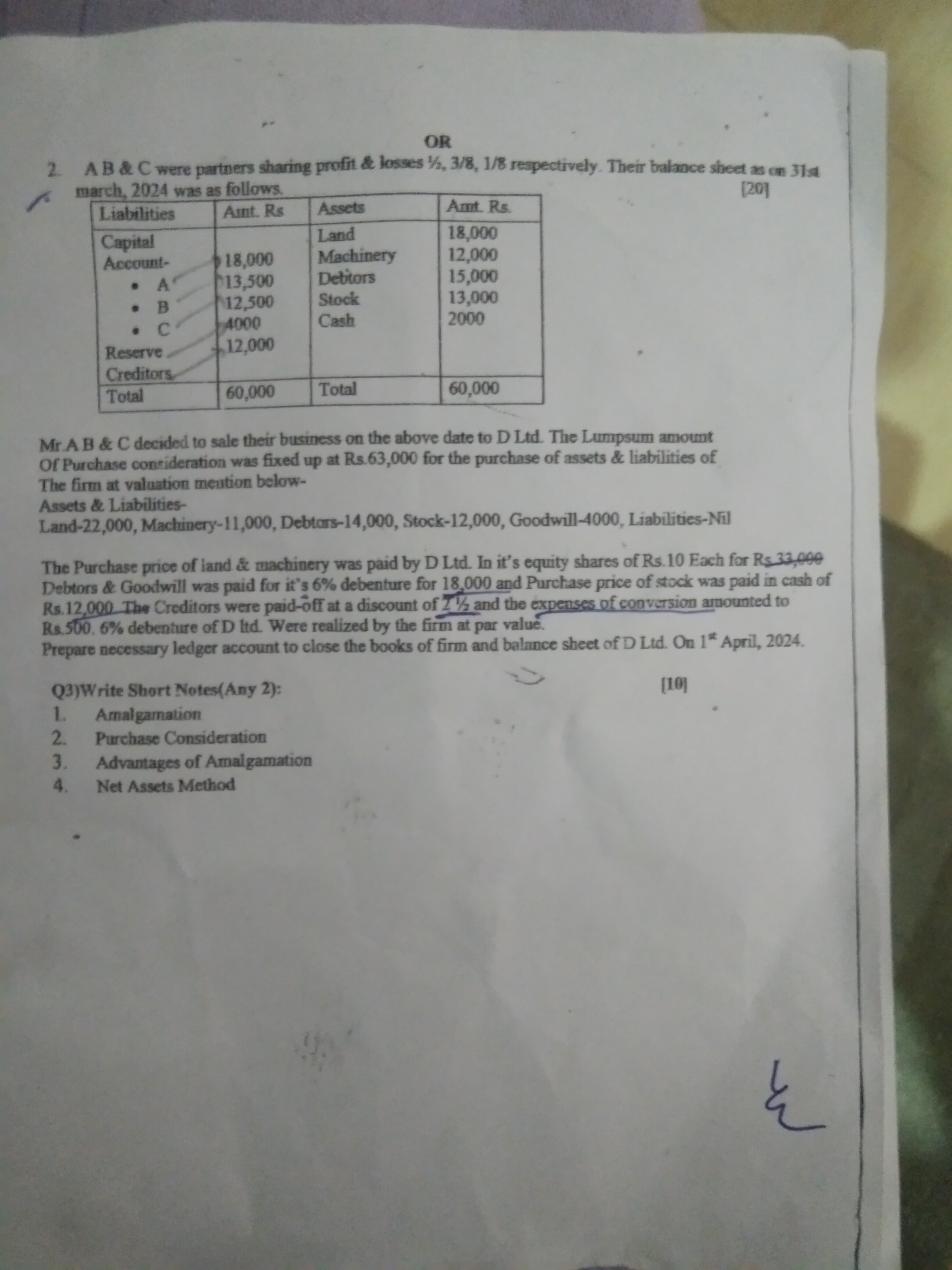

Mr. A, B, and C decided to sell their business on the above date to D Ltd. The lumpsum amount for purchase consideration was fixed at Rs.63,000. Prepare necessary ledger accounts t... Mr. A, B, and C decided to sell their business on the above date to D Ltd. The lumpsum amount for purchase consideration was fixed at Rs.63,000. Prepare necessary ledger accounts to close the books of the firm and the balance sheet of D Ltd. on 1st April, 2024. Write short notes on any 2: 1. Amalgamation 2. Purchase Consideration 3. Advantages of Amalgamation 4. Net Assets Method.

Understand the Problem

The question is asking for accounts to be prepared to close the books of a firm and create a balance sheet for D Ltd based on a given scenario involving the sale of assets and liabilities. It also requires brief notes on specific accounting concepts.

Answer

Prepare Realization Account, Partners' Capital Accounts, and Bank/Cash Account; followed by D Ltd.'s Balance Sheet. Amalgamation and Purchase Consideration explained.

To solve the problem, you would need to prepare the following ledger accounts: Realization Account, Partners’ Capital Accounts, and Bank/Cash Account; followed by the Balance Sheet of D Ltd. as of 1st April, 2024. Here are short notes on 'Amalgamation' and 'Purchase Consideration.'

Answer for screen readers

To solve the problem, you would need to prepare the following ledger accounts: Realization Account, Partners’ Capital Accounts, and Bank/Cash Account; followed by the Balance Sheet of D Ltd. as of 1st April, 2024. Here are short notes on 'Amalgamation' and 'Purchase Consideration.'

More Information

Amalgamation

Amalgamation refers to the combination of one or more companies into a new entity. It involves the merger or consolidation of companies to achieve synergies and gain competitive advantages.

Purchase Consideration

The purchase consideration is the total amount paid by the acquiring company to the shareholders of the company being acquired in an amalgamation. It can be paid in the form of cash, shares, or other securities.

Tips

Ensure all ledger accounts are balanced accurately. Common mistakes include incorrect distribution of realized gains/losses and incorrect preparation of the balance sheet.

Sources

- Amalgamation of Firms - Dr. Nishikant Jha - drnishikantjha.com

- Byjus - Accounting and Amalgamation - byjus.com

- Corporate Accounting and Auditing - ICmai - icmai.in

AI-generated content may contain errors. Please verify critical information