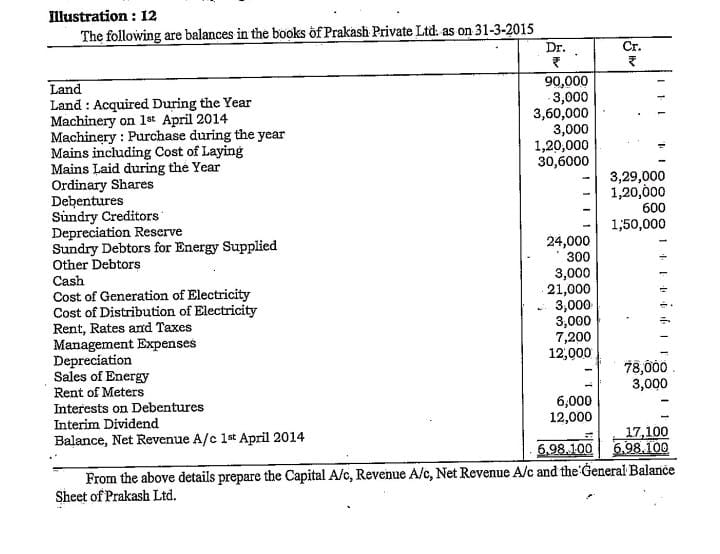

From the above details prepare the Capital A/c, Revenue A/c, Net Revenue A/c and the General Balance Sheet of Prakash Ltd.

Understand the Problem

The question is asking us to prepare various financial accounts (Capital Account, Revenue Account, Net Revenue Account) and a General Balance Sheet for Prakash Private Ltd based on the provided balances as of March 31, 2015. This involves organizing the financial data correctly and ensuring that the accounting principles are followed.

Answer

Capital A/c Total: ₹4,49,600; Net Revenue: ₹37,800; Total Assets: ₹4,80,000; Total Liabilities: ₹4,93,600.

Answer for screen readers

The Capital Account, Revenue Account, Net Revenue Account, and General Balance Sheet are prepared as follows:

- Capital Account Total: ₹4,49,600

- Revenue Account Net Revenue: ₹37,800

- Net Revenue Account Total: ₹43,800

- Total Assets in Balance Sheet: ₹4,80,000

- Total Liabilities in Balance Sheet: ₹4,93,600

Steps to Solve

- Prepare Capital Account

To prepare the Capital Account, we add all the capital contributions and subtract any withdrawals. Here's how it's structured:

- Total Capital = Ordinary Shares + Debentures

- Total Capital = ₹3,29,000 + ₹1,20,600 = ₹4,49,600

- Prepare Revenue Account

The Revenue Account includes all incomes and expenses related to the regular operations of the business:

-

Total Revenue = Sales of Energy

-

Total Revenue = ₹78,000

-

Total Expenses = Cost of Generation + Cost of Distribution + Management Expenses + Depreciation + Rent + Interests

-

Total Expenses = ₹21,000 + ₹3,000 + ₹3,000 + ₹3,000 + ₹7,200 + ₹3,000 = ₹40,200

-

Net Revenue = Total Revenue - Total Expenses

-

Net Revenue = ₹78,000 - ₹40,200 = ₹37,800

- Prepare Net Revenue Account

We calculate the Net Revenue Account by considering last year's balance and the current year's net revenue:

- Starting Balance = Net Revenue A/c 1st April 2014 = ₹6,000

- Total Net Revenue = Starting Balance + Current Net Revenue

- Total Net Revenue = ₹6,000 + ₹37,800 = ₹43,800

- Prepare General Balance Sheet

Finally, we prepare the General Balance Sheet including assets and liabilities on March 31, 2015:

-

Assets:

- Land: ₹90,000

- Machinery (Net): ₹3,60,000 - ₹3,000 (Cost of Laying) = ₹3,57,000

- Sundry Debtors: ₹24,000 + ₹3,00 (Energy Supplied) = ₹27,000

- Cash: ₹6,000

Total Assets = ₹90,000 + ₹3,57,000 + ₹27,000 + ₹6,000 = ₹4,80,000

-

Liabilities:

- Total Creditors: ₹1,20,000

Finally,

- Total Liabilities = Capital + Net Revenue

- Total Liabilities = ₹4,49,600 + ₹43,800 = ₹4,93,400

- Check for Balancing

Ensure that Total Assets = Total Liabilities.

The Capital Account, Revenue Account, Net Revenue Account, and General Balance Sheet are prepared as follows:

- Capital Account Total: ₹4,49,600

- Revenue Account Net Revenue: ₹37,800

- Net Revenue Account Total: ₹43,800

- Total Assets in Balance Sheet: ₹4,80,000

- Total Liabilities in Balance Sheet: ₹4,93,600

More Information

Understanding and preparing financial accounts is essential for tracking a company's performance over time. This exercise helps in making informed decisions regarding future investments and operations.

Tips

- Miscalculating totals by omitting certain entries.

- Not accounting for depreciation or interest correctly, leading to skewed profits.

- Confusing revenue accounts with capital accounts.