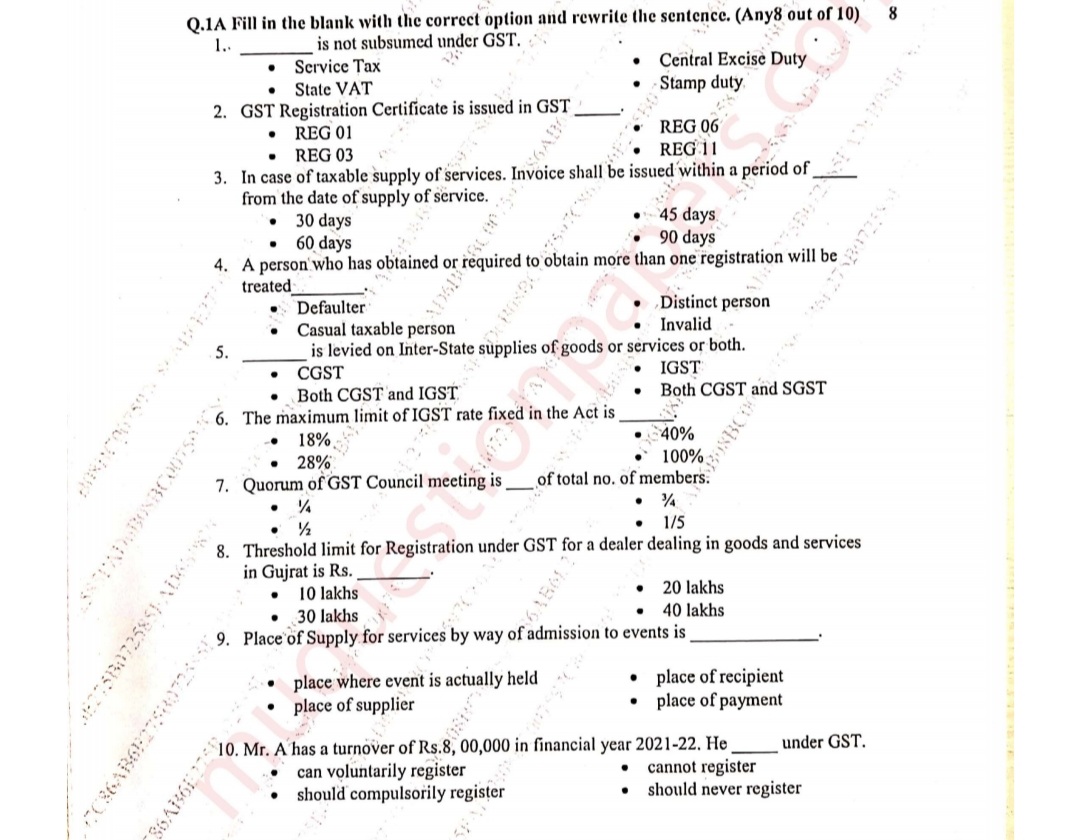

Fill in the blank with the correct option and rewrite the sentence (Any 8 out of 10).

Understand the Problem

The question is asking to fill in blanks regarding GST regulations and concepts, requiring knowledge about GST classifications and rules.

Answer

1. Stamp duty 2. REG 06 3. 30 days 4. Distinct person 5. IGST 6. 28% 7. 1/2 8. Rs. 20 lakhs

- Stamp duty is not subsumed under GST.

- GST Registration Certificate is issued in GST REG 06.

- In case of taxable supply of services, invoice shall be issued within a period of 30 days.

- A person who has obtained or required to obtain more than one registration will be treated as a Distinct person.

- IGST is levied on Inter-State supplies of goods or services or both.

- The maximum limit of IGST rate fixed in the Act is 28%.

- Quorum of GST Council meeting is 1/2 of total no. of members.

- Threshold limit for Registration under GST for a dealer dealing in goods and services in Gujarat is Rs. 20 lakhs.

Answer for screen readers

- Stamp duty is not subsumed under GST.

- GST Registration Certificate is issued in GST REG 06.

- In case of taxable supply of services, invoice shall be issued within a period of 30 days.

- A person who has obtained or required to obtain more than one registration will be treated as a Distinct person.

- IGST is levied on Inter-State supplies of goods or services or both.

- The maximum limit of IGST rate fixed in the Act is 28%.

- Quorum of GST Council meeting is 1/2 of total no. of members.

- Threshold limit for Registration under GST for a dealer dealing in goods and services in Gujarat is Rs. 20 lakhs.

More Information

GST-related queries often mix central and state levies, making it important to know which taxes are subsumed and the specifics of registration thresholds.

Tips

A common mistake is confusing between central and state taxes and their GST inclusion.

AI-generated content may contain errors. Please verify critical information