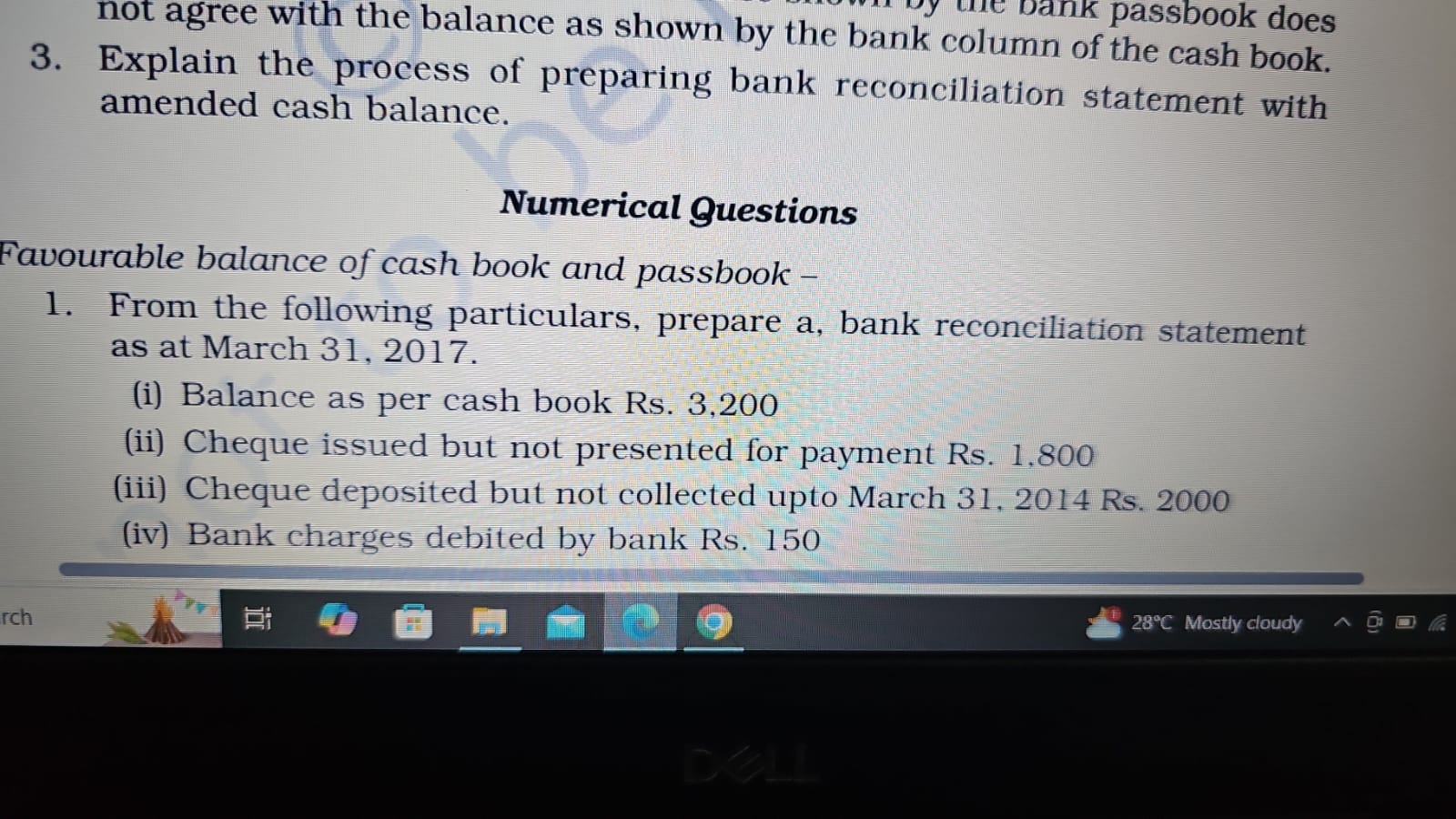

From the following particulars, prepare a bank reconciliation statement as at March 31, 2017. (i) Balance as per cash book Rs. 3,200 (ii) Cheque issued but not presented for paymen... From the following particulars, prepare a bank reconciliation statement as at March 31, 2017. (i) Balance as per cash book Rs. 3,200 (ii) Cheque issued but not presented for payment Rs. 1,800 (iii) Cheque deposited but not collected up to March 31, 2014 Rs. 2,000 (iv) Bank charges debited by bank Rs. 150

Understand the Problem

The question is asking to prepare a bank reconciliation statement based on given particulars as of March 31, 2017. This involves calculating the adjusted cash balance by accounting for issued cheques, deposits not yet collected, and bank charges.

Answer

The adjusted cash balance is Rs. 3,250.

Answer for screen readers

The adjusted cash balance as per the bank reconciliation statement is Rs. 3,250.

Steps to Solve

- Identify the Cash Book Balance Start with the balance as per the cash book given in the problem.

- Balance as per cash book: Rs. 3,200

- Adjust for Cheques Issued but Not Presented Subtract the amount of cheque issued but not yet presented for payment, as it reduces the actual cash balance.

-

Cheque issued but not presented: Rs. 1,800

Adjusted balance after this step: $$ 3,200 - 1,800 = 1,400 $$

- Adjust for Cheques Deposited but Not Collected Add the amount of cheques deposited but not yet collected, as it increases the actual cash balance.

-

Cheque deposited but not collected: Rs. 2,000

Adjusted balance after this step: $$ 1,400 + 2,000 = 3,400 $$

- Adjust for Bank Charges Debited Subtract bank charges debited by the bank, as it reduces the cash balance.

-

Bank charges debited: Rs. 150

Final adjusted cash balance: $$ 3,400 - 150 = 3,250 $$

- Prepare the Bank Reconciliation Statement Compile all adjustments to prepare the final bank reconciliation statement.

$$ \begin{array}{|c|c|} \hline \text{Particulars} & \text{Amount (Rs.)} \ \hline \text{Balance as per Cash Book} & 3,200 \ \hline \text{Less: Cheques Issued Not Presented} & (1,800) \ \hline \text{Add: Cheques Deposited Not Collected} & 2,000 \ \hline \text{Less: Bank Charges} & (150) \ \hline \text{Adjusted Cash Balance} & 3,250 \ \hline \end{array} $$

The adjusted cash balance as per the bank reconciliation statement is Rs. 3,250.

More Information

A bank reconciliation statement helps ensure that the cash balance in the cash book agrees with the bank's records. This process is important for identifying discrepancies and ensuring accurate financial reporting.

Tips

- Misplacing the adjustments: Always ensure to add or subtract the amounts correctly based on whether they are decreases or increases to the cash balance.

- Neglecting bank charges: It’s common to forget bank charges. Always include these in your adjustments.

AI-generated content may contain errors. Please verify critical information