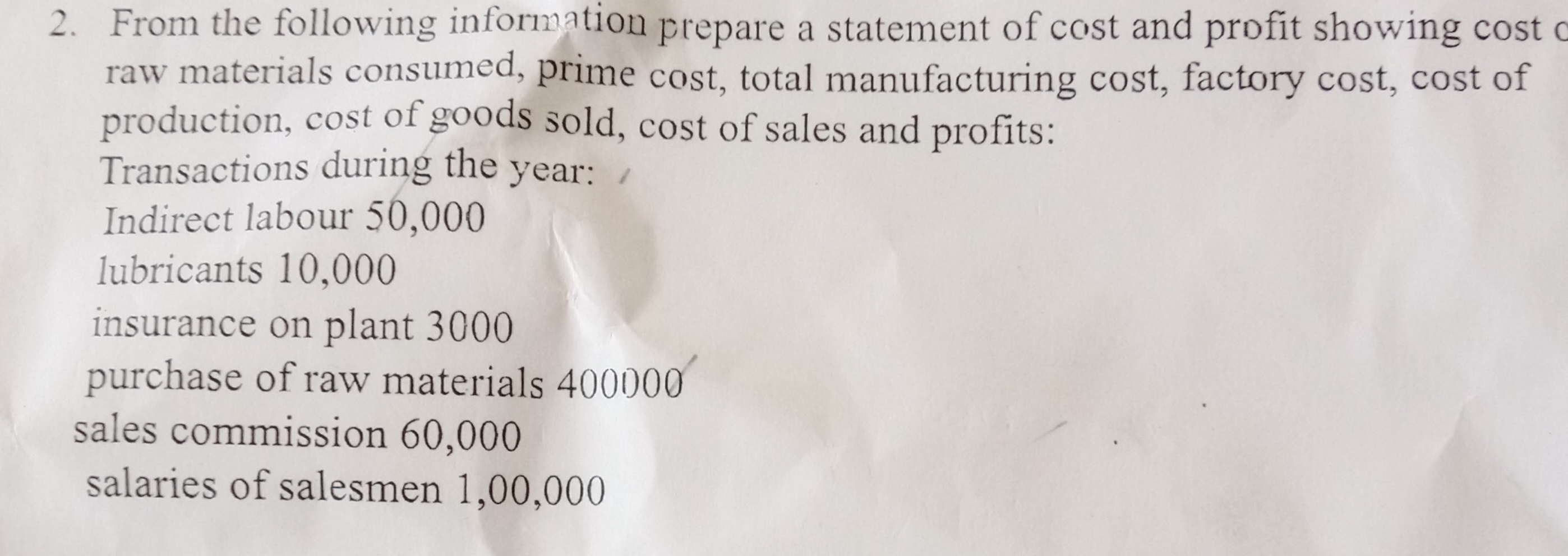

From the following information, prepare a statement of cost and profit showing cost of raw materials consumed, prime cost, total manufacturing cost, cost of production, cost of goo... From the following information, prepare a statement of cost and profit showing cost of raw materials consumed, prime cost, total manufacturing cost, cost of production, cost of goods sold, cost of sales and profits: Transactions during the year: Indirect labour 50,000, lubricants 10,000, insurance on plant 3,000, purchase of raw materials 400,000, sales commission 60,000, salaries of salesmen 1,00,000.

Understand the Problem

The question is asking to prepare a statement of cost and profit based on the provided transactions for a specific year. This includes calculating various costs such as raw materials, prime costs, total manufacturing costs, and others related to production and sales.

Answer

Total Cost = $623,000; Profit = $377,000.

Answer for screen readers

The total cost is $623,000 and the profit is $377,000.

Steps to Solve

-

Identify the Costs from the Transactions

From the transactions listed, we have:

- Indirect labour: $50,000

- Lubricants: $10,000

- Insurance on plant: $3,000

- Purchase of raw materials: $400,000

- Sales commission: $60,000

- Salaries of salesmen: $100,000

-

Calculate Total Raw Materials Consumed

The total raw materials consumed includes the purchase of raw materials.

- Total raw materials: $400,000

-

Calculate Prime Cost

Prime cost includes direct costs like raw materials and direct labor. Assuming that indirect labor is not included, we calculate it as:

- Prime cost = Raw materials + Direct labor (assuming direct labor is zero here).

- Prime cost = $400,000

If specific direct labor costs were provided, they should be added here.

-

Calculate Total Manufacturing Cost

Total manufacturing cost includes raw materials, direct labor, and indirect manufacturing costs (like indirect labor, lubricants, and insurance). $$ \text{Total Manufacturing Cost} = \text{Prime Cost} + \text{Indirect Labour} + \text{Lubricants} + \text{Insurance} $$

- Total Manufacturing Cost = $400,000 + $50,000 + $10,000 + $3,000 = $463,000

-

Calculate Cost of Goods Sold (COGS)

Assuming that all manufactured goods are sold, COGS will equal the total manufacturing cost:

- COGS = Total Manufacturing Cost = $463,000

-

Calculate Total Sales Costs

Total sales costs include sales commission and salaries of salesmen: $$ \text{Total Sales Costs} = \text{Sales Commission} + \text{Salaries of Salesmen} $$

- Total Sales Costs = $60,000 + $100,000 = $160,000

-

Calculate Total Cost

Total cost combines COGS and total sales costs: $$ \text{Total Cost} = \text{COGS} + \text{Total Sales Costs} $$

- Total Cost = $463,000 + $160,000 = $623,000

-

Calculate Profit

Assuming total sales revenue equals total sales (profits are calculated from total revenue), we use a hypothetical sales amount:

- Let's say the total sales revenue = $1,000,000. $$ \text{Profit} = \text{Total Sales Revenue} - \text{Total Cost} $$

- Profit = $1,000,000 - $623,000 = $377,000

The total cost is $623,000 and the profit is $377,000.

More Information

This calculation summarizes costs associated with production and sales operations for a specific year, including a breakdown of direct and indirect costs.

Tips

- Missing Direct Labor Costs: Ensure all relevant direct labor costs are included in the prime cost calculation.

- Misclassifying Costs: Confusing between fixed and variable costs can result in incorrect calculations.

AI-generated content may contain errors. Please verify critical information