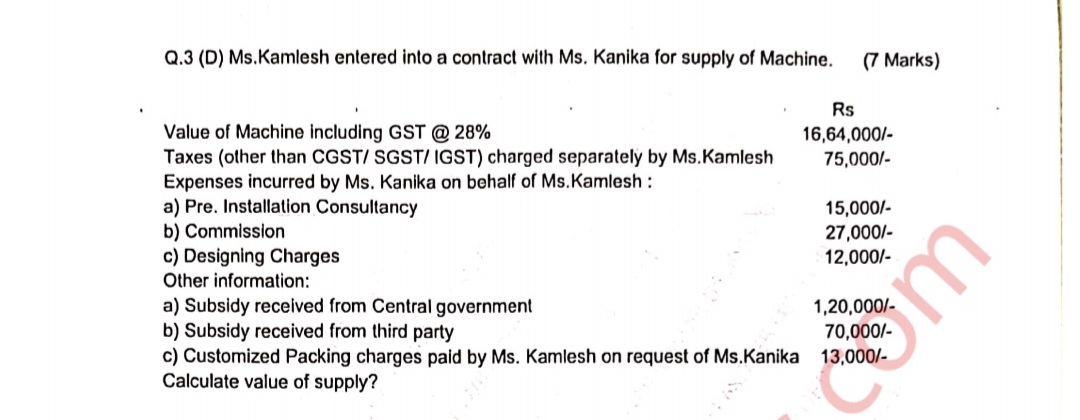

Ms. Kamlesh entered into a contract with Ms. Kanika for supply of a machine. Calculate the value of supply considering the provided expenses and subsidies.

Understand the Problem

The question involves calculating the value of a supply involving a machine contract, taking into account various expenses and subsidies mentioned. To solve it, we will summarize the provided values, subtract subsidies and calculate the overall supply value.

Answer

The final supply value is $16,03,000$.

Answer for screen readers

The final supply value is $16,03,000$.

Steps to Solve

- Calculate Total Expenses Incurred by Ms. Kanika

Add all the expenses incurred by Ms. Kanika on behalf of Ms. Kamlesh.

[ \text{Total Expenses} = 15,000 + 27,000 + 12,000 ]

[ \text{Total Expenses} = 54,000 ]

- Calculate Total Subsidies Received

Sum the subsidies received from the Central government and a third party.

[ \text{Total Subsidies} = 1,20,000 + 70,000 ]

[ \text{Total Subsidies} = 1,90,000 ]

- Calculate Supply Value Before Adjusting for Subsidies

Combine the value of the machine including GST and the other taxes charged separately.

[ \text{Supply Value Before Subsidies} = 16,64,000 + 75,000 + 54,000 ]

[ \text{Supply Value Before Subsidies} = 17,93,000 ]

- Subtract Total Subsidies from the Supply Value

Subtract the total subsidies calculated from the supply value.

[ \text{Final Supply Value} = 17,93,000 - 1,90,000 ]

[ \text{Final Supply Value} = 16,03,000 ]

The final supply value is $16,03,000$.

More Information

The final supply value represents the total amount payable by Ms. Kamlesh after considering the expenses incurred by Ms. Kanika and the subsidies received. This calculation reflects the actual financial impact of the contract.

Tips

- Forgetting to include all expenses or subsidies can lead to incorrect calculations.

- Misunderstanding the terms can cause confusion about what values to add or subtract.

AI-generated content may contain errors. Please verify critical information