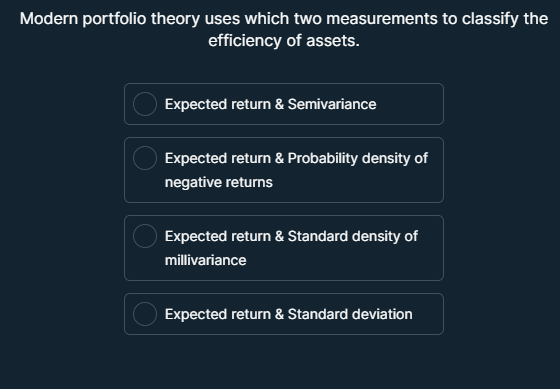

Modern portfolio theory uses which two measurements to classify the efficiency of assets?

Understand the Problem

The question is asking which two measurements are used in modern portfolio theory to evaluate the efficiency of assets. It presents multiple choice options that relate to financial metrics.

Answer

Expected return & Standard deviation

The final answer is Expected return & Standard deviation

Answer for screen readers

The final answer is Expected return & Standard deviation

More Information

Modern portfolio theory classifies asset efficiency using expected return as a measure of potential gain and standard deviation as a measure of risk or volatility.

Tips

A common mistake is confusing variance with standard deviation; however, standard deviation is more often used in practice because it is expressed in the same units as the expected return.

Sources

- Modern Portfolio Theory - Wikipedia - en.wikipedia.org

- Modern Portfolio Theory (MPT) - Overview - corporatefinanceinstitute.com

AI-generated content may contain errors. Please verify critical information