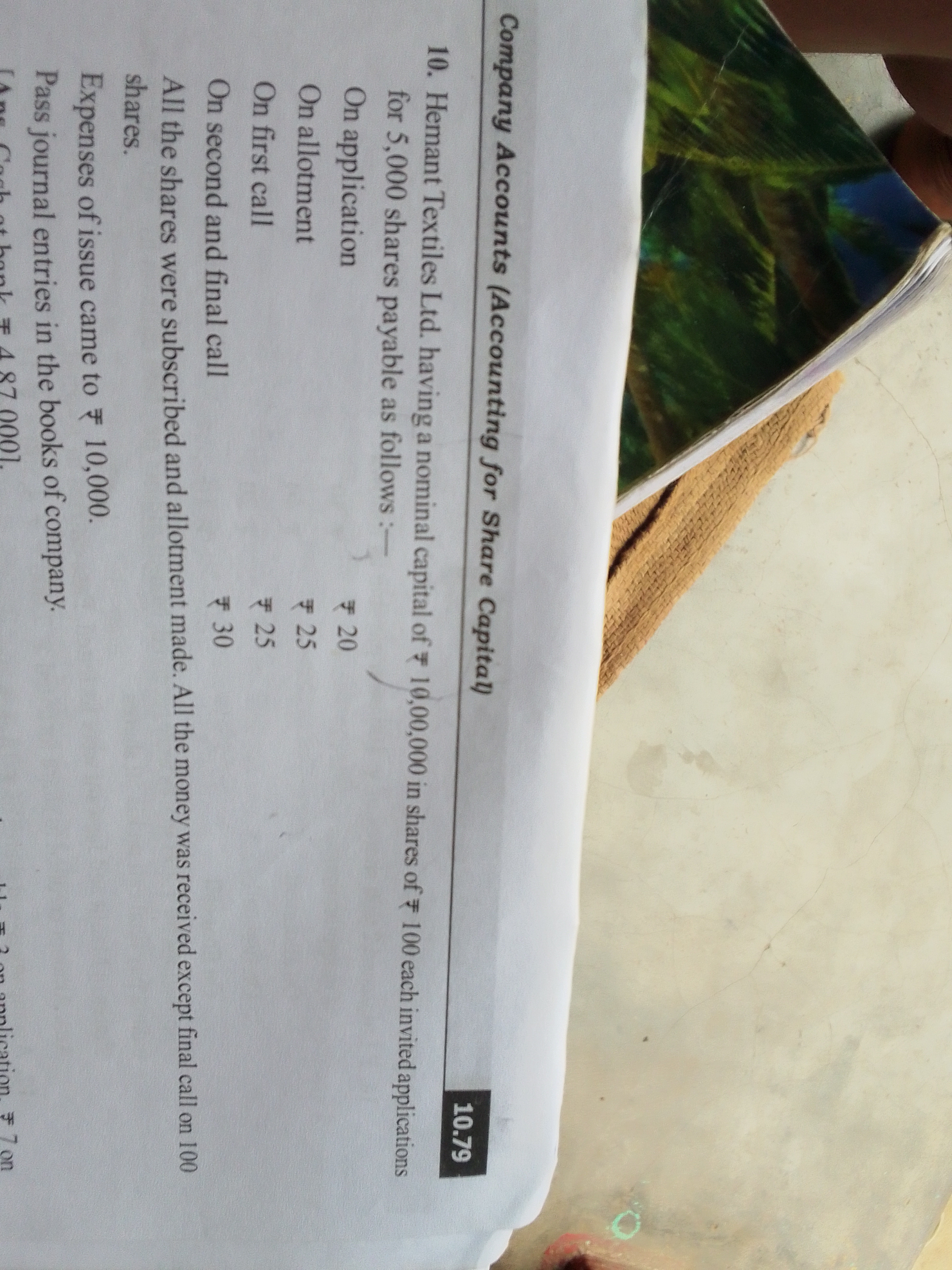

Herman Textiles Ltd. has a nominal capital of ₹1,000,000 in shares of ₹100 each invited applications for 5,000 shares payable as follows: On application ₹ 25, On allotment ₹ 20, On... Herman Textiles Ltd. has a nominal capital of ₹1,000,000 in shares of ₹100 each invited applications for 5,000 shares payable as follows: On application ₹ 25, On allotment ₹ 20, On first call ₹ 30, On second and final call ₹ 25. All the shares were subscribed and allotment made. The expenses of issue came to ₹ 10,000. Pass journal entries in the books of company.

Understand the Problem

The question provides details about a company's share capital, including nominal capital, shares payable, and expenses related to share issue. It asks to record journal entries in the company's books based on this information.

Answer

1. Bank ₹ 125,000 2. Share Application Account ₹ 125,000 3. Share Capital ₹ 500,000 4. Share Allotment Account ₹ 100,000 5. Share First Call Account ₹ 150,000 6. Share Issue Expense ₹ 10,000

Answer for screen readers

-

Journal Entry for Application Money Received

- Debit: Bank ₹ 125,000

- Credit: Share Application Account ₹ 125,000

-

Journal Entry for Allotment Money

- Debit: Share Application Account ₹ 125,000

- Credit: Share Capital ₹ 500,000

- Credit: Share Allotment Account ₹ 100,000

-

Journal Entry for First Call Money

- Debit: Share Allotment Account ₹ 100,000

- Credit: Share First Call Account ₹ 150,000

-

Journal Entry for Second and Final Call Money

- Debit: Share First Call Account ₹ 150,000

- Credit: Share Second and Final Call Account ₹ 125,000

-

Journal Entry for Share Issue Expenses

- Debit: Share Issue Expense ₹ 10,000

- Credit: Bank ₹ 10,000

Steps to Solve

- Calculate Total Amounts Received We need to calculate the total amount received from each stage of payment for the 5,000 shares.

- Amount on application: 5,000 shares × ₹ 25 = ₹ 125,000

- Amount on allotment: 5,000 shares × ₹ 20 = ₹ 100,000

- Amount on first call: 5,000 shares × ₹ 30 = ₹ 150,000

- Amount on second and final call: 5,000 shares × ₹ 25 = ₹ 125,000

- Journal Entry for Application Money We record the application money received. The entry will be:

- Debit: Bank ₹ 125,000

- Credit: Share Application Account ₹ 125,000

- Journal Entry for Allotment Money After allotting the shares, we record the amount received on allotment:

- Debit: Share Application Account ₹ 125,000

- Credit: Share Capital ₹ 500,000

- Credit: Share Allotment Account ₹ 100,000

- Journal Entry for First Call Money Next, we record the first call money received:

- Debit: Share Allotment Account ₹ 100,000

- Credit: Share First Call Account ₹ 150,000

- Journal Entry for Second and Final Call Money Finally, we record the second and final call money:

- Debit: Share First Call Account ₹ 150,000

- Credit: Share Second and Final Call Account ₹ 125,000

- Journal Entry for Share Issue Expenses Record the expenses associated with the share issue:

- Debit: Share Issue Expense ₹ 10,000

- Credit: Bank ₹ 10,000

-

Journal Entry for Application Money Received

- Debit: Bank ₹ 125,000

- Credit: Share Application Account ₹ 125,000

-

Journal Entry for Allotment Money

- Debit: Share Application Account ₹ 125,000

- Credit: Share Capital ₹ 500,000

- Credit: Share Allotment Account ₹ 100,000

-

Journal Entry for First Call Money

- Debit: Share Allotment Account ₹ 100,000

- Credit: Share First Call Account ₹ 150,000

-

Journal Entry for Second and Final Call Money

- Debit: Share First Call Account ₹ 150,000

- Credit: Share Second and Final Call Account ₹ 125,000

-

Journal Entry for Share Issue Expenses

- Debit: Share Issue Expense ₹ 10,000

- Credit: Bank ₹ 10,000

More Information

The journal entries reflect the financial transactions related to share capital in a company's books. Understanding the structure of share capital and the accounting for various calls on shares is crucial for maintaining accurate records in this context.

Tips

- Failing to record all calls: Ensure that each payment stage (application, allotment, calls) is recorded properly.

- Not accounting for share issue expenses: Always deduct any expenses related to issuing shares from the overall capital raised.

- Confusing debits and credits: Remember that debits increase asset accounts (like Bank) and expenses, while credits increase liability accounts and capital.

AI-generated content may contain errors. Please verify critical information