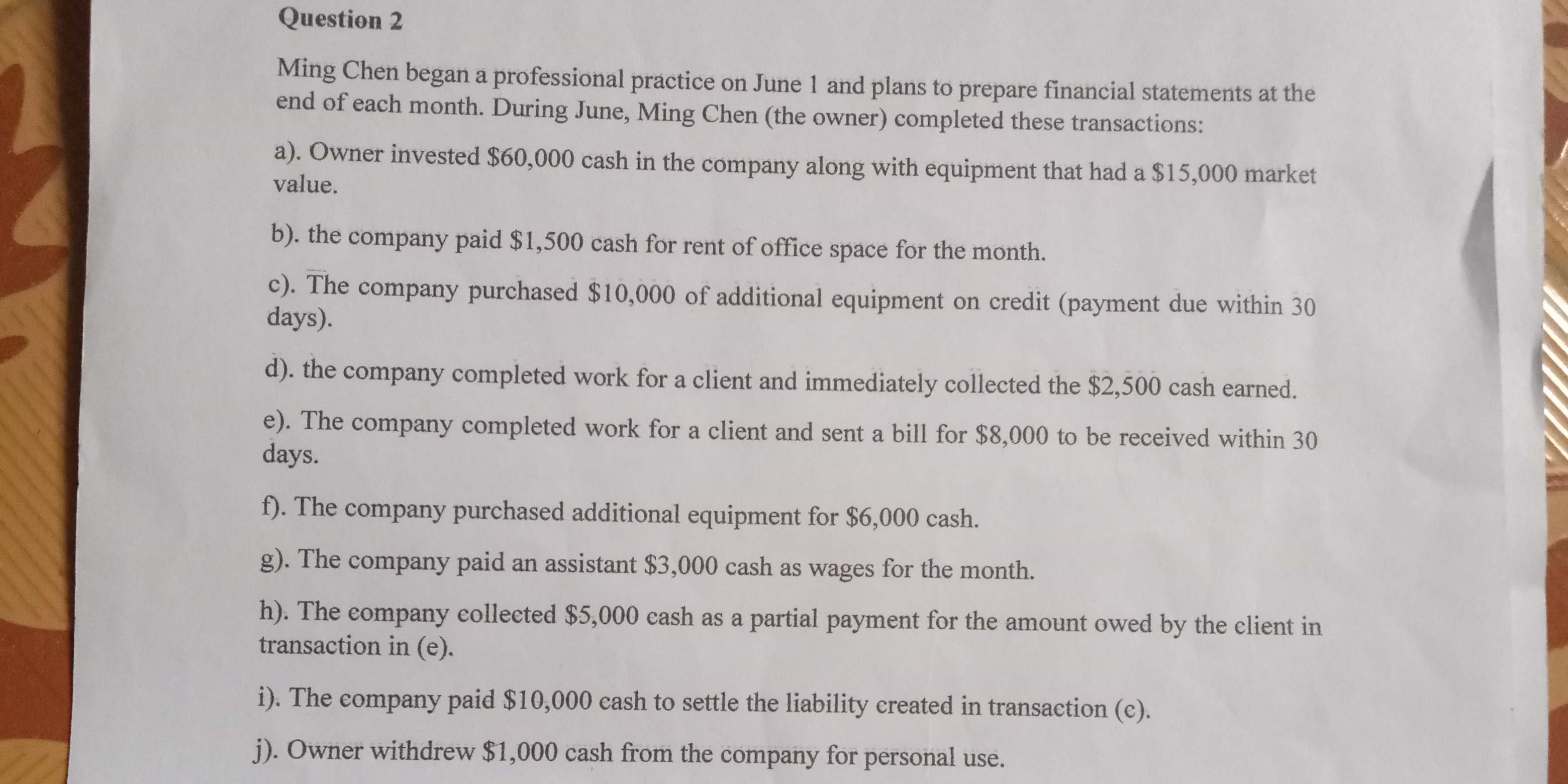

Ming Chen began a professional practice on June 1 and plans to prepare financial statements at the end of each month. During June, Ming Chen (the owner) completed these transaction... Ming Chen began a professional practice on June 1 and plans to prepare financial statements at the end of each month. During June, Ming Chen (the owner) completed these transactions: a) Owner invested $60,000 cash in the company along with equipment that had a $15,000 market value. b) the company paid $1,500 cash for rent of office space for the month. c) The company purchased $10,000 of additional equipment on credit (payment due within 30 days). d) the company completed work for a client and immediately collected the $2,500 cash earned. e) The company completed work for a client and sent a bill for $8,000 to be received within 30 days. f) The company purchased additional equipment for $6,000 cash. g) The company paid an assistant $3,000 cash as wages for the month. h) The company collected $5,000 cash as a partial payment for the amount owed by the client in transaction (e). i) The company paid $10,000 cash to settle the liability created in transaction (c). j) Owner withdrew $1,000 cash from the company for personal use.

Understand the Problem

The question is asking to analyze various transactions performed by Ming Chen during the month of June and prepare financial statements based on those transactions. It involves bookkeeping and accounting principles related to investments, expenses, equipment purchases, revenue recognition, and withdrawals.

Answer

Cash = $48,000; Equipment = $31,000; Accounts Receivable = $3,000; Accounts Payable = $0; Revenue = $10,500; Expenses = $4,500; Owner's Drawing = $1,000.

Answer for screen readers

The final entries for each transaction lead to the following impact on financial statements:

- Cash = $60,000 - $1,500 - $6,000 + $2,500 + $5,000 - $10,000 - $1,000 = $48,000

- Equipment = $15,000 + $10,000 + $6,000 = $31,000

- Accounts Receivable = $8,000 - $5,000 = $3,000

- Accounts Payable = $10,000 - $10,000 = $0

- Revenue = $2,500 + $8,000 = $10,500

- Expenses = $1,500 + $3,000 = $4,500

- Owner's Drawing = $1,000

Steps to Solve

-

Record Owner's Investment Ming Chen invested $60,000 cash into the company and equipment valued at $15,000.

This increases cash and equipment assets.- Cash: +$60,000

- Equipment: +$15,000

-

Record Rent Payment The company paid $1,500 cash for rent.

This decreases cash assets and increases rent expense.- Cash: -$1,500

- Rent Expense: +$1,500

-

Record Equipment Purchase on Credit The company purchased $10,000 of additional equipment on credit.

This increases equipment and creates a liability (accounts payable).- Equipment: +$10,000

- Accounts Payable: +$10,000

-

Record Work Completed and Cash Collection The company completed work and collected $2,500 in cash.

This increases cash and increases revenue.- Cash: +$2,500

- Revenue: +$2,500

-

Record Work Completed and Invoice Issued The company sent a bill for $8,000 to a client for work done.

This increases accounts receivable and revenue.- Accounts Receivable: +$8,000

- Revenue: +$8,000

-

Record Additional Equipment Purchase The company purchased additional equipment for $6,000 cash.

This decreases cash assets and increases equipment assets.- Cash: -$6,000

- Equipment: +$6,000

-

Record Wage Payment The company paid $3,000 cash as wages for the month.

This decreases cash assets and increases wage expenses.- Cash: -$3,000

- Wage Expense: +$3,000

-

Record Collection of Partial Payment The company collected $5,000 cash as a partial payment from the client.

This increases cash and decreases accounts receivable.- Cash: +$5,000

- Accounts Receivable: -$5,000

-

Record Payment to Settle Liability The company paid $10,000 cash to settle the liability from the equipment purchase.

This decreases cash and decreases accounts payable.- Cash: -$10,000

- Accounts Payable: -$10,000

-

Record Owner's Withdrawal The owner withdrew $1,000 cash for personal use.

This decreases cash and increases owner's drawing.

- Cash: -$1,000

- Owner's Drawing: +$1,000

The final entries for each transaction lead to the following impact on financial statements:

- Cash = $60,000 - $1,500 - $6,000 + $2,500 + $5,000 - $10,000 - $1,000 = $48,000

- Equipment = $15,000 + $10,000 + $6,000 = $31,000

- Accounts Receivable = $8,000 - $5,000 = $3,000

- Accounts Payable = $10,000 - $10,000 = $0

- Revenue = $2,500 + $8,000 = $10,500

- Expenses = $1,500 + $3,000 = $4,500

- Owner's Drawing = $1,000

More Information

This summary lists the assets, liabilities, revenues, and expenses based on the transactions completed in June. The cash position reflects the owner's ongoing financial activity, while revenue and expenses help determine profitability.

Tips

- Neglecting the Credit Transactions: Not accounting for equipment purchased on credit can misrepresent liabilities.

- Forget to Adjust Accounts Receivable: Failure to update accounts receivable after cash collections may lead to overstated assets.

AI-generated content may contain errors. Please verify critical information