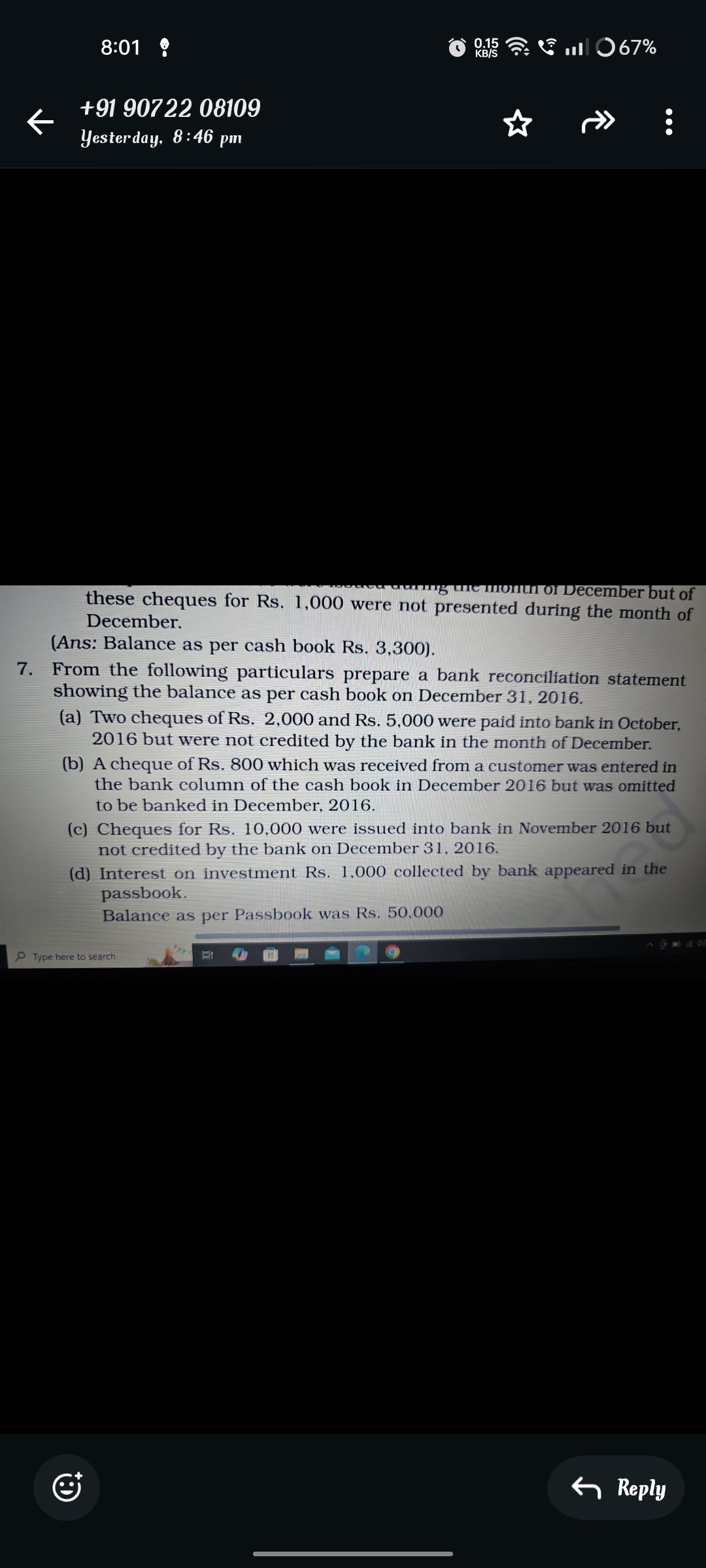

From the following particulars, prepare a bank reconciliation statement showing the balance as per cash book on December 31, 2016. (a) Two cheques of Rs. 2,000 and Rs. 5,000 were p... From the following particulars, prepare a bank reconciliation statement showing the balance as per cash book on December 31, 2016. (a) Two cheques of Rs. 2,000 and Rs. 5,000 were paid into bank in October 2016 but were not credited by the bank in the month of December. (b) A cheque of Rs. 800 which was received from a customer was entered in the bank column of the cash book in December 2016 but was omitted to be banked in December 2016. (c) Cheques for Rs. 10,000 were issued into bank in November 2016 but not credited by the bank on December 31, 2016. (d) Interest on investment Rs. 1,000 collected by bank appeared in the passbook. Balance as per Passbook was Rs. 50,000.

Understand the Problem

The question is asking for the preparation of a bank reconciliation statement based on provided transactions and balances for a specific date. It focuses on entries made and their effects on the cash book and passbook balances.

Answer

The balance as per cash book is Rs. 48,800.

Answer for screen readers

The balance as per cash book on December 31, 2016, is Rs. 48,800.

Steps to Solve

- Identify the Initial Balance from Passbook

The balance as per the passbook is given as Rs. 50,000.

- Adjust for Deposits Not Credited

Two cheques of Rs. 2,000 and Rs. 5,000 were paid into the bank but not credited:

- Total uncredited cheques = Rs. 2,000 + Rs. 5,000 = Rs. 7,000

- Adjust for Cheque Omitted to be Banked

A cheque of Rs. 800 was received but not deposited:

- Total omitted cheque = Rs. 800

- Adjust for Issued Cheques Not Cleared

A cheque for Rs. 10,000 was issued but not credited:

- Total issued but not cleared = Rs. 10,000

- Adjust for Interest Collected by Bank

Interest on investment of Rs. 1,000 collected by the bank needs to be added:

- Interest = Rs. 1,000

- Calculate Final Cash Book Balance

Now, calculate the cash book balance with the adjustments:

[ \text{Balance as per Cash Book} = \text{Balance as per Passbook} + \text{Deposits Not Credited} + \text{Omitted Cheque} - \text{Issued but Not Cleared} + \text{Interest} ]

Plug in the values: [ \text{Balance as per Cash Book} = 50,000 + 7,000 + 800 - 10,000 + 1,000 ]

- Final Calculation

Now, perform the calculations step by step:

- Add: ( 50,000 + 7,000 = 57,000 )

- Add the omitted cheque: ( 57,000 + 800 = 57,800 )

- Subtract issued cheque: ( 57,800 - 10,000 = 47,800 )

- Add interest: ( 47,800 + 1,000 = 48,800 )

Thus, the balance as per cash book is Rs. 48,800.

The balance as per cash book on December 31, 2016, is Rs. 48,800.

More Information

The bank reconciliation process helps in understanding the discrepancies between the cash book and the passbook balances. It is vital for accurate financial reporting and ensures that both records align correctly.

Tips

- Forgetting to include all items that affect the reconciliation.

- Miscalculating the addition and subtraction during the adjustments.

AI-generated content may contain errors. Please verify critical information