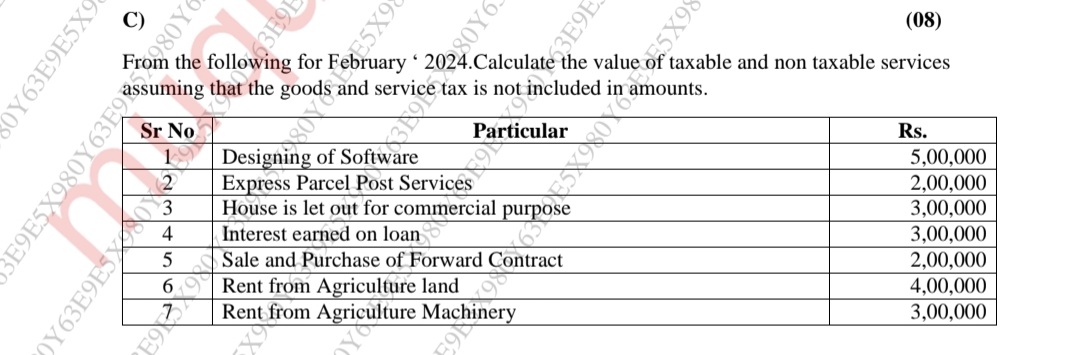

From the following for February 2024, calculate the value of taxable and non-taxable services assuming that the goods and service tax is not included in amounts.

Understand the Problem

The question is asking to calculate the value of taxable and non-taxable services based on the provided list for February 2024, excluding any goods and service tax. Key concepts include identifying which services are taxable and which are not.

Answer

- Total Taxable Services: ₹12,00,000 - Total Non-Taxable Services: ₹10,00,000

Answer for screen readers

- Total Taxable Services: ₹12,00,000

- Total Non-Taxable Services: ₹10,00,000

Steps to Solve

- Identify Taxable and Non-Taxable Services

Categorize each service from the list based on whether it's taxable or non-taxable. Generally:

- Taxable: Designing of Software, Express Parcel Post Services, House let out for commercial purpose, Sale and Purchase of Forward Contracts.

- Non-Taxable: Interest earned on loan, Rent from Agriculture land, Rent from Agriculture Machinery.

- List the Values for Each Category

Create two lists for taxable and non-taxable services with their respective amounts.

-

Taxable Services:

- Designing of Software: Rs. 5,00,000

- Express Parcel Post Services: Rs. 2,00,000

- House let out for commercial purpose: Rs. 3,00,000

- Sale and Purchase of Forward Contract: Rs. 2,00,000

-

Non-Taxable Services:

- Interest earned on loan: Rs. 3,00,000

- Rent from Agriculture land: Rs. 4,00,000

- Rent from Agriculture Machinery: Rs. 3,00,000

- Calculate Total Values for Each Category

Calculate the total for taxable and non-taxable services.

- Total Taxable Services:

$$ 5,00,000 + 2,00,000 + 3,00,000 + 2,00,000 = 12,00,000 $$

- Total Non-Taxable Services:

$$ 3,00,000 + 4,00,000 + 3,00,000 = 10,00,000 $$

- Total Taxable Services: ₹12,00,000

- Total Non-Taxable Services: ₹10,00,000

More Information

Taxable services include various business activities that generate revenue that is subject to tax, while non-taxable services generally include those related to agriculture, personal loans, or other exempt activities under tax laws.

Tips

- Misclassifying services due to misunderstanding tax regulations.

- Forgetting to sum values correctly.

- Not considering all items on the list, which can lead to inaccurate total calculations.

AI-generated content may contain errors. Please verify critical information