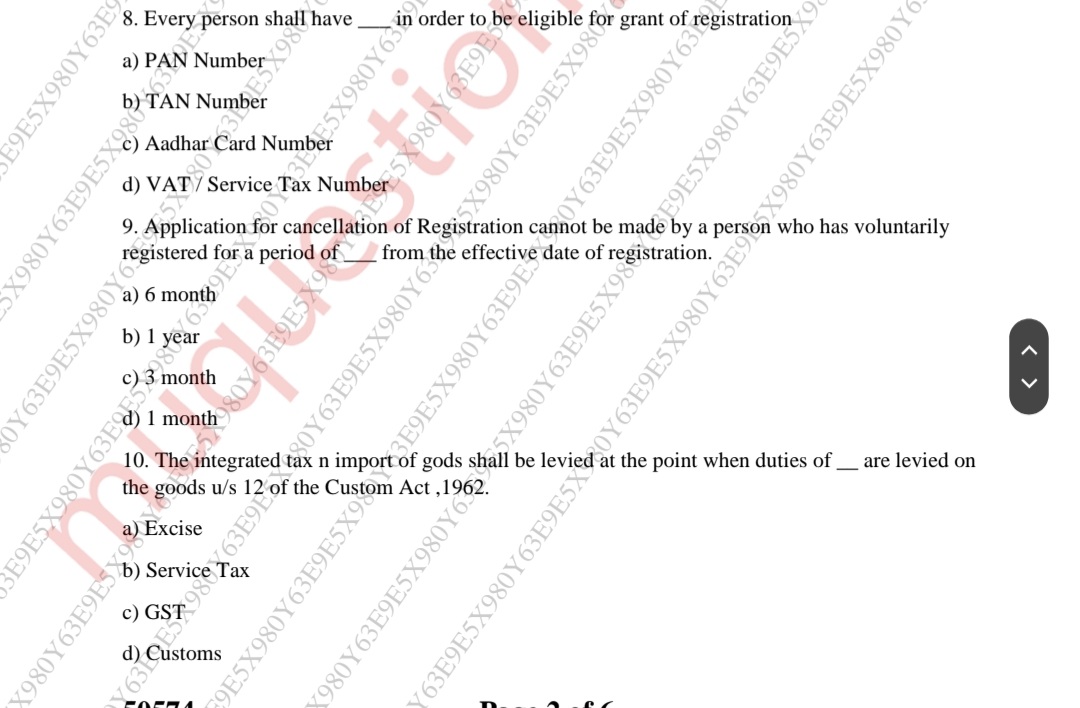

Every person shall have ___ in order to be eligible for grant of registration. Application for cancellation of Registration cannot be made by a person who has voluntarily registere... Every person shall have ___ in order to be eligible for grant of registration. Application for cancellation of Registration cannot be made by a person who has voluntarily registered for a period of ___ from the effective date of registration. The integrated tax on import of goods shall be levied at the point when duties of ___ are levied on the goods u/s 12 of the Custom Act, 1962.

Understand the Problem

The question is asking about the requirements for registration, the cancellation period for registration, and taxation related to the import of goods. This indicates a focus on legal or regulatory knowledge, likely in the context of taxation or business registration.

Answer

8) PAN Number, 9) 1 Year, 10) Customs

The final answer is: 8) PAN Number, 9) 1 Year, 10) Customs

Answer for screen readers

The final answer is: 8) PAN Number, 9) 1 Year, 10) Customs

More Information

For GST registration in India, a Permanent Account Number (PAN) is required. Voluntary registrants must stay registered for at least one year, and the integrated tax on imports is levied when customs duties are applied.

Tips

Ensure you remember the specific registration requirements and rules related to cancellation timelines.

Sources

- GOODS & SERVICE TAX (GST) FREQUENTLY ASKED QUESTION - taxes.tripura.gov.in

- Cancelling GST registration - Singapore - IRAS - iras.gov.sg