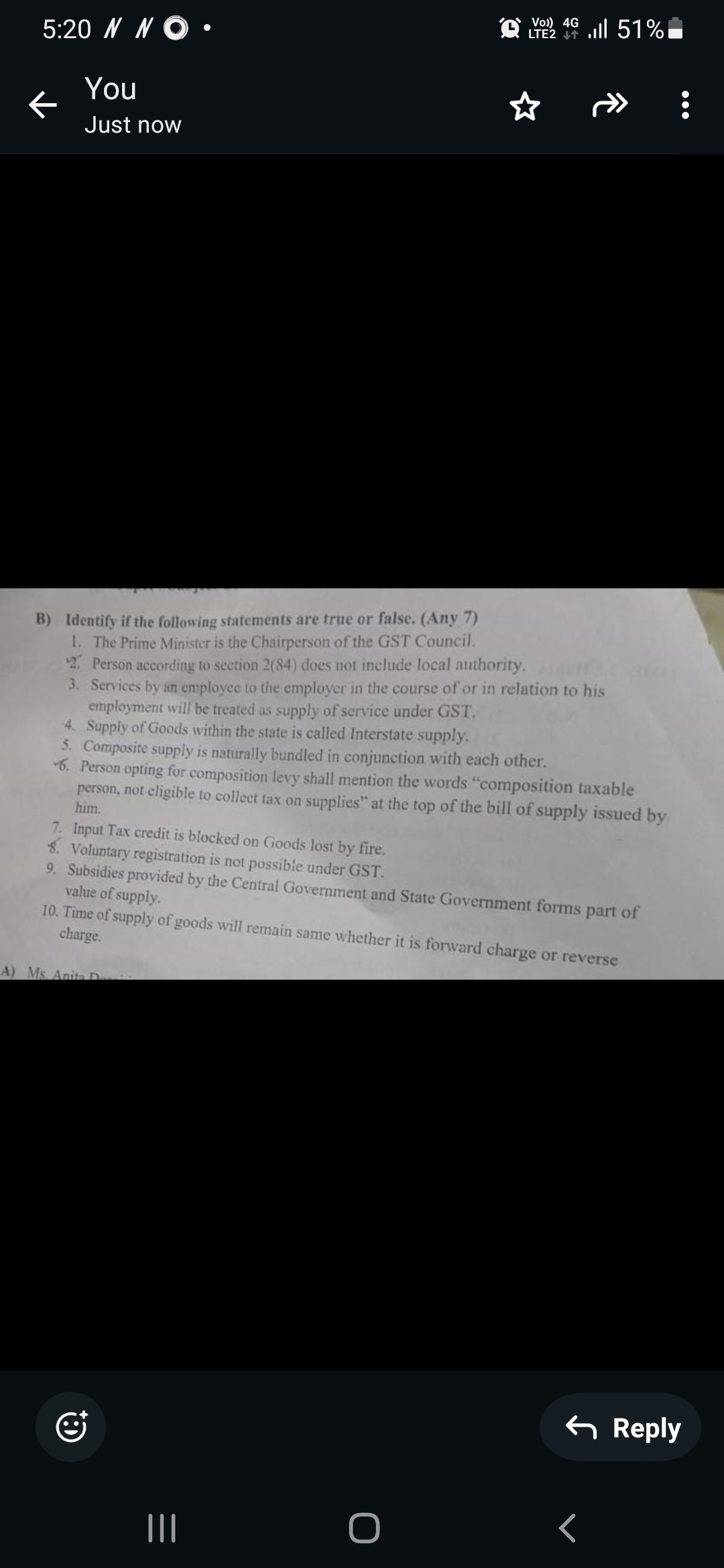

Identify if the following statements are true or false. (Any 7) 1. The Prime Minister is the Chairperson of the GST Council. 2. Person according to section 2(84) does not include l... Identify if the following statements are true or false. (Any 7) 1. The Prime Minister is the Chairperson of the GST Council. 2. Person according to section 2(84) does not include local authority. 3. Services by an employee to the employer in the course of or in relation to his employment will be treated as supply of service under GST. 4. Supply of Goods within the state is called Interstate supply. 5. Composite supply is naturally bundled in conjunction with each other. 6. Person opting for composition levy shall mention the words 'composition taxable person, not eligible to collect tax on supplies' at the top of the bill of supply issued by him. 7. Input Tax credit is blocked on Goods lost by fire. 8. Voluntary registration is not possible under GST. 9. Subsidies provided by the Central Government and State Government forms part of value of supply. 10. Time of supply of goods will remain same whether it is forward charge or reverse charge.

Understand the Problem

The question is asking whether a series of statements related to the Goods and Services Tax (GST) are true or false. The user needs to evaluate each statement based on their understanding of GST regulations.

Answer

1. False 2. False 3. False 4. False 5. True 6. True 7. True

- False 2. False 3. False 4. False 5. True 6. True 7. True

Answer for screen readers

- False 2. False 3. False 4. False 5. True 6. True 7. True

More Information

The GST Council is chaired by the Union Finance Minister, not the Prime Minister. 'Person' includes local authority, and services by an employee do not count as supply under GST.

Tips

Be careful to differentiate between intra-state and inter-state terms, and always verify the role descriptions of government positions in councils.

Sources

- Q. With regards to the formation of the GST Council - byjus.com

- Who among the following are included in GST Council - testbook.com