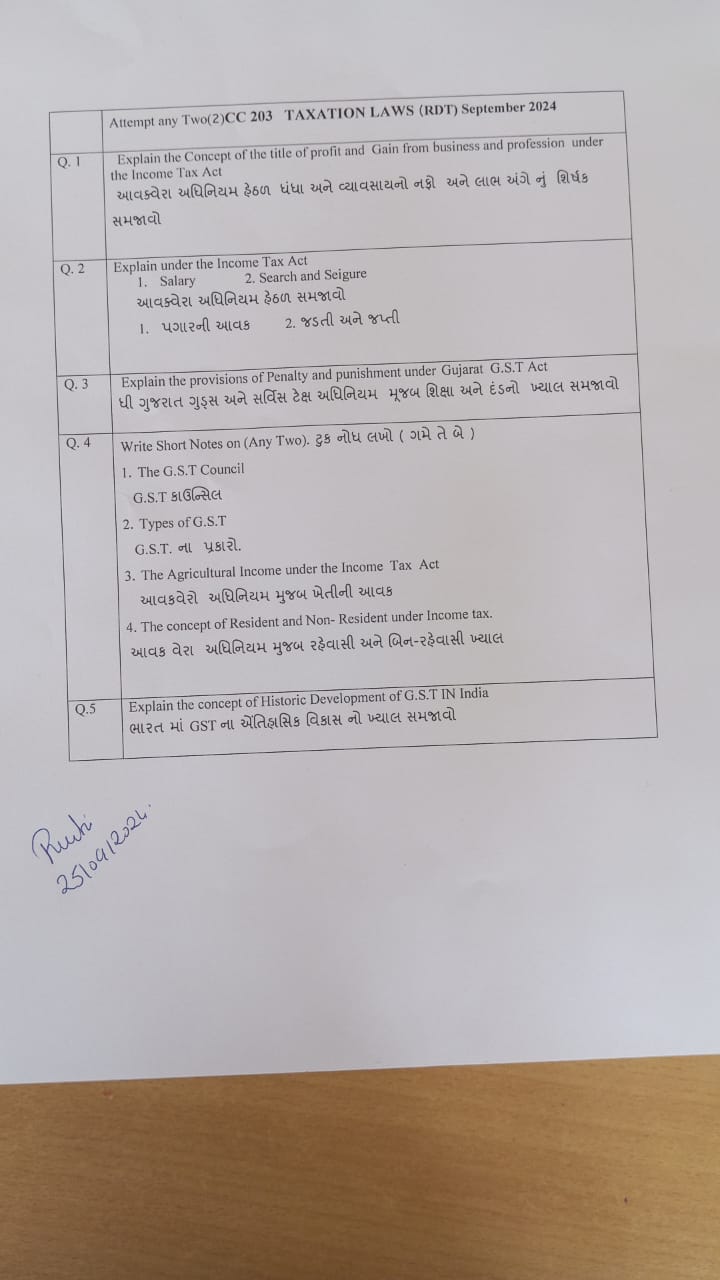

Explain the concept of the title of profit and gain from business and profession under the Income Tax Act. Explain under the Income Tax Act: 1. Salary 2. Search and Seizure. Explai... Explain the concept of the title of profit and gain from business and profession under the Income Tax Act. Explain under the Income Tax Act: 1. Salary 2. Search and Seizure. Explain the provisions of penalty and punishment under the Gujarat GST Act. Write short notes on (Any Two): 1. The GST Council 2. Types of GST 3. The Agricultural Income under the Income Tax Act 4. The concept of Resident and Non-Resident under Income Tax. Explain the concept of historic development of GST in India.

Understand the Problem

The question set is asking various detailed questions about taxation laws in India under the Income Tax Act and GST. It is an exam paper requiring explanations of different concepts and provisions within these laws.

Answer

Answer for screen readers

AI-generated content may contain errors. Please verify critical information