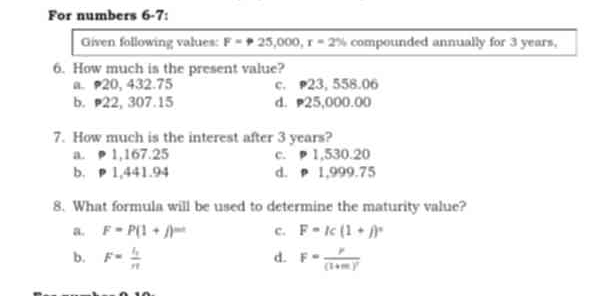

How much is the present value? How much is the interest after 3 years? What formula will be used to determine the maturity value?

Understand the Problem

The question is asking for the present value, interest after 3 years, and the formula for determining maturity value based on provided financial values and parameters.

Answer

The present value is approximately $23,558.06$, the interest after 3 years is $1,441.94$, and the formula is $F = P(1 + r)^t$.

Answer for screen readers

The present value is approximately $PV \approx 23,558.06$, the interest after 3 years is $I \approx 1,441.94$, and the formula used to determine the maturity value is $F = P(1 + r)^t$.

Steps to Solve

- Identify Given Information

We are given the future value $F = 25,000$, the interest rate $r = 2% = 0.02$, and the time $t = 3$ years.

- Calculate Present Value

The formula for the present value (PV) when compounding interest is:

$$ PV = \frac{F}{(1 + r)^t} $$

Substituting the values we have:

$$ PV = \frac{25000}{(1 + 0.02)^3} $$

- Perform Calculation for Present Value

Calculating $(1 + 0.02)^3$:

$$ (1 + 0.02)^3 = (1.02)^3 \approx 1.061208 $$

Now plug this back into the present value equation:

$$ PV = \frac{25000}{1.061208} \approx 23,558.06 $$

- Calculate Interest After 3 Years

To find interest, we use the formula:

$$ \text{Interest} = F - PV $$

Substituting the values:

$$ \text{Interest} = 25000 - 23,558.06 $$

- Perform Interest Calculation

Calculating the interest:

$$ \text{Interest} \approx 25000 - 23,558.06 \approx 1,441.94 $$

- Determine the Maturity Value Formula

The formula to determine the maturity value based on the formula for present value is:

$$ F = P (1 + r)^t $$

Where $P$ is the present value, $r$ is the interest rate, and $t$ is the time.

The present value is approximately $PV \approx 23,558.06$, the interest after 3 years is $I \approx 1,441.94$, and the formula used to determine the maturity value is $F = P(1 + r)^t$.

More Information

The present value is essential in finance to determine how much a future sum of money is worth today, considering a certain interest rate. Understanding these calculations is crucial for making informed financial decisions.

Tips

- Incorrect Compounding: Not applying the correct exponent to the rate and time when calculating present value.

- Substituting Incorrectly: Mishandling the substitution in the formulas can lead to errors in both present value and interest calculations.

AI-generated content may contain errors. Please verify critical information