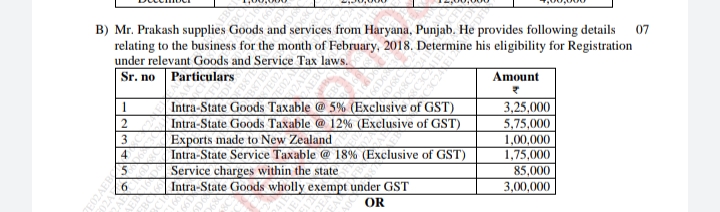

Mr. Prakash supplies Goods and services from Haryana, Punjab. He provides following details relating to the business for the month of February, 2018. Determine his eligibility for... Mr. Prakash supplies Goods and services from Haryana, Punjab. He provides following details relating to the business for the month of February, 2018. Determine his eligibility for Registration under relevant Goods and Service Tax laws.

Understand the Problem

The question is asking to determine Mr. Prakash's eligibility for registration under Goods and Service Tax laws based on his supplies and services for February 2018. We will analyze the taxable amounts provided to see if they meet the registration requirements.

Answer

Mr. Prakash's turnover is below the GST registration threshold in 2018.

The total taxable turnover for Mr. Prakash is ₹10,75,000. Since this is below the ₹20 lakh threshold for GST registration in 2018, Mr. Prakash is not required to register for GST.

Answer for screen readers

The total taxable turnover for Mr. Prakash is ₹10,75,000. Since this is below the ₹20 lakh threshold for GST registration in 2018, Mr. Prakash is not required to register for GST.

More Information

Under the GST laws in 2018, businesses with a taxable turnover exceeding ₹20 lakhs were required to register for GST. Mr. Prakash’s taxable turnover was well below this threshold.

Tips

Ensure to exclude exempt supplies from the taxable turnover calculation and confirm the registration threshold as it may vary slightly based on state and year.