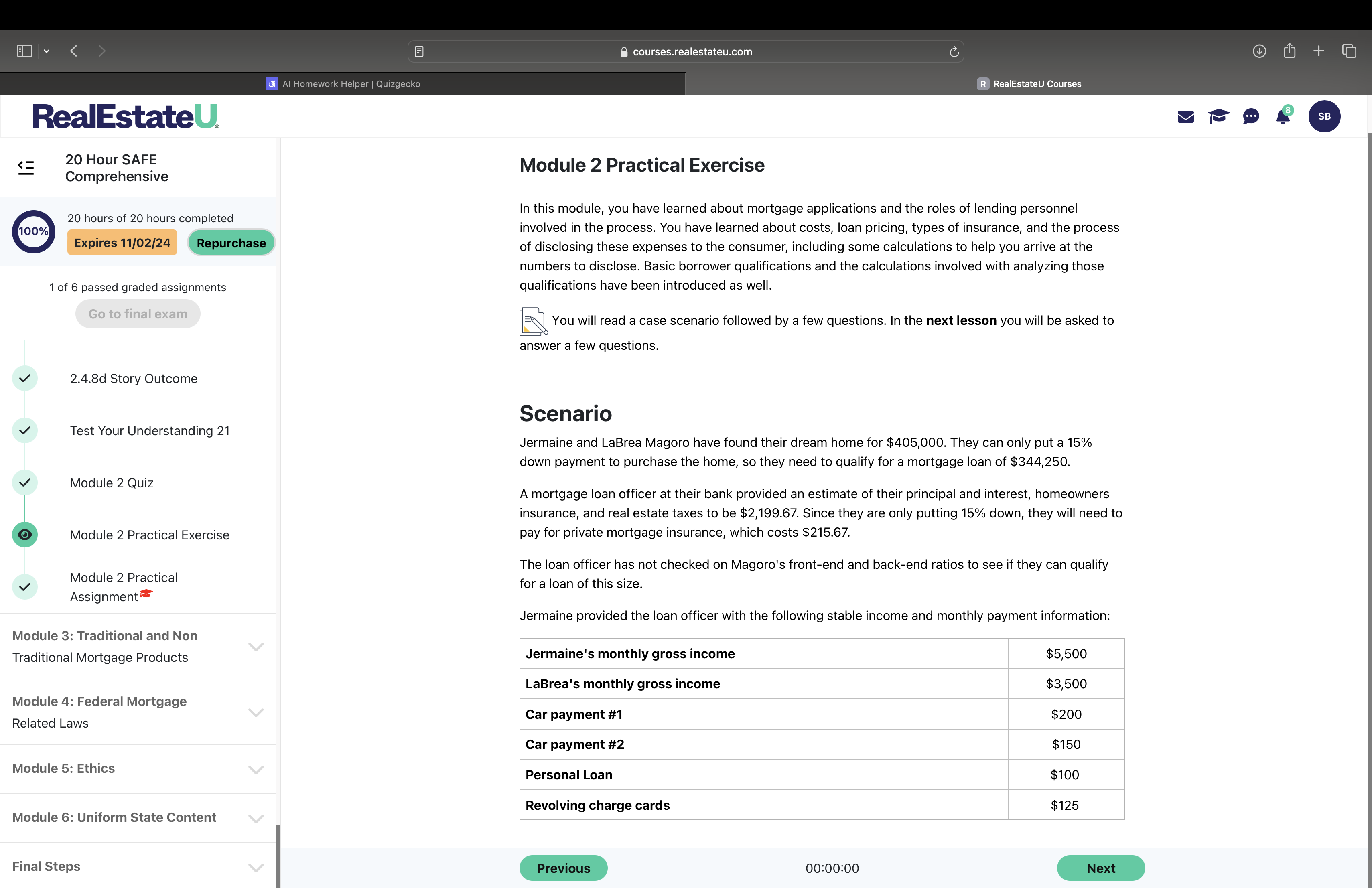

Jermaine and LaBrea Magoro have found their dream home for $405,000. They can only put a 15% down payment to purchase the home, so they need to qualify for a mortgage loan of $344,... Jermaine and LaBrea Magoro have found their dream home for $405,000. They can only put a 15% down payment to purchase the home, so they need to qualify for a mortgage loan of $344,250. A mortgage loan officer provided an estimate of $2,199.67 for their principal and interest, homeowners insurance, and real estate taxes. They need to pay for private mortgage insurance, which costs $215.67. Jermaine provided the loan officer with the following stable income and monthly payment information: Jermaine's monthly gross income is $5,500, LaBrea's monthly gross income is $3,500, Car payment #1 is $200, Car payment #2 is $150, Personal Loan is $100, and Revolving charge cards are $125. In this scenario, what should Jermaine and LaBrea consider in order to qualify for the mortgage loan?

Understand the Problem

The question involves understanding a mortgage application scenario where the applicants seek to qualify for a mortgage loan based on their financial situation. The key concepts include loan amount, down payment percentage, and monthly income vs. expenses.

Answer

Front-end: 26.83%, Back-end: 33.28%. Within standard mortgage limits.

Jermaine and LaBrea's front-end ratio is 26.83% and back-end ratio is 33.28%. These ratios are typically within acceptable limits for mortgage qualification standards. If they remain within these limits and have a stable income with no other significant debts, they should qualify for the mortgage loan.

Answer for screen readers

Jermaine and LaBrea's front-end ratio is 26.83% and back-end ratio is 33.28%. These ratios are typically within acceptable limits for mortgage qualification standards. If they remain within these limits and have a stable income with no other significant debts, they should qualify for the mortgage loan.

More Information

Mortgage qualification often depends on meeting certain ratio thresholds. The front-end ratio typically should not exceed 28%, and the back-end ratio should not exceed 36%. Jermaine and LaBrea's ratios are within typical qualifying limits.

Tips

A common mistake is not including all monthly debt payments in the back-end calculation, which could underestimate the ratio.

Sources

- HomeReady Mortgage | Fannie Mae - singlefamily.fanniemae.com

- Mortgage Required Income Calculator - Capital Bank - capitalbankmd.com