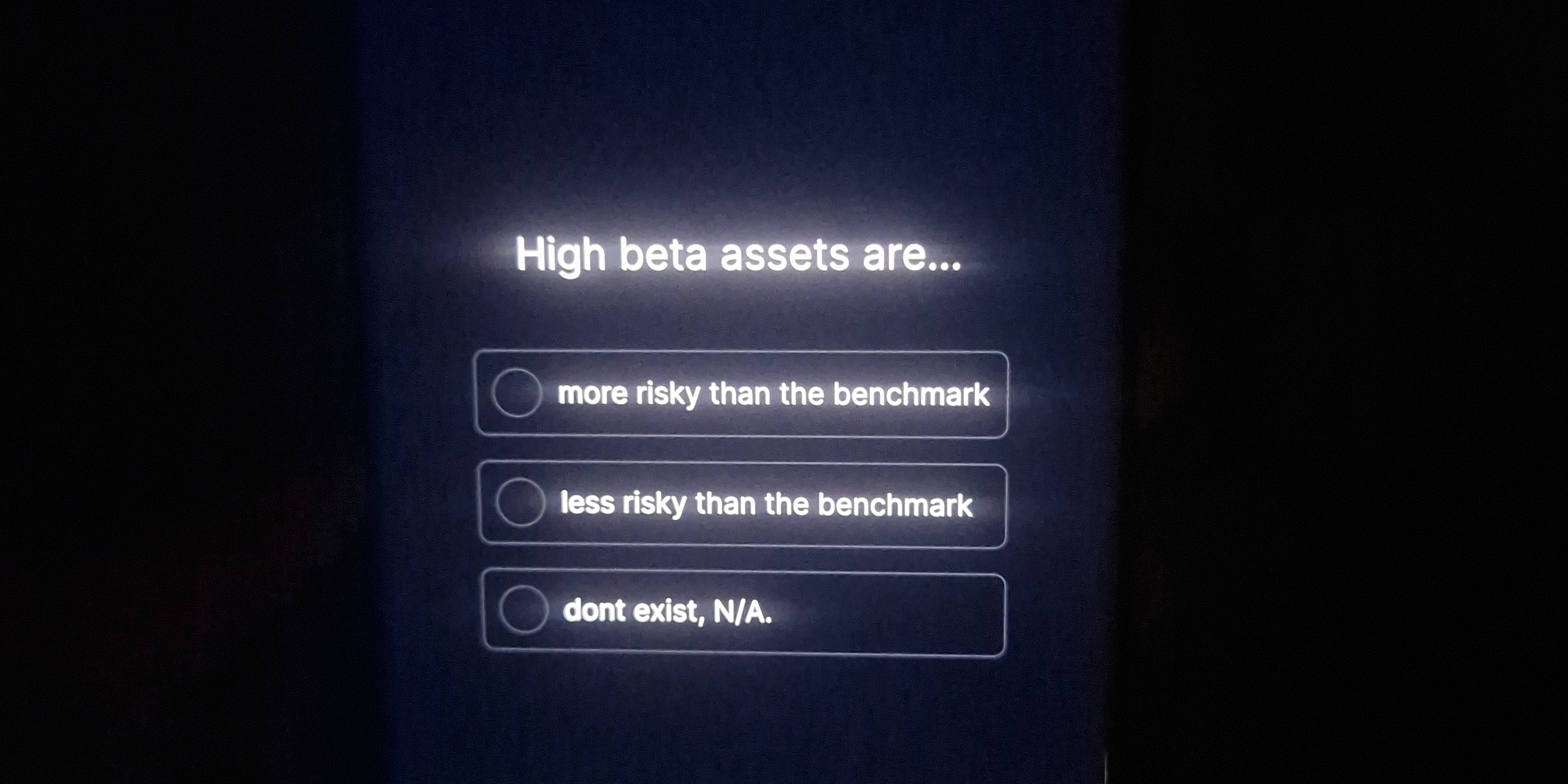

High beta assets are...

Understand the Problem

The question is asking about the characteristics of high beta assets in the context of finance, specifically how their risk compares to a benchmark. It implies a need for understanding financial metrics related to asset risk.

Answer

More risky than the benchmark.

High beta assets are more risky than the benchmark.

Answer for screen readers

High beta assets are more risky than the benchmark.

More Information

High-beta assets have greater volatility compared to the market benchmark, indicating higher risk and potentially higher returns during market surges.

Tips

A common mistake is confusing 'high beta' with safety; high beta signifies higher risk due to increased volatility.

Sources

- What Beta Means: Considering a Stock's Risk - Investopedia - investopedia.com

- What Is Beta? | Everything to Know About Stock Volatility - SmartAsset - smartasset.com

AI-generated content may contain errors. Please verify critical information