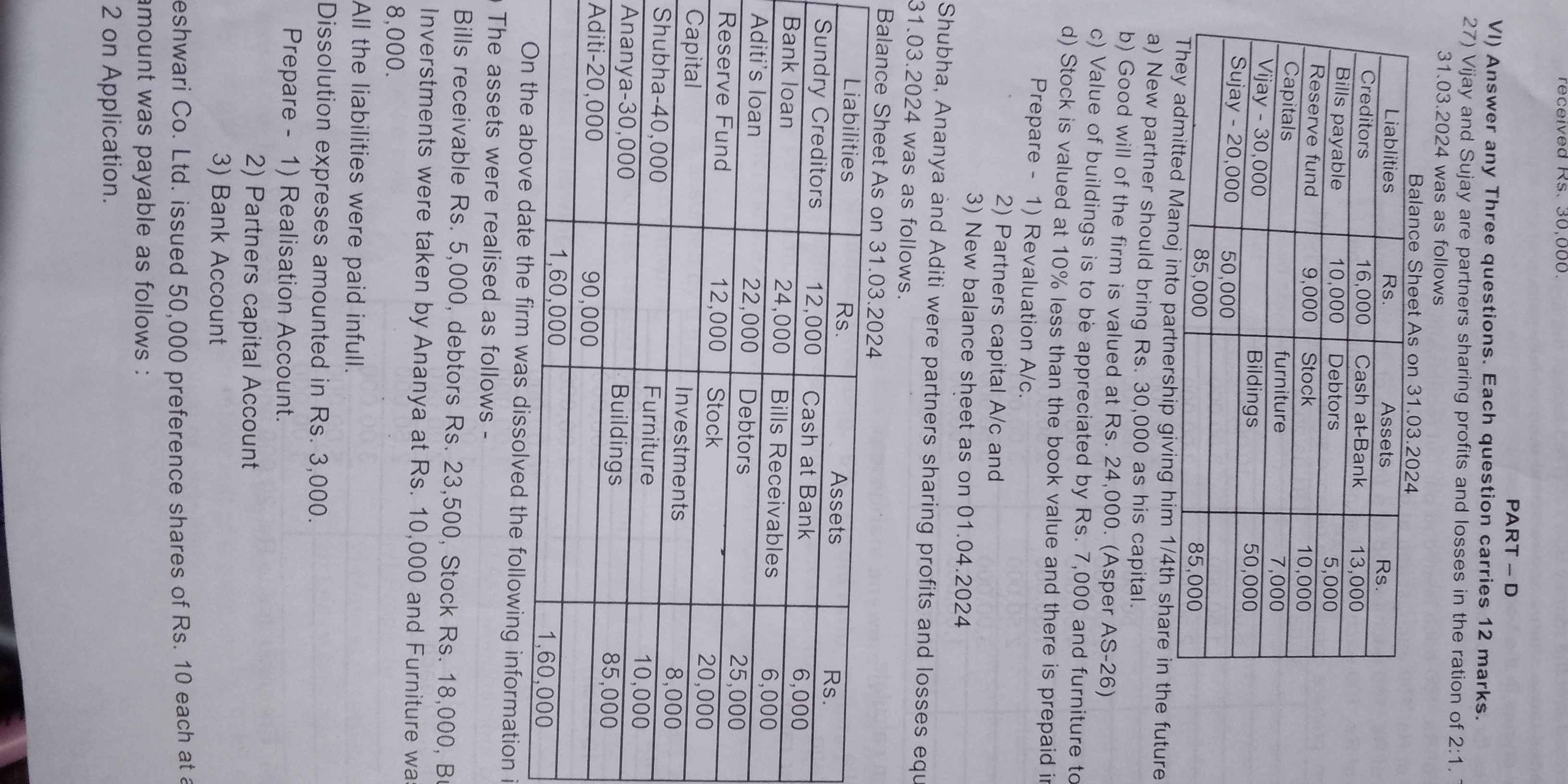

Prepare 1) Revaluation Account, 2) Partners Capital Account, and 3) Balance Sheet as on 31.03.2024.

Understand the Problem

The question requires the preparation of three financial statements: the Revaluation Account, Partners' Capital Accounts, and the Balance Sheet as of specific dates. It involves understanding the financial position of a partnership firm, including assets, liabilities, and the distribution of profits and shares among partners.

Answer

- Revaluation loss: Rs. 2,000 - Final Capital (Shubha: Rs. 39,333.33, Ananya: Rs. 29,333.33, Aditi: Rs. 19,333.33) - Total Balance Sheet Assets = Liabilities = Rs. 85,000

Answer for screen readers

-

Revaluation Account:

- Loss from revaluation: Rs. 2,000

-

Partners' Capital Accounts:

- Shubha: Rs. 39,333.33

- Ananya: Rs. 29,333.33

- Aditi: Rs. 19,333.33

-

Balance Sheet:

- Total assets = Total liabilities + Total capitol = Rs. 85,000

Steps to Solve

-

Prepare Revaluation Account

To record the gains and losses on the revaluation of assets and liabilities during the dissolution of the partnership.

- List all assets and liabilities along with their book values.

- Identify the new values as per the dissolution agreement and calculate the revaluation differences.

- Record profits or losses in the Revaluation Account.

Revaluation Calculation:

-

Bills Receivable: $23,500 \quad (No change)$

-

Debtors: $18,000 \quad (No change)$

-

Stock: $18,000 \quad (No change)$

-

Furniture: Book Value (10,000), New Value (8,000)

- Loss: (10,000 - 8,000 = 2,000)

-

Total Loss: (2,000)

Revaluation Account: [ \text{Revaluation Account} ]

Particulars Debit (Rs.) Credit (Rs.) To Furniture Loss 2,000 Total Loss 2,000 -

Prepare Partners' Capital Accounts

To show the distribution of capital among the partners after accounting for the revaluation losses and liabilities.

- Open each partner's capital account.

- Deduct losses and any withdrawals.

- Calculate the final balance for each partner.

Capital Accounts Calculation:

- Shubha: Initial Capital (40,000), Loss ( \frac{2,000}{3} = 666.67) (approx.)

- Ananya: Initial Capital (30,000), Loss (666.67)

- Aditi: Initial Capital (20,000), Loss (666.67)

Partners Capital Accounts: [ \text{ Shubha Capital Account } ]

Particulars Debit (Rs.) Credit (Rs.) To Loss 666.67 Balance c/d 39,333.33 [ \text{ Ananya Capital Account } ]

Particulars Debit (Rs.) Credit (Rs.) To Loss 666.67 Balance c/d 29,333.33 [ \text{ Aditi Capital Account } ]

Particulars Debit (Rs.) Credit (Rs.) To Loss 666.67 Balance c/d 19,333.33 -

Prepare the Balance Sheet as of 31.03.2024

To outline the financial position of the partnership.

- List total assets and liabilities, including the partner capitals after adjustments.

- Ensure that assets equal liabilities plus partner capital.

Balance Sheet: [ \text{ Balance Sheet as of 31.03.2024 } ]

Liabilities Rs. Assets Rs. Creditors 16,000 Cash at Bank 13,000 Bills Payable 10,000 Debtors 15,000 Reserve Fund 9,000 Stock 7,000 Shubha Capital 39,333.33 Furniture 8,000 Ananya Capital 29,333.33 Investments 20,000 Aditi Capital 19,333.33 Total Liabilities 40,000 Total Assets 85,000

-

Revaluation Account:

- Loss from revaluation: Rs. 2,000

-

Partners' Capital Accounts:

- Shubha: Rs. 39,333.33

- Ananya: Rs. 29,333.33

- Aditi: Rs. 19,333.33

-

Balance Sheet:

- Total assets = Total liabilities + Total capitol = Rs. 85,000

More Information

This exercise demonstrates the dissolution of a partnership and the correct accounting treatment of the revaluation of assets and liabilities. The method of dividing losses among partners according to their profit-sharing ratio is essential.

Tips

- Failing to deduct losses from the capital accounts.

- Not adjusting the revaluation of assets properly before preparing the Capital Accounts.

AI-generated content may contain errors. Please verify critical information