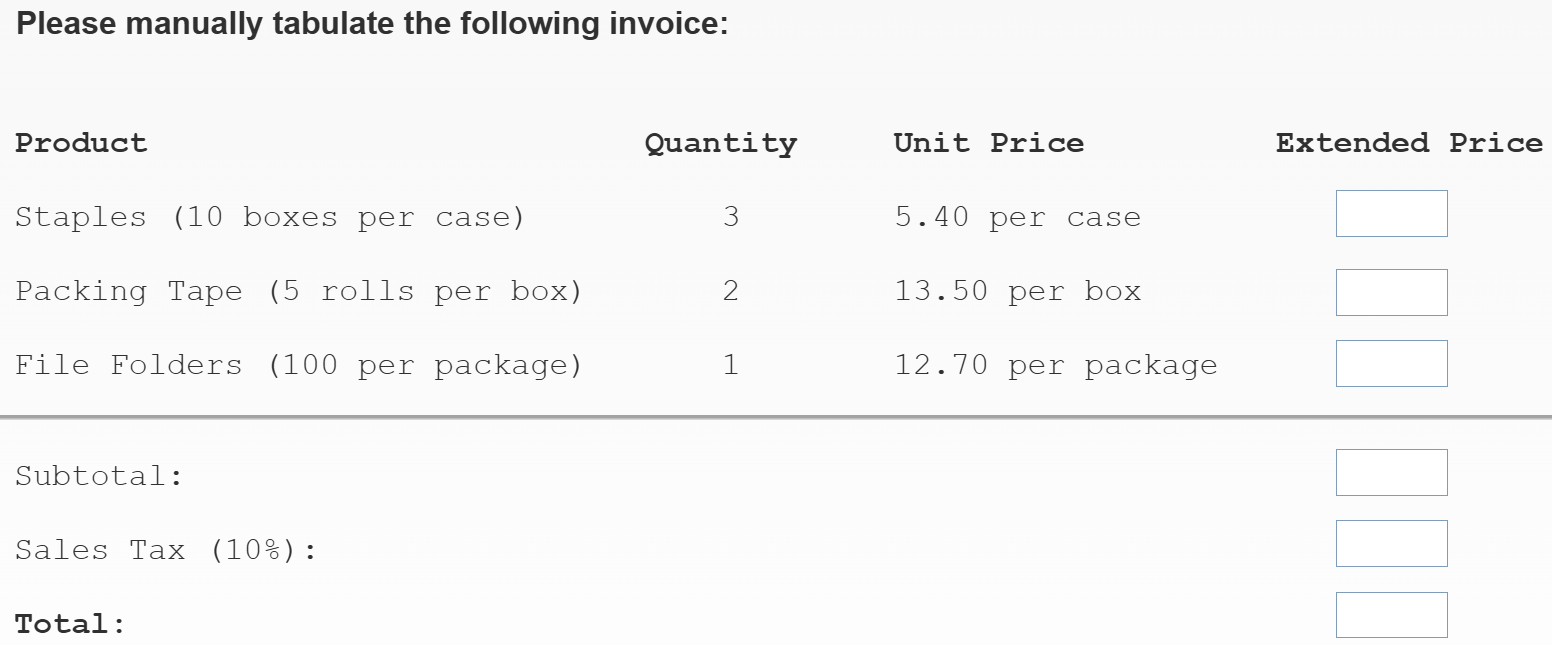

Please manually tabulate the following invoice: Product: Staples (10 boxes per case) Quantity: 3 Unit Price: 5.40 per case Packing Tape (5 rolls per box) Quantity: 2 Unit Price: 13... Please manually tabulate the following invoice: Product: Staples (10 boxes per case) Quantity: 3 Unit Price: 5.40 per case Packing Tape (5 rolls per box) Quantity: 2 Unit Price: 13.50 per box File Folders (100 per package) Quantity: 1 Unit Price: 12.70 per package. Subtotal: Sales Tax (10%): Total:

Understand the Problem

The question is asking for the manual calculation of an invoice based on products, quantities, and unit prices provided in a table. The goal is to compute the extended prices for each product, subtotal, sales tax, and total amount due.

Answer

Total: $61.49

Answer for screen readers

-

Extended Price for Staples: $16.20

-

Extended Price for Packing Tape: $27.00

-

Extended Price for File Folders: $12.70

-

Subtotal: $55.90

-

Sales Tax (10%): $5.59

-

Total: $61.49

Steps to Solve

-

Calculate Extended Price for Each Product

To calculate the extended price for each product, use the formula:

$$ \text{Extended Price} = \text{Quantity} \times \text{Unit Price} $$-

For Staples:

$$ 3 \text{ cases} \times 5.40 \text{ per case} = 16.20 $$ -

For Packing Tape:

$$ 2 \text{ boxes} \times 13.50 \text{ per box} = 27.00 $$ -

For File Folders:

$$ 1 \text{ package} \times 12.70 \text{ per package} = 12.70 $$

-

-

Calculate the Subtotal

The subtotal is the sum of the extended prices calculated in the previous step:

$$ \text{Subtotal} = 16.20 + 27.00 + 12.70 $$ -

Calculate the Sales Tax

To find the sales tax, multiply the subtotal by 10%:

$$ \text{Sales Tax} = \text{Subtotal} \times 0.10 $$ -

Calculate the Total Amount Due

The total amount due is the sum of the subtotal and the sales tax:

$$ \text{Total} = \text{Subtotal} + \text{Sales Tax} $$

-

Extended Price for Staples: $16.20

-

Extended Price for Packing Tape: $27.00

-

Extended Price for File Folders: $12.70

-

Subtotal: $55.90

-

Sales Tax (10%): $5.59

-

Total: $61.49

More Information

The calculation of the extended price, subtotal, sales tax, and total is a common task in invoice management. This problem highlights basic multiplication and addition skills, as well as understanding percentage calculations for sales tax.

Tips

- Forgetting to multiply: It’s easy to forget the multiplication step when calculating the extended price.

- Misapplying the tax rate: Ensure the sales tax is calculated based on the subtotal and is properly expressed as a percentage.

AI-generated content may contain errors. Please verify critical information