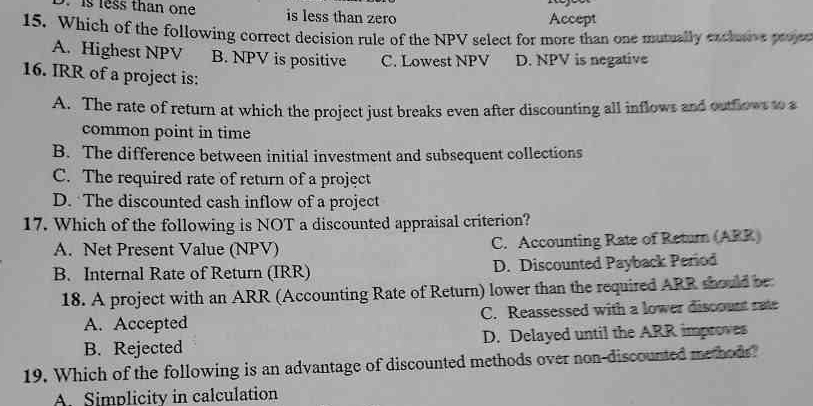

IRR of a project is: A. The rate of return at which the project just breaks even after discounting all inflows and outflows to a common point in time B. The difference between init... IRR of a project is: A. The rate of return at which the project just breaks even after discounting all inflows and outflows to a common point in time B. The difference between initial investment and subsequent collections C. The required rate of return of a project D. The discounted cash inflow of a project Which of the following is NOT a discounted appraisal criterion? A. Net Present Value (NPV) B. Internal Rate of Return (IRR) C. Accounting Rate of Return (ARR) D. Discounted Payback Period A project with an ARR (Accounting Rate of Return) lower than the required ARR should be: A. Accepted B. Rejected C. Reassessed with a lower discount rate D. Delayed until the ARR improves Which of the following is an advantage of discounted methods over non-discounted methods? A. Simplicity in calculation

Understand the Problem

The questions are related to financial concepts, specifically focusing on investment appraisal methods such as IRR (Internal Rate of Return), NPV (Net Present Value), and ARR (Accounting Rate of Return). They ask for definitions and application criteria of these concepts in decision-making.

Answer

16. A 17. C 18. B 19. A is NOT an advantage.

- IRR of a project is: A. The rate of return at which the project just breaks even after discounting all inflows and outflows to a common point in time. 17. Which of the following is NOT a discounted appraisal criterion? C. Accounting Rate of Return (ARR). 18. A project with an ARR lower than the required ARR should be: B. Rejected. 19. Which of the following is an advantage of discounted methods over non-discounted methods? A. Simplicity in calculation is NOT an advantage of discounted methods over non-discounted methods.

Answer for screen readers

- IRR of a project is: A. The rate of return at which the project just breaks even after discounting all inflows and outflows to a common point in time. 17. Which of the following is NOT a discounted appraisal criterion? C. Accounting Rate of Return (ARR). 18. A project with an ARR lower than the required ARR should be: B. Rejected. 19. Which of the following is an advantage of discounted methods over non-discounted methods? A. Simplicity in calculation is NOT an advantage of discounted methods over non-discounted methods.

More Information

IRR is used to evaluate the profitability of potential investments. ARR is not discounted because it doesn’t consider the time value of money. Discounted methods account for the time value of money, contrary to the incorrect labeling of simplicity as an advantage.

Tips

Ensure to know the differences between discounted and non-discounted methods, particularly the handling of the time value of money.

Sources

- Internal Rate of Return (IRR): Formula and Examples - Investopedia - investopedia.com

- Internal Rate of Return (IRR) - Calculator & Formula - corporatefinanceinstitute.com

- Net Present Value (NPV) - Corporate Finance Institute - corporatefinanceinstitute.com

AI-generated content may contain errors. Please verify critical information