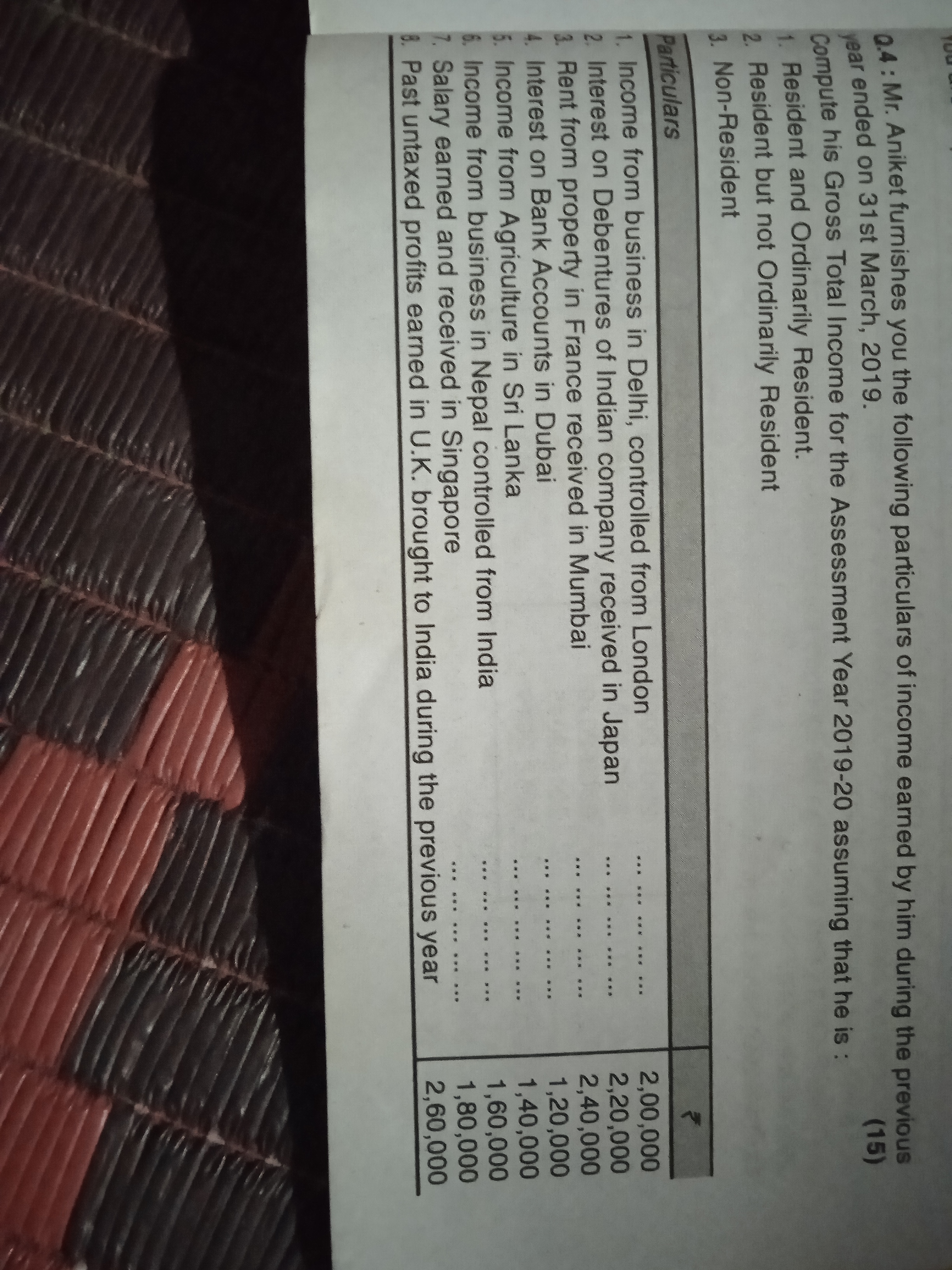

Mr. Ankiet furnishes the following particulars of income earned by him during the previous year ended on 31st March 2019. Compute his total income for the Assessment Year 2019-20,... Mr. Ankiet furnishes the following particulars of income earned by him during the previous year ended on 31st March 2019. Compute his total income for the Assessment Year 2019-20, assuming that he is a resident and ordinarily resident.

Understand the Problem

The question provides details of various sources of income for Mr. Ankiet during the assessment year and asks to compute his total income based on the information provided. It involves interpreting income from different sources and determining residency status.

Answer

The total income for Mr. Ankiet for the Assessment Year 2019-20 is ₹15,80,000.

Answer for screen readers

The total income for Mr. Ankiet for the Assessment Year 2019-20 is ₹15,80,000.

Steps to Solve

-

Income from Different Sources

First, let's gather all the sources of income provided:

- Business in Delhi: ₹2,00,000

- Interest on Debentures: ₹2,40,000

- Rent from Property in France: ₹1,40,000

- Interest from Bank Accounts in Dubai: ₹1,60,000

- Income from Agriculture in Sri Lanka: ₹1,40,000

- Salary from Business in Nepal: ₹2,00,000

- Salary earned in Singapore: ₹2,40,000

- Past untaxed profits earned in U.K. brought to India: ₹2,60,000

-

Identifying Taxable Income

Mr. Ankiet is a resident and ordinarily resident, so all global income will be taxable in India. The following amounts are included:

- Income from business in Delhi

- Interest on debentures

- Rent from property

- Interest from bank accounts

- Income from agriculture

- Salary from business in Nepal

- Salary from Singapore

- Past untaxed profits

-

Calculating Total Income

Now, we will add up all the taxable income amounts:

- Total Income = ₹2,00,000 (Delhi) + ₹2,40,000 (Debentures) + ₹1,40,000 (France)

- ₹1,60,000 (Dubai) + ₹1,40,000 (Sri Lanka) + ₹2,00,000 (Nepal)

- ₹2,40,000 (Singapore) + ₹2,60,000 (UK)

- So, $$ \text{Total Income} = 2,00,000 + 2,40,000 + 1,40,000 + 1,60,000 + 1,40,000 + 2,00,000 + 2,40,000 + 2,60,000 $$

-

Sum Up the Values

Adding these values together:

- Total income calculation: $$ = 2,00,000 + 2,40,000 + 1,40,000 + 1,60,000 + 1,40,000 + 2,00,000 + 2,40,000 + 2,60,000 = 15,80,000 $$

The total income for Mr. Ankiet for the Assessment Year 2019-20 is ₹15,80,000.

More Information

Mr. Ankiet's total income includes all the global income he earned as he is a resident and ordinarily resident in India. Each source of income is taxed without any exemptions based on residency.

Tips

- A common mistake is omitting to include foreign income when computing total income for a resident.

- Ensure that all the sources are accounted for, especially when considering income from overseas.

AI-generated content may contain errors. Please verify critical information