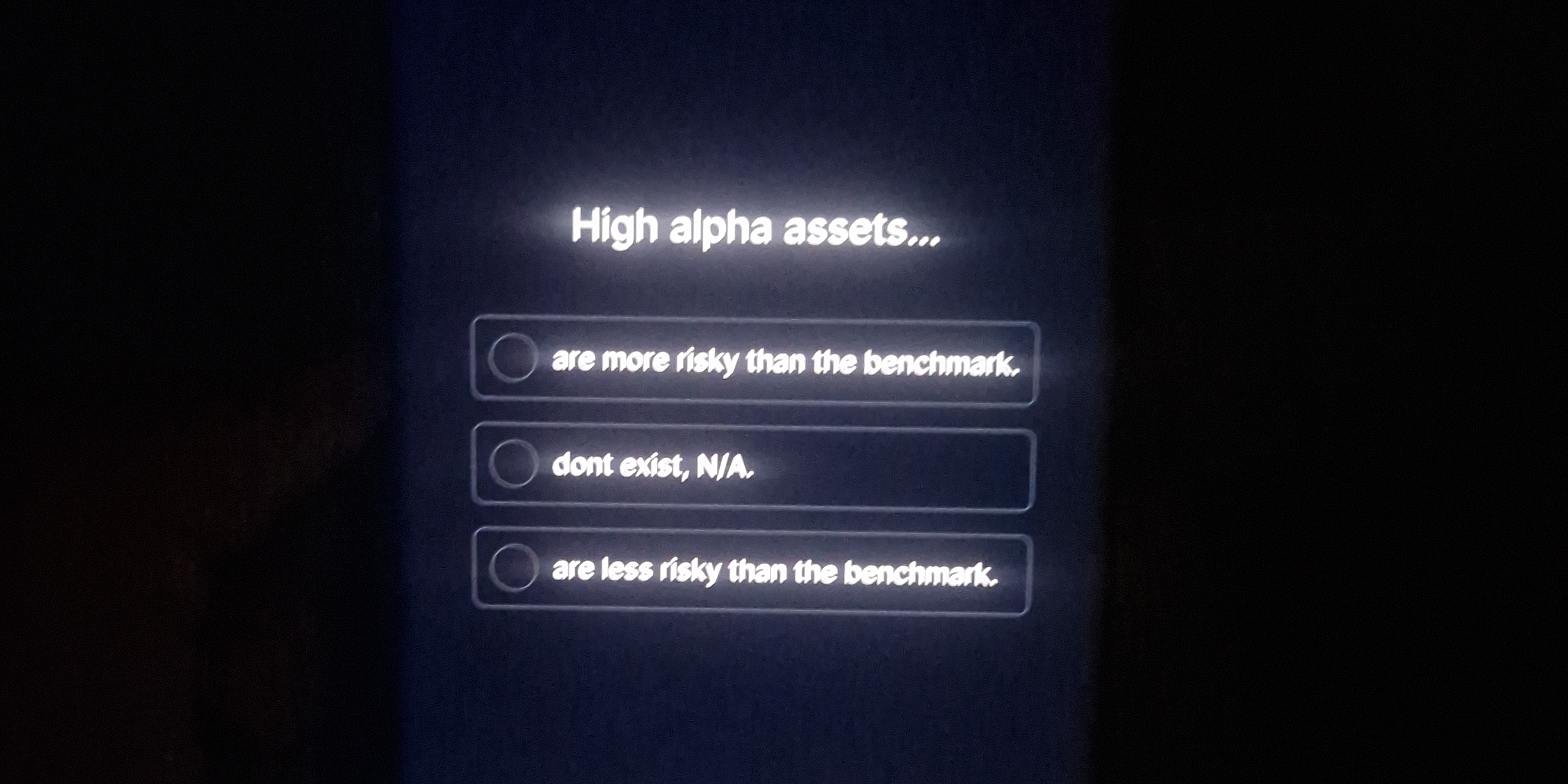

High alpha assets are more risky than the benchmark.

Understand the Problem

The question is asking for the nature of high alpha assets in terms of risk compared to a benchmark. It is looking for an understanding of the risk associated with high alpha assets.

Answer

High alpha assets are less risky than the benchmark.

High alpha assets are less risky than the benchmark.

Answer for screen readers

High alpha assets are less risky than the benchmark.

More Information

A high alpha indicates an investment has exceeded its benchmark's returns while managing risk effectively. Thus, a high alpha asset, contrary to being risky, shows better performance relative to its risk.

Tips

A common mistake is assuming high alpha means high risk, whereas it actually signifies better risk management and return relative to the benchmark.

Sources

- Alpha & Beta: Smart Investment Tools Showing Reward vs Volatility - quantilia.com

- What is alpha in investing? - Yahoo Finance - finance.yahoo.com

- Alpha in Stocks (2024): Definition, Calculation, and Strategy - thetradinganalyst.com

AI-generated content may contain errors. Please verify critical information