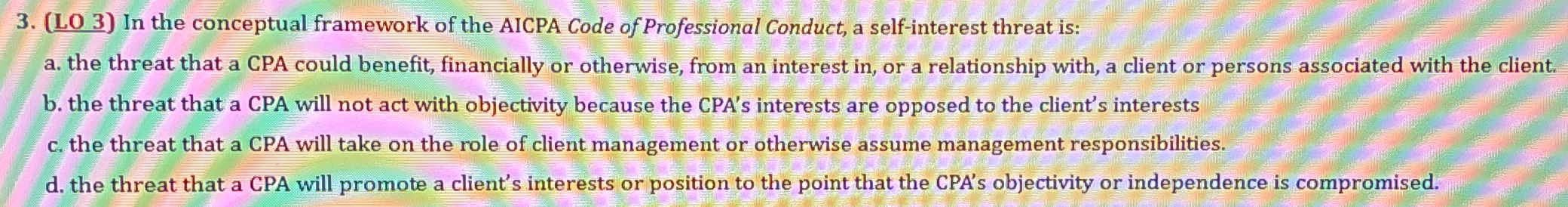

In the conceptual framework of the AICPA Code of Professional Conduct, a self-interest threat is: a) the threat that a CPA could benefit, financially or otherwise, from an interest... In the conceptual framework of the AICPA Code of Professional Conduct, a self-interest threat is: a) the threat that a CPA could benefit, financially or otherwise, from an interest in, or a relationship with, a client or persons associated with the client. b) the threat that a CPA will not act with objectivity because the CPA's interests are opposed to the client's interests. c) the threat that a CPA will take on the role of client management or otherwise assume management responsibilities. d) the threat that a CPA will promote a client's interests or position to the point that the CPA's objectivity or independence is compromised.

Understand the Problem

The question is asking to identify or understand the concept of a self-interest threat within the AICPA Code of Professional Conduct, specifically detailing potential threats a CPA may face in their professional conduct with clients.

Answer

a) The threat that a CPA could benefit, financially or otherwise, from an interest in, or a relationship with, a client or persons associated with the client.

The final answer is: a) the threat that a CPA could benefit, financially or otherwise, from an interest in, or a relationship with, a client or persons associated with the client.

Answer for screen readers

The final answer is: a) the threat that a CPA could benefit, financially or otherwise, from an interest in, or a relationship with, a client or persons associated with the client.

More Information

In the AICPA Code of Professional Conduct, a self-interest threat involves the potential for a CPA to benefit personally, which could compromise their objectivity.

Tips

A common mistake is confusing a self-interest threat with other threats like advocacy or familiarity threats.

Sources

- 1.000.010 Conceptual Framework for Members in Public Practice - viewpoint.pwc.com

- Chapter 2 – Professional Ethics for Accountants - Pressbooks.pub - pressbooks.pub

AI-generated content may contain errors. Please verify critical information