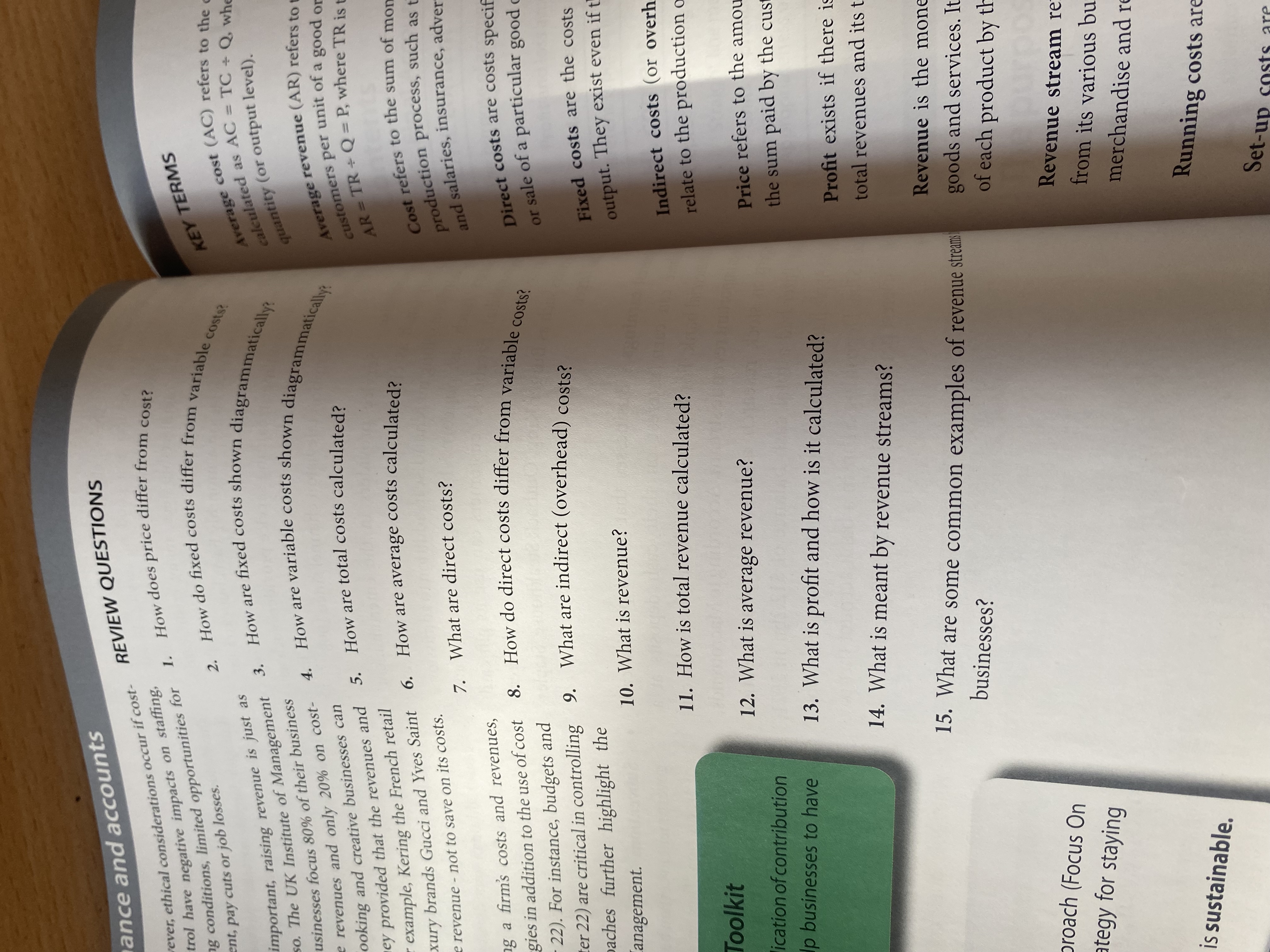

How does price differ from cost? How do fixed costs differ from variable costs? How are fixed costs shown diagrammatically? How are variable costs shown diagrammatically? How are t... How does price differ from cost? How do fixed costs differ from variable costs? How are fixed costs shown diagrammatically? How are variable costs shown diagrammatically? How are total costs calculated? How are average costs calculated? What are direct costs? How do direct costs differ from variable costs? What are indirect (overhead) costs? What is revenue? How is total revenue calculated? What is average revenue? What is profit and how is it calculated? What is meant by revenue streams? What are some common examples of revenue streams?

Understand the Problem

The questions are asking about various concepts related to finance, particularly costs, revenue, and profit calculations. It covers the distinctions between fixed and variable costs, how different types of costs are calculated, and basic definitions of revenue and profit.

Answer

Price is what the customer pays, cost is production expenditure. Fixed costs are constant; variable costs vary with production. Total costs = fixed + variable costs. Average costs = total cost/quantity. Direct costs are traceable to products; indirect costs are not. Revenue = sales income. Profit = revenue - costs.

Price is the amount a customer pays for a product or service, while cost is the expenditure incurred to produce it. Fixed costs do not change with production level, whereas variable costs do. Fixed costs are shown as a horizontal line on a cost-volume graph, while variable costs start at the origin and slope upwards. Total costs are calculated by adding fixed and variable costs. Average costs are total costs divided by the quantity produced. Direct costs can be traced directly to a product, whereas variable costs change with production volume. Indirect costs, or overheads, cannot be directly traced to one product. Revenue is the total income from sales, calculated as price times quantity sold. Average revenue is total revenue divided by quantity sold. Profit is total revenue minus total costs. Revenue streams are sources of income, such as sales, subscriptions, or licensing.

Answer for screen readers

Price is the amount a customer pays for a product or service, while cost is the expenditure incurred to produce it. Fixed costs do not change with production level, whereas variable costs do. Fixed costs are shown as a horizontal line on a cost-volume graph, while variable costs start at the origin and slope upwards. Total costs are calculated by adding fixed and variable costs. Average costs are total costs divided by the quantity produced. Direct costs can be traced directly to a product, whereas variable costs change with production volume. Indirect costs, or overheads, cannot be directly traced to one product. Revenue is the total income from sales, calculated as price times quantity sold. Average revenue is total revenue divided by quantity sold. Profit is total revenue minus total costs. Revenue streams are sources of income, such as sales, subscriptions, or licensing.

More Information

Understanding the distinctions between different cost types and their behavior is vital for business decision-making and financial planning. Recognizing revenue streams helps businesses diversify income.

Tips

A common mistake is confusing fixed costs with total fixed costs over time. Ensure you understand cost behavior across different production levels.

Sources

- Variable Cost vs. Fixed Cost: What's the Difference? - Investopedia - investopedia.com

- Fixed vs. Variable Costs: What's the Difference - FreshBooks - freshbooks.com

- Types of Costs | DP IB Business Management Revision Notes 2022 - savemyexams.com

AI-generated content may contain errors. Please verify critical information