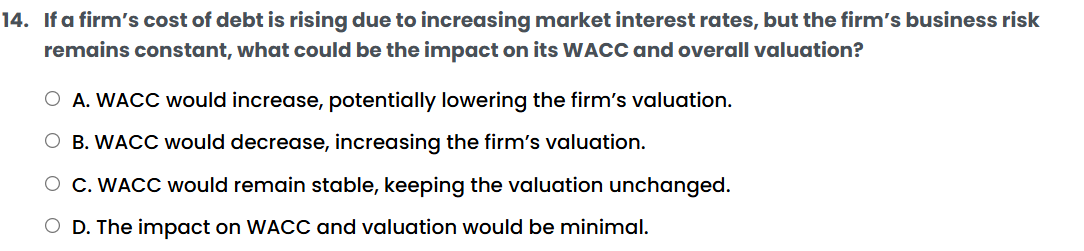

If a firm's cost of debt is rising due to increasing market interest rates, but the firm's business risk remains constant, what could be the impact on its WACC and overall valuatio... If a firm's cost of debt is rising due to increasing market interest rates, but the firm's business risk remains constant, what could be the impact on its WACC and overall valuation?

Understand the Problem

The question is asking about the relationship between a firm's rising cost of debt due to market interest rates and its impact on the Weighted Average Cost of Capital (WACC) and overall valuation. It requires analyzing how these financial metrics might change given the specified conditions.

Answer

WACC would increase, potentially lowering the firm's valuation.

The final answer is WACC would increase, potentially lowering the firm's valuation.

Answer for screen readers

The final answer is WACC would increase, potentially lowering the firm's valuation.

More Information

An increase in market interest rates raises the cost of debt, contributing to a higher WACC. A higher WACC reduces the present value of future cash flows, potentially leading to a lower valuation.

Tips

A common mistake is thinking that business risk changes in this scenario, which it doesn't. Only the cost of debt is affected here.

Sources

- Interest Rates and Other Factors That Affect WACC - Investopedia - investopedia.com

AI-generated content may contain errors. Please verify critical information